In an electrifying turn of events, Solana (SOL) has recently surged by an impressive 4.31%, reaching a price of $204.15. This upward momentum is a part of a remarkable 26% weekly rally, fueled by a transformative wave of corporate treasury shifts. With its relative strength index (RSI) hitting an extreme 82.22, SOL is positioned at a crucial crossroads as it tests the $210 resistance level. The landscape is further dynamic as prominent companies like DeFi Development, Sol Strategies, and Bit Mining approach the monumental $100 billion market capitalization milestone. This article dives deep into the technical analysis, infrastructure developments, and institutional adoption that are shaping Solana’s prospects over the next 90 days in this historic period of corporate embrace.

What makes this surge significant? In a market traditionally driven by individual retail investors, it seems that institutional players are now playing a pivotal role. The ongoing shift of corporate treasuries towards cryptocurrencies like SOL could redefine market dynamics, making the current trading environment less speculative and more strategically driven. Could we be witnessing the dawn of a new era in cryptocurrency investments?

As we explore the technical intricacies, it’s essential to note how SOL’s current price reflects a powerful daily gain, pushing it closer to breaching the psychological resistance at $210. With a striking intraday range of $11.24—or 5.5% of the current price—this movement showcases a blend of institutional accumulation and a growing sense of FOMO among retail investors. Such dynamics have not only captured attention but have also triggered a renewed interest in Solana’s robust potential amidst this acceleration of corporate adoption.

Source: TradingView

Source: TradingView

On a technical level, while the RSI suggests caution with its soaring reading above 80—often a precursor to corrections of 10-15%—the involvement of corporate treasuries introduces unusual market dynamics that may sustain the upward trend longer than traditional metrics might predict. After all, institutional investors possess the resources and intent to hold positions longer, unlike the typical retail-driven sell-offs that often follow peaks in momentum.

The moving average convergence divergence (MACD) indicators reinforce this bullish outlook, presenting positive signals that support ongoing momentum rather than indicating exhaustion. In this juxtaposition, Solana stands at a precipice: bargain hunters and momentum traders are waiting to see if it breaks above the $210 psychological level, a move that could unlock further upward potential, or if it may experience a strategic pullback towards the $190–$195 support levels.

What’s driving this corporate treasury shift? Public companies are now amassing SOL for diversification purposes, leading to a significant structural change in the cryptocurrency landscape. Companies like DeFi Development, which has secured nearly 1 million SOL tokens—a staggering investment of $200 million—are participating in this corporate treasury movement. With firms such as Sol Strategies and Bit Mining also joining the fray, there’s a palpable shift in demand that transcends mere speculation, suggesting that corporate treasuries might be here to stay in the crypto market.

This corporate adoption coincides perfectly with a technical breakout for Solana, positioning it for continued institutional interest as traditional finance warms up to blockchain infrastructure. This shift promises not just speculative upside but a fundamental change in how cryptocurrencies are utilized in business contexts.

SOL. @MetaMask. Transak. Your gateway to multi-chain crypto 💙 Read more on @BTCTN 👇🏼 https://t.co/88EIZ9UFXc

Moreover, the integration of the SOL fiat gateway by Transak on platforms like MetaMask signifies a major step in enhancing accessibility. It reduces the technical barriers that have previously hindered broader adoption of the Solana ecosystem, allowing mainstream users to transact in SOL more seamlessly. Further, Jito Labs’ aspirations to develop Solana into a decentralized NASDAQ through their proposed “BAM” block marketplace reflect an ambitious effort to redefine financial infrastructures using high-performance blockchain technology. This is more than just idealism; it’s a practical application of blockchain that could very well replace aspects of traditional finance in the near future.

Looking at the historical context, SOL is inching closer to its previous all-time high of $295.83 from January. With current valuations reflecting a 31% discount to that peak, investors are presented with a compelling risk-reward opportunity. The recovery of 109% from April’s lows signifies growing institutional confidence, which fuels optimism for further price increases.

Source: TradingView

Source: TradingView

The immediate support for SOL is observed at around $193.75, reinforced by psychological support levels between $190 and $195. The exceptional positioning of the exponential moving averages (EMA), with prices consistently 21-27% above key averages, validates the strength of corporate accumulation and bolsters the existing trend of price appreciation. Conversely, breaking below the $190 level may lead to deeper corrections ranging between $170 and $180, emphasizing the need for prudent risk management strategies.

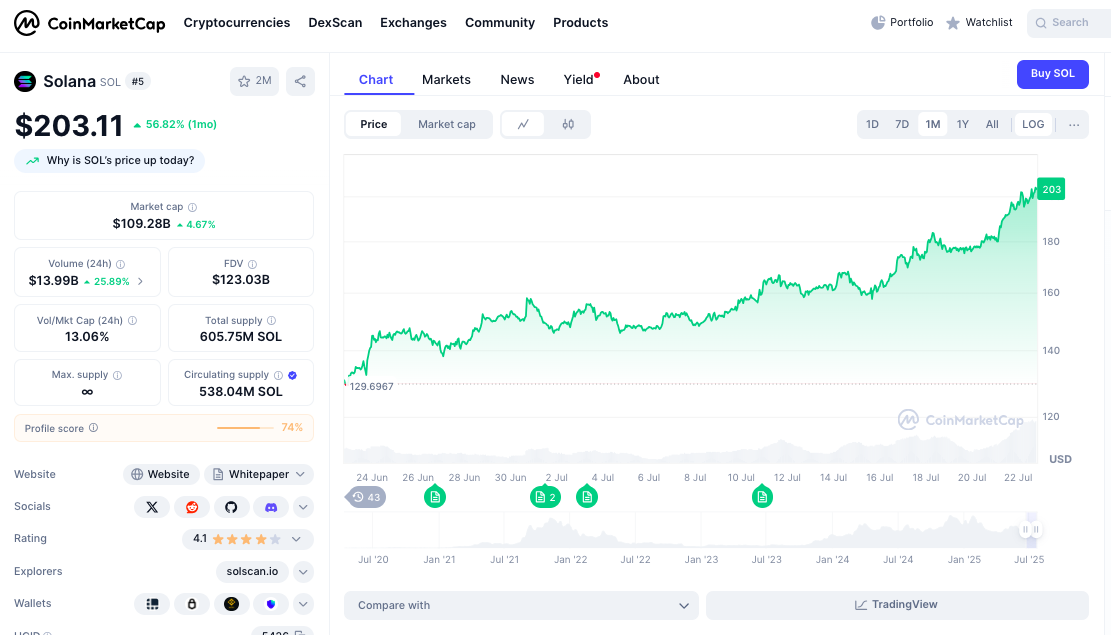

In terms of market metrics, Solana boasts a market capitalization of $108.59 billion, buoyed by a remarkable 24-hour trading volume of $14.36 billion—a staggering 38.29% increase. This strong volume-to-market cap ratio of 13.17% indicates heightened involvement from both corporate and institutional players, lending credence to the validity of Solana’s current breakout.

Source: CoinMarketCap

Source: CoinMarketCap

As for social sentiment, it’s clear that corporate validation is propelling community optimism. Recent analyses from LunarCrush have indicated a robust engagement within the community, with an AltRank reaching 33, highlighting Solana’s strong social standing among cryptocurrencies. The positive sentiment at 82%, coupled with over 41 million total engagements, reflects Solana’s ability to capture massive attention during periods of corporate adoption. The enthusiasm is palpable with price targets circulating between $250 and $400, emphasizing a collective maturity towards a utility-focused investment narrative rather than speculative trading.

$SOL is ready for a massive pump. Targeting $400-$450 for this bull run.

In terms of forecasts, three scenarios emerge for SOL over the next 90 days. The Bull Case anticipates continued corporate treasury adoption alongside a successful breakout above $210, driving prices up to $250-$280. This scenario hinges on ongoing institutional engagement and robust infrastructure development.

In a more tempered Base Case, we could see a healthy pullback as the RSI normalizes, with prices retreating to the $190–$195 range. This scenario would serve to reset technical indicators while maintaining the positive corporate momentum.

Finally, the Bear Case, while less likely given the current dynamics, involves a break below $190 that could see prices descend to $170-$180. However, the firm corporate treasury backdrop helps mitigate potential drastic downturns, supporting the notion of stability and opportunity for recovery cycles.

Source: TradingView

Source: TradingView

In summary, as Solana continues to flourish amidst this wave of corporate treasury adoption, its trajectory appears promising. A breakout above the $210 resistance could potentially rally the price to new heights, illustrating the cryptocurrency’s potential to transform from speculative asset to a fundamental component in corporate finance. However, investors must remain vigilant as technical indicators suggest the possibility of corrections, providing opportunities for strategic entries. In the ever-evolving world of cryptocurrency, Solana’s story is just beginning, and its potential is ripe for exploration.