Discovering the Roots of Modern Finance: A Journey Through Time

In the labyrinth of contemporary finance, where complexity and prestige reign, it’s easy to forget that the roots of our financial systems are steeped in the most human and practical of needs. The concepts that underpin today’s futures markets, options trading, and global commerce didn’t just spring up overnight; they are remnants of ancient civilizations meticulously laying the groundwork for what we know today.

Long before the glitzy towers of Wall Street or the busy floors of the Chicago Board of Trade, human beings were already engaging in intricate forms of risk management, speculative pricing, and contract-based trading, particularly in agriculture. The unpredictability of nature required cooperation, foresight, and trust-based networks to navigate future outcomes, echoing the essence of modern trading systems.

The Birth of Financial Strategies in Ancient Civilizations

One of the earliest testimonies to financial foresight can be traced back to the biblical story in Genesis 41, where an Egyptian Pharaoh dreams of seven years of bountiful harvests followed by seven years of famine. Enter Joseph, who interprets this vision and devises an early state-managed commodity strategy: by imposing a 20% tax during the prosperous years, the surplus grain is stored for sale during famine periods. Not only does Egypt weather the storms of nature, but it also profits, exporting grains to neighboring nations. This narrative is not just a tale; it embodies the foundational logic of commodity speculation and reserves management.

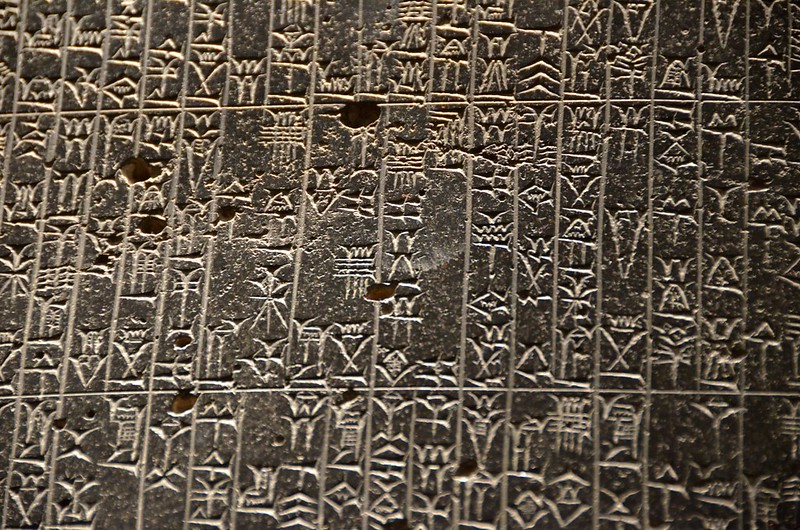

Further back in history, the Code of Hammurabi (circa 1750 BCE) documented contracts for future deliveries at pre-agreed prices, marking one of the earliest instances of futures agreements. These contracts were safeguarded within temples, transforming them into the first known clearinghouses, illustrating an early blend of finance and faith.

From Aristotle’s account of Thales securing exclusive olive press rights in ancient Greece to the Romans employing forward contracts in grain markets, the ancient world was rife with financial ingenuity. Not to forget the Phoenicians, who revolutionized maritime trade by pioneering shared-risk ventures — a precursor to modern-day equity investments. Thus, from Mesopotamia to Rome, humanity has ceaselessly innovated ways to navigate time, trust, and risk.

The Knights Templar: Pioneers of a Moral Financial System

Ancient scholars tell tales of a “gift economy,” where transactions were often based on social customs rather than market principles. Enter the Knights Templar, a unique order that established an early financial system rooted in morality and trust rather than mere gold. The Templars operated within a sovereign economy designed to empower communities, creating a moral currency system that represented acts of chivalry and service rather than hard cash.

Their innovations are nothing short of remarkable. They established one of the medieval world’s most advanced financial networks, allowing pilgrims to deposit money in one city and redeem it in another while safely navigating treacherous territories. This was an early form of international banking, fueled by trust and a moral mission to protect individuals undertaking perilous journeys.

The Evolution of Financial Markets: Hedge Funds and Beyond

Fast forward to the mid-20th century, when a new class of financial vehicles emerged that would dramatically reshape investment strategies: hedge funds. Alfred Winslow Jones, often considered the father of hedge funds, launched the first of its kind in 1949. His groundbreaking approach combined long and short positions to manage market risks, introducing a compensation model that still echoes in today’s financial world.

By the 1960s, the allure of hedge funds captured the attention of the wealthy elite, expanding beyond equities into commodities and foreign exchange, ultimately evolving into highly sophisticated instruments of global finance. The 1990s ushered in an era of deregulation, allowing hedge funds to proliferate and experiment with aggressive investment strategies.

Prominent figures like George Soros became synonymous with the new hedge fund landscape, exemplifying how these entities could not only influence markets but also trigger seismic shifts within them. Soros’s high-profile short of the British pound in 1992 is a testament to the power these funds wielded, marking a defining moment in financial history.

High-Frequency Trading: The Race for Speed

As the 21st century unfolded, the rise of high-frequency trading (HFT) marked yet another evolution in finance, leveraging advanced technology to execute trades at lightning speeds. Institutions equipped with powerful algorithms and superior data access defined this new era, where milliseconds became the ultimate currency in the battle for market supremacy. But this relentless drive for speed raised questions about fairness, transparency, and the balance between human intuition and algorithmic precision.

This legacy of evolution from ancient transactions to hedge fund strategies encapsulates a broader narrative: how financial communication networks have shaped our world. From the clay tablets of Mesopotamia to the digital exchanges of today, the quest for information symmetry has fueled the ascent of financial tools designed to provide an edge.

Future of Finance: A Legacy Reclaimed Through Decentralization

Reflecting on the time-honored innovations of ancient civilizations reveals that finance has always been about more than just profit. The connections forged through trust and governance formed the bedrock upon which modern financial systems are built. Today, as we stand on the brink of a decentralized financial revolution with Web3 technologies, there lies an incredible opportunity to reimagine our relationship with money.

In many ways, Web3 echoes the Knights Templar’s traditions: emphasizing security, mutual trust, and empowerment for the greater good. By adopting decentralized infrastructures, we are not just reinventing financial tools but revitalizing purpose — shifting towards a system that prioritizes transparency and honor over mere profit.

As we embrace this transformative wave, it invites us to reclaim the essence of finance: building a trusted, community-driven financial landscape that serves people and protects against the pitfalls of centralized power. It’s not merely about technological advancement; it’s a philosophical return to a system managed by the principles that have guided humanity since the dawn of commerce.

Join the discussion on how we can shape the future of finance together. What role do you see yourself playing in this transformative period? Share your thoughts in the comments below!