🚀 XRP Shatters Milestones: A Closer Look at the Recent Surge

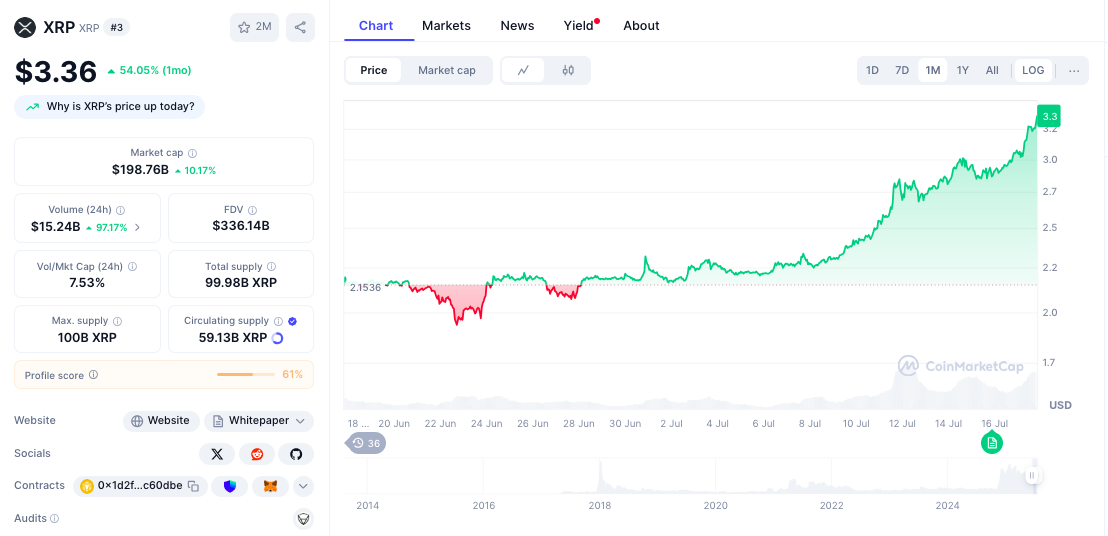

In a remarkable display of momentum, XRP has surged by 7.19%, bringing its price up to $3.2563. This impressive climb has not only pushed XRP past the historic $190 billion market cap but also sent the Relative Strength Index (RSI) into overbought territory at an astonishing 86.07. The excitement is palpable in the cryptocurrency community, especially with the impending launch of the ProShares Ultra XRP ETF and speculation surrounding the potential dismissal of the SEC’s appeal against Ripple. As XRP gears up to test the critical resistance level of $3.30, let’s unpack the current market dynamics and future prospects for XRP.

📌 Why This Matters

The significance of XRP breaking through the $190 billion market cap cannot be overstated. Achieving this valuation solidifies XRP’s standing as a legitimate player within the cryptocurrency ecosystem, attracting institutional interest and boosting its credibility. As regulatory clarity improves and institutional mechanisms like ETFs emerge, XRP is poised to transition from speculation to a recognized asset class that institutions can include in their financial portfolios. This change not only reflects the evolving landscape of digital currencies but also the growing acceptance of XRP as a potential standard for payments.

🔥 Expert Opinions: Insights from Analysts

Market analysts have mixed feelings about the short-term trajectory of XRP. On one hand, the launch of the ProShares Ultra XRP ETF is anticipated to bring in a wave of institutional capital, which could further propel XRP to new highs. Analysts predict a surge in buying pressure, especially if the SEC’s appeal against Ripple is withdrawn. Others caution that the current RSI levels suggest XRP may experience a correction before making another significant push upward. As one analyst aptly put it, “XRP is like a sprinter running at top speed; while it’s exhilarating, eventually it needs to catch its breath.”

🚀 Future Outlook: What Lies Ahead for XRP?

As we gaze into the crystal ball, two scenarios emerge for XRP’s trajectory over the next few months:

- Momentum Continuation (50% Probability): Should the SEC dismiss its appeal against Ripple and the ETF perform as expected, XRP could soar towards the $4.50 to $5.00 range.

- Healthy Correction (35% Probability): A pullback may occur, with XRP retreating toward the $2.80 to $3.00 region, potentially creating more substantial buying opportunities for savvy investors.

In either case, the direction XRP takes will be heavily influenced by regulatory developments and market sentiment. The key resistance levels to watch would be the psychological barriers at $3.30 and historical highs near $3.84.

🔍 Key Technical Analysis: Support and Resistance Levels

The technical analysis reveals clear support at $2.9873, bolstered by psychological thresholds at $3.00–$3.10. The price’s current configuration indicates a strong institutional buy-in, with XRP trading significantly above its major moving averages. However, should it falter, the EMA cluster at $2.40–$2.60 acts as a safety cushion during downturns. Major resistance is observed at $3.2986, with psychological barriers at $3.3000, beyond which substantial profit-taking could occur.

🔑 Market Metrics: Validating Institutional Status

At present, XRP boasts a robust market capitalization of $198.76 billion and a daily trading volume surpassing $15 billion, underscoring its appeal among institutional investors. This dominance reflects the asset’s underlying infrastructure status, further validated by its controlled tokenomics and supportive community engagement strategies. According to recent metrics, XRP’s sentiment ranks exceptionally high, illustrating its engaging social presence and community backing.

💬 Community Sentiment: Riding the Wave of Euphoria

Community engagement surrounding XRP is surging, as indicated by data from LunarCrush showing a top-tier social performance with an AltRank of 5. The enthusiasm for XRP is palpable, with a remarkable 82% positive sentiment in discussions about its ETF developments and ongoing SEC resolution prospects. The community is not merely passive; active investors are projecting future price targets set at remarkable levels, such as $15 to $23, which fuels the euphoria and collective hope of further institutional adoption.

📈 Conclusion: Navigating a Critical Juncture

XRP stands at a tipping point, shaped by regulatory clarity and new institutional investments through ETFs. With its RSI at extreme levels, the situation is poised for a potential breakout or a much-needed correction to re-establish momentum. As XRP continues to allure both institutional and retail investors, the upcoming weeks will be crucial in determining whether it will set new records or pull back for a breather. Investors and enthusiasts alike are eagerly watching this dynamic market—where do you think XRP will head next? Join the conversation and share your insights!

“`

This rewritten article aims to engage readers more effectively with varied sentence structure, clear headings, and substantial content while maintaining the integrity of the original information.