Market Shake-Up: XRP Takes a Plunge Amid Trade Tensions

In a whirlwind weekend for cryptocurrency markets, XRP saw a significant dip, falling to $1.64 during the Asian trading session. This downturn came on the heels of unsettling trade announcements from former President Donald Trump, which sent ripples of concern through the investor community. However, as trading kicked off on Monday, XRP managed a partial recovery, though uncertainty continued to dominate.

📌 Why This Matters

This latest fluctuation in XRP’s price highlights the vulnerability of cryptocurrencies to external economic factors, especially during periods of heightened trade tensions. The impact of geopolitical events can create a ripple effect, prompting widespread selling across the crypto market. As traders closely monitor these developments, the sharp decline in XRP raises questions about the robustness of digital assets in unpredictable climates.

Shifting Sentiment: Fear and Greed Index Dips

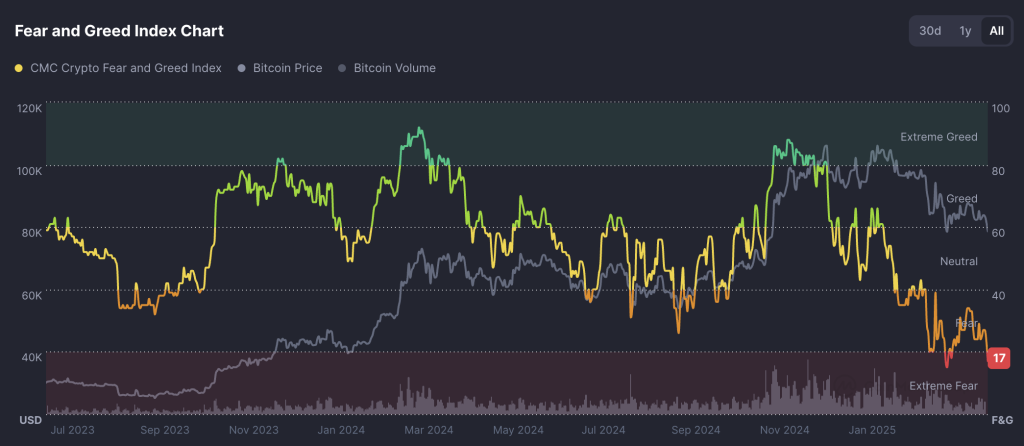

The broader cryptocurrency market experienced a tumultuous shift on Sunday, with many assets witnessing sharp sell-offs as European markets reacted to Trump’s tariff announcements. The Fear and Greed Index, a barometer of investor sentiment, plunged to 17—just shy of its record low—highlighting that traders are currently entrenched in a state of extreme fear.

The Numbers: XRP’s Decline in Context

XRP, in particular, recorded a loss of 6.2% over the last 24 hours, even as trading volumes surged a staggering 570%. This heightened volatility comes after the token had successfully established a support level above $1.78 for the past two months. The breach of this essential threshold suggests increased bearish pressure and raises concerns that XRP may soon test the psychologically significant $1 mark.

🔥 Expert Opinions

Market analysts are weighing in on the current state of XRP. Many express caution, citing technical indicators that point to growing bearish momentum. The daily chart reveals two dark red bars on the MACD histogram over the previous 48 hours, which signifies increasing downside pressure.

Furthermore, the Relative Strength Index (RSI) has failed to break above its signal line, reinforcing the current bearish outlook. As XRP enjoyed a brief recovery earlier today, traders are watching to see if this rebound holds, or if it is merely a temporary glitch driven by leveraged positions.

🚀 Future Outlook: $1.30 Support in Focus

The outlook for XRP is precarious. Technical analysis suggests that if the $1.65 support line falters, the next stop for XRP could be $1.30, marking a potential 21% drop from current levels. A breakdown below this could signal a further decline to $1, a level that could attract additional selling pressure as market sentiment grows increasingly negative.

The key to future movements may lie in price actions as the U.S. trading session comes to a close. If XRP drops below $1.70, it could indicate renewed weakness and possibly lead to a new session low.

MACD and RSI Confirm Ongoing Weakness

Momentum indicators remain bearish, with the MACD displaying red histogram bars and the RSI still trapped below bullish territory. Traders are advised to keep a close watch on the behavior of XRP around the critical levels of $1.65 and $1.30. A decisive breach of these support levels may pave the way for a drop to $1 in the not-so-distant future.

Emerging Alternatives in the Crypto Space

Despite the challenging market conditions, innovative blockchain projects continue to emerge, offering promise to investors who are willing to seek them out. One such project is SUBBD, a decentralized content distribution platform. SUBBD aims to empower creators, allowing them to retain ownership of their content and earn more for their efforts.

Since launching its presale, SUBBD has already raised over $100,000 and garnered attention from creators with a combined follower count of over 250 million. This platform offers a refreshing alternative to traditional content platforms like YouTube and TikTok, which often leave creators feeling undervalued due to their compensation structures.

Conclusion: What’s Next for XRP?

As the cryptocurrency space grapples with external shocks and souring investor sentiment, the path forward for XRP—and indeed, many digital assets—remains uncertain. Whether this token can stabilize and regain lost ground remains to be seen. Investors are encouraged to monitor developments closely and consider new opportunities like SUBBD that represent the innovative potential of blockchain technology. Will XRP find its footing, or will it continue to drift downward? Share your thoughts below!