Is XRP on the Brink of a Breakthrough? Exploring Recent Movements

The cryptocurrency landscape is ever-evolving, and right now, XRP is making headlines once again. Currently trading at $2.22, XRP has experienced a slight dip of 0.58% over the last 24 hours. However, it’s essential to note that this price remains comfortably above the pivotal support level of $2.20, thanks largely to Ripple’s strategic advancements into the traditional finance sector. The firm recently submitted an application for a banking charter with the U.S. Office of the Comptroller of the Currency (OCC) and is vying for a Federal Reserve master account. These groundbreaking moves could enable Ripple to seamlessly integrate into the U.S. payments infrastructure—a significant shift for a crypto-centric company. With these developments, traders are buzzing with optimism, eyeing a potential surge in XRP values, possibly reaching as high as $10 in the long run.

📌 Why This Matters: The Ripple Effect on XRP

The implications of Ripple’s actions extend far beyond immediate price fluctuations. Successful acquisition of a banking license could grant Ripple direct access to the U.S. payment rails, a game changer in the crypto world. This would not only enhance XRP’s liquidity but also position it as a legitimate player in interbank transactions. Furthermore, the ongoing discussions surrounding potential XRP ETFs have sparked renewed interest among institutional investors, suggesting that XRP may soon become one of the cornerstones of a regulated crypto investment landscape.

🔥 Expert Opinions: Insights from Analysts

Market experts are weighing in on the ripple effects of these developments. Analysts are increasingly optimistic, hypothesizing that the convergence of a favorable regulatory environment, alongside Ripple’s banking aspirations, could drive XRP’s price significantly higher. Industry analysts point out:

- Banking License: Gaining a U.S. banking charter could position Ripple as a bridge between traditional finance and the digital currency ecosystem.

- ETF Rumors: If an XRP ETF is approved, it could unleash a tidal wave of retail and institutional investment, significantly boosting XRP demand.

- CBDC Partnerships: Ripple’s collaborations with central banks worldwide reinforce its relevance in the evolving financial landscape.

As one analyst puts it: “If regulatory clarity is achieved, XRP could very well emerge as the leading cryptocurrency for institutional adoption.”

🚀 Future Outlook: Is $10 Within Reach?

While the immediate pathway to $10 seems steep, the market sentiment suggests that Ripple’s alignment with traditional financial institutions might catalyze a gradual rise. Current technical indicators support this notion. XRP’s price is tightening into a wedge around the $2.23 resistance level, which has seen multiple tests without a successful breach. The short-term outlook appears cautiously optimistic, especially as traders watch for a breakout.

If bulls can surmount the $2.2340 mark backed by solid trading volume, XRP could swiftly rally toward $2.2822 and potentially $2.3400. Conversely, a slip below $2.20 might trigger a retreat to key support levels around $2.147 and $2.084. Traders are keeping an eager eye on this developing situation.

XRP Trade Setup: Are We Headed for a Breakout?

For those looking to trade XRP, here’s a quick rundown of the potential setup:

- Entry Point: Above $2.23 with bearish confirmation

- Target Levels: $2.2822 and $2.3400

- Stop-Loss: Below the $2.20 trendline

- Market Sentiment: Bullish as long as the price remains above the 100-SMA

Given Ripple’s growing alignment with institutional players, XRP continues to be one of the most closely monitored altcoins heading into 2025.

Bitcoin Hyper: A Rising Contender in the Crypto Sphere

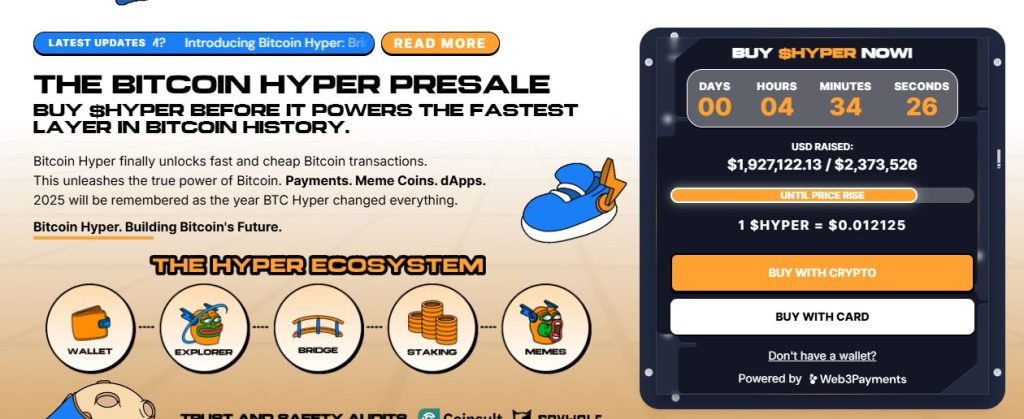

Shifting gears to another exciting development in the cryptocurrency market, Bitcoin Hyper ($HYPER) has recently surged past $1.92 million in its presale, raising $1,927,122 out of a target of $2,373,526. Priced at $0.012125, Bitcoin Hyper promises to merge the robust security of Bitcoin with the swift processing capabilities of the Solana Virtual Machine. This innovative approach enables not only efficient smart contracts but also opens avenues for decentralized applications (dApps) and meme coin creation while leveraging Bitcoin’s ecosystem.

The upcoming launch is generating serious buzz within the crypto community, and the combination of staking, a streamlined presale process, and a comprehensive rollout expected by Q1 2025, positions Bitcoin Hyper as a contender to keep your eyes on.

Conclusion: The Road Ahead for XRP and Beyond

The cryptocurrency sphere remains a whirlwind of opportunities and uncertainties. With Ripple’s ambitious plans and the favorable winds behind XRP, we could be on the brink of significant transformations in the market landscape. What are your thoughts on Ripple’s banking ambitions and the potential for XRP to reach new heights? Join the conversation and share your predictions!