Ripple’s Bold Move: Ending the SEC Legal Dispute

In a landmark decision that resonates throughout the cryptocurrency world, Ripple has officially concluded its protracted legal battle with the U.S. Securities and Exchange Commission (SEC). This development marks the conclusion of one of the most scrutinized regulatory disputes in crypto history. The anticipation now surges around the SEC’s potential response, as indications suggest they might also withdraw their appeal, solidifying the groundbreaking rulings made by Judge Analisa Torres in 2023.

🚨 #Ripple officially ended its #SEC legal fight yesterday — but this May 2025 filing still matters. It reaffirms: #XRP is not a security. pic.twitter.com/ubgLZpwbcI— RippleXity (@RippleXity) June 28, 2025

Legal Insights: What’s at Stake?

Judge Torres’ final ruling brought a mixed bag of outcomes. While she upheld that Ripple’s institutional sales of XRP contravened securities laws, she confirmed that sales on exchanges did not fall under the same scrutiny. Ripple’s CEO, Brad Garlinghouse, took to social media, stating, “We’re closing this chapter once and for all.” Legal experts, including attorney Bill Morgan, heralded this resolution as a remarkable victory for not only Ripple but the broader cryptocurrency landscape.

- XRP Not Considered a Security: Institutional XRP sales were confirmed as non-compliant, but public exchange sales were deemed compliant.

- Financial Penalties Confirmed: Ripple will face a $125 million civil penalty.

- Focus on Growth: Ripple is now positioned to pursue expansion and enhance its partnerships.

Market Response: XRP’s Resurgence

The ripple effect (no pun intended) of this legal closure has been palpable within the XRP community. In just 24 hours, the token saw a price upswing of 4.4%, reaching $2.19. Ripple’s Chief Legal Officer, Stuart Alderoty, has reassured the market that the classification of XRP remains unchanged, bolstering the asset’s credibility in areas like institutional finance and cross-border transactions. This newfound legal certainty provides Ripple a unique opportunity to amplify its strategic use of XRP in both tokenized finance and enterprise payments.

Charting the Future: XRP’s Technical Analysis

A closer look at XRP’s technical setup reveals intriguing possibilities. The 4-hour price chart indicates a symmetrical triangle pattern, where market momentum is currently coiling under a critical resistance level at $2.21. Notably, the formation of higher lows from the $1.99 mark illustrates the establishment of a firm support trendline.

The emergence of a golden cross between the 50-EMA and 200-EMA signals a bullish sentiment, with a recent green MACD histogram pointing to increasing positive momentum. The bullish marubozu candle at the resistance level suggests that buyers are vigorously testing supply thresholds.

Elevating Trading Strategies: Key Levels to Watch

For traders looking to capitalize on XRP’s upward trajectory, setting clear entry and exit points is crucial:

- Entry Point: Consider going long above $2.215 for a confirmed breakout.

- Target 1: $2.288

- Target 2: $2.338

- Stop-Loss: Place below $2.139 to protect against risks.

If resistance persists, a retracement down to $2.14 may offer a strategic re-entry for bull traders, optimizing risk-to-reward ratios. A successful breakout beyond this point could propel XRP toward the psychological $2.50 mark, with potential for further rallies extending to $3.50 as market interest intensifies.

Shifting Gears: Bitcoin Hyper’s Blockbuster Presale

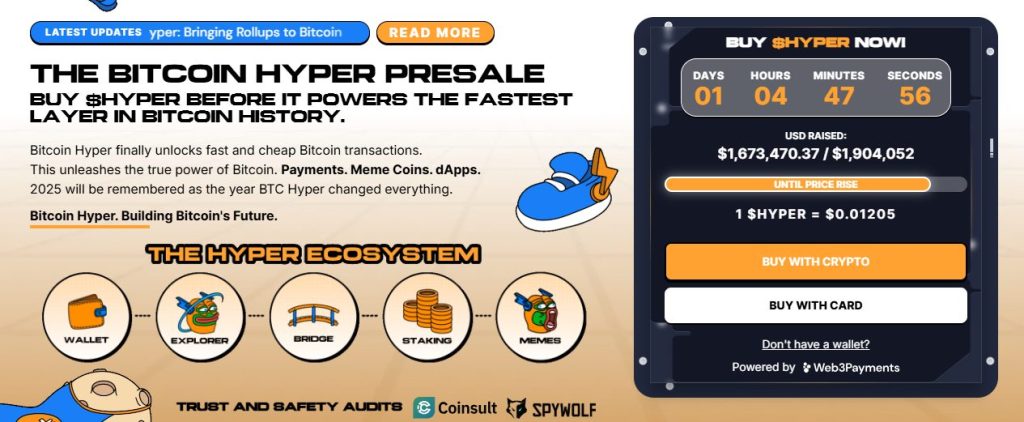

In parallel developments, innovation is thriving within the crypto ecosystem. Bitcoin Hyper ($HYPER), a pioneering Bitcoin-native Layer 2 solution, has soared past $1.6 million in its public presale, amassing $1,673,470 of its $1,904,052 target. This surge in funds comes just before the presale price escalates, capturing the interest of savvy investors looking to lock in the current price of $0.01205 per HYPER.

Bitcoin Hyper integrates the robust security of Bitcoin with the scalability of the Solana Virtual Machine (SVM), positioning itself uniquely in the market. This system promises rapid processing of smart contracts while maintaining low transaction costs—a vital feature for those looking to build high-speed decentralized applications and meme coins with minimal overhead.

Conclusion: A New Dawn for Ripple and the Crypto Community

As Ripple moves on from this legal chapter, the implications extend far beyond its immediate operations. The clarity provided by the court’s ruling not only reaffirms the status of XRP but also invigorates optimism within the crypto community as a whole. With the potential for rising institutional interest and innovative advancements such as Bitcoin Hyper, the road ahead seems full of opportunity. What do you think about Ripple’s victory and its implications for the future of cryptocurrency? Share your thoughts below!