💥 XRP: A Potential Major Move on the Horizon

Investors are buzzing with excitement as XRP seems poised for a significant shift in momentum. After enduring weeks marked by sell-offs and profit-taking, long-term holders are now ramping up their accumulation of the token. This change in investor strategy is not only fascinating; it comes as XRP enjoys a notable 10% rebound from a recent low of $2.05, stirring up renewed conversations about bullish price predictions for this digital asset. Could we be on the brink of an XRP breakout despite the prevailing macroeconomic pressures including U.S. trade tensions and a fragile labor market?

📈 A Shift in Investor Behavior: Accumulation Trends

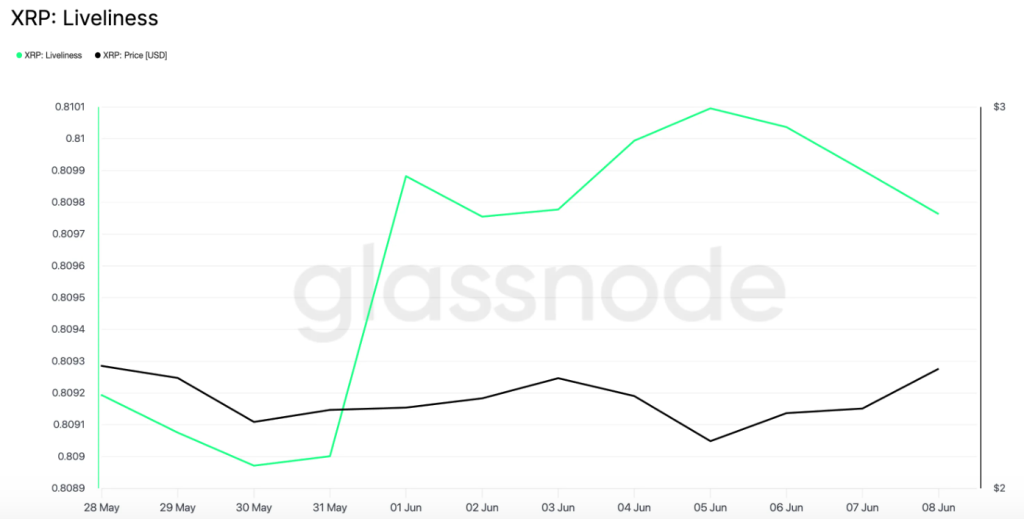

Recent data from Glassnode reveals intriguing trends in XRP’s investor behavior. The ‘liveliness’ of XRP—an important metric denoting the ratio of coin days destroyed to total coin days accumulated—has shown a decline from 1% on June 5 to 0.809 as of June 8. This trend displays a crucial pivot where long-term holders are opting to hold their XRP rather than sell, suggesting a potential for accumulation.

Moreover, the derivatives market reflects a similar sentiment. Coinglass reports that XRP has maintained a positive funding rate consistently since June 6, currently at 0.0106%. This positive funding rate indicates a bullish sentiment in the market, where short sellers are compensating for holding onto their positions, thereby reinforcing the notion that buying pressure is building behind XRP.

🔍 Price Analysis: What Are Long-Term Holders Anticipating?

The recent rally appears to affirm a bullish trajectory, illustrated by the establishment of a six-month pennant pattern. This formation nearly evaded invalidation with a bounce from its upper boundary, serving as a resilient support level.

Despite a slip into a consolidation phase over the last month, recent price movements have successfully breached this range. Adding to the positive indicators, the Relative Strength Index (RSI) has moved back above the neutral threshold at 51, suggesting a cooling of selling pressure. The three-day MACD indicator is also signaling a bullish crossover, indicating that buying activity may soon outstrip selling. This bullish divergence already materializes on the one-day chart, suggesting the potential for a sustained uptrend.

Currently, XRP is also sitting at the 0.5 Fibonacci retracement level, a classic accumulation zone, particularly beneficial during uptrends. If momentum continues, a successful breakout could propel XRP towards the $4.38 mark by the end of the year, representing a jaw-dropping potential surge of 90% from current levels.

💡 Why This Matters: Understanding the Implications

The significance of these accumulation trends and price movements cannot be overstated. A resurgence in long-term holder confidence typically signals a bullish market sentiment, which could entice new investors to enter the XRP scene. With established investors choosing to HODL in large quantities, the potential for upward price momentum is bolstered. This is especially crucial as macroeconomic factors remain unpredictable.

🔥 Expert Opinions: Analysts Weigh In

Crypto analysts express a mix of optimism and caution regarding XRP’s near-term future. Many believe that sustained accumulation by long-term holders could set the stage for significant upward price movement. An analyst from a leading crypto research firm remarked, “The data we’re seeing hints at a strong fundamental shift with long-term holders demonstrating confidence in future price appreciation. If XRP can breach the $3 mark convincingly, we could witness a rally unlike any other.”

🚀 Future Outlook: What’s Next for XRP?

As interest in XRP grows, so does the evolution of storing and managing digital assets among holders. Many are increasingly embracing self-custody solutions such as MetaMask and innovative wallets like Best Wallet ($BEST), which not only promise enhanced security but also provide unique investment opportunities in upcoming tokens.

This non-custodial wallet allows users to track and invest in emerging tokens, empowering holders with more control over their digital assets. Additionally, the forthcoming Best Card—a crypto debit card set to enhance real-world transactions utilizing stablecoins—highlights a growing adaptation of crypto in everyday transactions, with over $13 million raised in the $BEST token presale.

✨ Conclusion: The Future Is Bright for XRP

The winds of change are swirling around XRP, as long-term holders rally and price indicators point towards potential growth. As the market adapts to both internal dynamics and external pressures, investors are keenly watching to see if XRP can reclaim its momentum. What do you think? Is XRP ready to break out, or will these promising signs fade in the light of broader market uncertainties? Join the conversation and share your thoughts!