The Controversy Surrounding USDC and Its Ties to North Korean Cybercrime

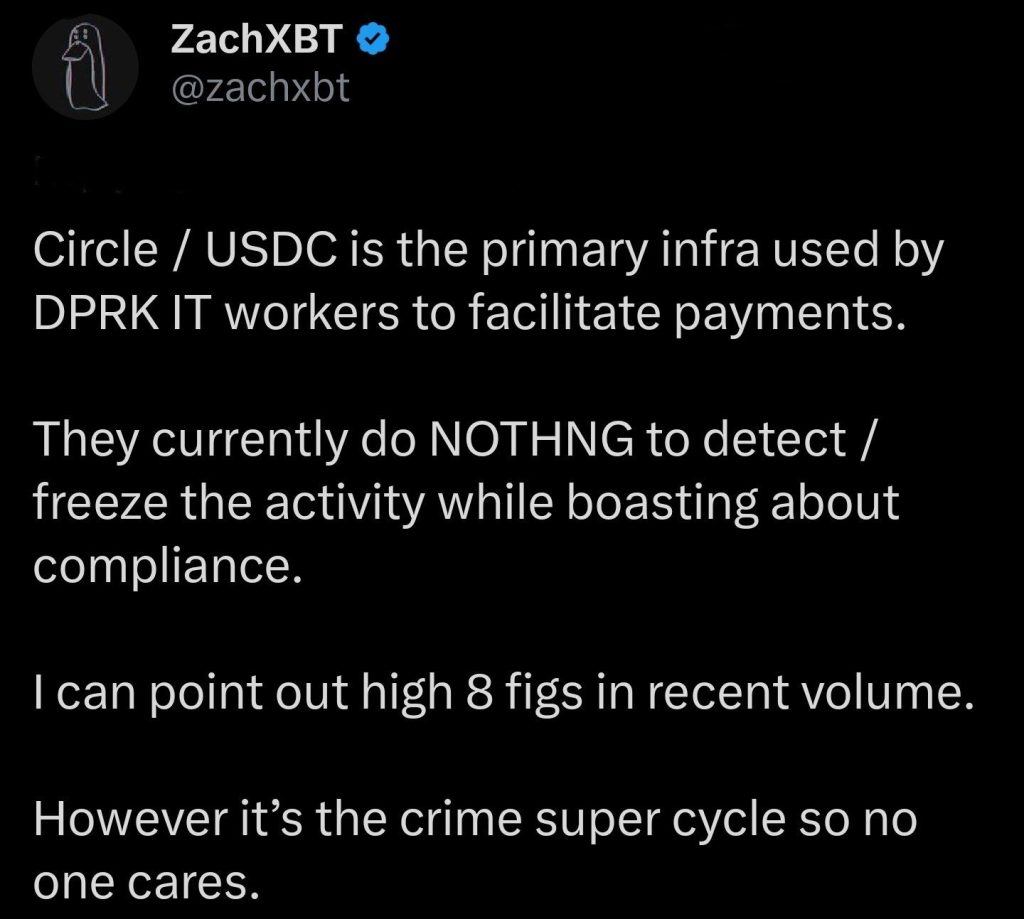

In a startling development that has sent shockwaves through the cryptocurrency community, renowned blockchain investigator ZachXBT has leveled serious accusations against Circle’s USDC stablecoin. He claims that USDC is functioning as a “primary infrastructure” for North Korean IT workers engaging in illicit financial activities. This critique comes at a critical juncture, as the Financial Action Task Force (FATF) has recently highlighted the disturbing trend of stablecoins becoming the favored tool for state-sponsored illicit operations, due to their inherent speed, liquidity, and perceived legitimacy.

Why This Matters: The Implications of Stablecoin Misuse

The importance of ZachXBT’s allegations cannot be overstated. As cryptocurrencies continue to reshape the financial landscape, they are also drawing the attention of malicious actors, particularly state-sponsored groups like North Korea. The regulatory implications extend beyond individual transactions; they touch on global financial systems and regulatory frameworks. With stablecoins increasingly used to bypass traditional financial restrictions, the risk they pose is becoming a pressing concern for regulators and governments worldwide. The waves created by these allegations may spark further investigations into compliance practices across the stablecoin market.

Deeper Dive into the Claims

ZachXBT claims to have traced high-value transactions—amounting to “high eight figures”—that allegedly connect North Korean IT operatives with the USDC infrastructure. This accusation intensifies scrutiny on Circle, especially in light of their assertions regarding a robust compliance landscape aimed at preventing such activities. The involvement of stablecoins like USDC in nefarious operations raises critical questions about the efficacy of existing compliance measures and the responsibility of regulated financial entities.

The Bigger Picture: North Korea’s Evolving Strategy

The urgency of ZachXBT’s concerns is further underscored by the FATF’s report detailing North Korea’s involvement in significant crypto thefts, including the infamous $1.46 billion hacked from the ByBit exchange. Alarmingly, only a minuscule fraction of these stolen assets has been recovered. Reports from the U.S. Department of Justice reveal that North Korean operatives often disguise themselves as remote IT workers using stolen identities, infiltrating Western companies to facilitate cryptocurrency theft and data breaches. This sophisticated layer of subterfuge indicates that such operations are part of a larger, systemic strategy designed to fund the regime’s military ambitions.

Expert Opinions: Concerns from Industry Analysts

Industry analysts have expressed grave concerns about the implications of these allegations. Some experts argue that the regulatory frameworks in place are profoundly lagging behind technological advancements in the blockchain space. One hypothetical expert perspective posits, “Stablecoins offer undeniable convenience, but that same efficiency can serve nefarious ends if not adequately monitored.” As the criminal landscape evolves, analysts emphasize the need for regulators to adopt a proactive stance to prevent financial vehicles from becoming enablers of crime.

The Future Outlook: Will Stablecoins Be a Target for Stricter Regulations?

As the situation unfolds, one can’t help but wonder: will we see stringent regulatory measures specifically targeting stablecoins in the near future? The rise of stablecoins has indeed reshaped financial operations, but regulatory bodies are struggling to keep pace. Nearly 100 countries are currently working on legislation like the Travel Rule to enhance transparency in cryptocurrency transactions. Despite these efforts, the implementation has been uneven, which poses continuous challenges in combating abuse across borders.

Conclusion: A Call for Action

The intersection of stablecoins and illicit finance highlights an urgent demand for more robust regulatory measures. As these allegations against Circle’s USDC and ongoing criminal activities suggest, failing to act could allow malicious actors to exploit the financial system further. The crypto community and regulatory bodies must convene and collaborate to forge a safer digital landscape. What measures do you think should be adopted to improve compliance within the crypto world? Let us know your thoughts in the comments below!

With virtual assets inherently borderless, regulatory failures in one jurisdiction can have global consequences.🔍📄 Read more in the Targeted Update on Implementation of the FATF Standards on Virtual Assets and VASPs: https://t.co/Gt5pyNU6DY#FATF #IllicitFinance #TravelRule @FATFNews— FATF (@FATFNews) June 26, 2025