Transforming the Landscape: Crypto Payments on the Rise

In recent times, cryptocurrencies have transitioned from mere speculative assets to viable payment methods. As we move into 2024, industry analysts are predicting a seismic shift in how cryptocurrencies, particularly Bitcoin (BTC), are utilized—no longer just viewed as a store of value, but increasingly seen as a medium for everyday transactions. This anticipated evolution in crypto payment methods is poised to be fueled by a combination of more favorable regulations and expanding technological infrastructure.

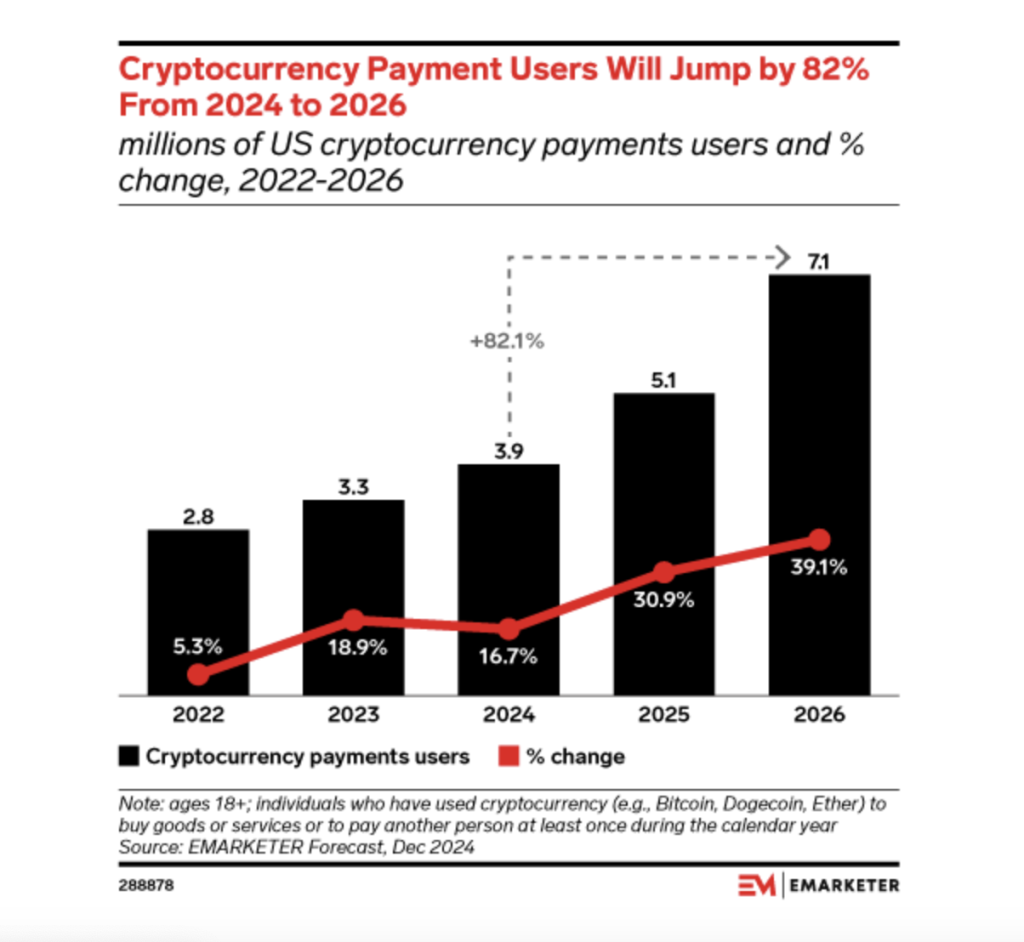

Recent insights from EMARKETER forecast a remarkable 82.1% growth in crypto payment adoption over two years beginning in 2024. This surge will be bolstered by an increasing number of businesses integrating crypto payment options into their services and more user-friendly regulations becoming the norm.

Why This Matters: The Promise of Enhanced Access

As cryptocurrencies become more integrated into everyday transactions, the implications for financial inclusivity are profound. A larger array of payment systems can lead to increased access for underserved communities, particularly in areas with limited banking infrastructure. By bridging these gaps, cryptocurrencies can unlock new economic opportunities and foster greater financial equity.

Addressing Security Concerns: A Major Hurdle

Despite the optimistic outlook, security remains a primary concern for many potential users. The findings from a recent survey conducted by Bitget Wallet reveal that over 37% of participants identified security risks as the foremost barrier to adopting crypto for payments. Additional concerns included the irreversible nature of transactions and insufficient legal protections. Clearly, addressing these apprehensions will be essential in driving wider adoption.

What’s driving crypto payment adoption and what’s holding it back? 👀We surveyed 4,599 users to uncover key trends shaping the future of PayFi 💰Here’s the key findings from our 2025 PayFi Report! 🧵👇 pic.twitter.com/yycmW7OcWO— Bitget Wallet 🩵 (@BitgetWallet) March 25, 2025

Streamlining Transactions: Simplified Processes and Traditional Partnerships

In response to the pressing concerns about security and complexity, several platforms have begun simplifying the crypto payment process. Bakhrom Saydulloev, a product lead at the payment infrastructure company Mercuryo, highlighted that despite market fluctuations, crypto payments have exhibited steady growth. He emphasizes that many existing offerings are overly complicated, creating friction at every step from account creation to transaction completion. Users, he asserts, have a simple wish: to enjoy the same low costs, speed, and security that traditional payment platforms provide.

To facilitate a more seamless experience, Mercuryo has partnered with Revolut Pay, allowing users to buy and sell cryptocurrencies in just a single click. The platform boasts enhanced security features like biometric authentication, ensuring that transactions remain safe while being user-friendly.

Additionally, crypto exchange CEX.IO has teamed up with MoneyGram to launch cash-in and cash-out services, enabling users to convert USDC into physical cash with ease, showcasing how blending traditional finance with crypto can provide innovative solutions.

Regulatory Developments: A Path Toward Stability

As platforms innovate to overcome adoption barriers, the regulatory landscape is also shifting to support safer crypto payment frameworks. According to the Bitget Wallet report, nearly 27% of investors are concerned about the lack of legal protections in crypto transactions. Regulations, such as the Markets in Crypto-Assets Regulation (MiCA) in the EU, are setting the groundwork for established financial institutions to issue crypto assets, paving the way for trust and legitimacy in the sector.

Coinbase is another player that has focused on minimizing friction in crypto payments. By offering free transfers of USDC and developing its layer-2 network, Base, Coinbase aims to facilitate rapid transactions with minimal fees, thereby attracting more users into the crypto payments ecosystem.

Global Landscape: Expanding Access in Emerging Markets

While developed regions see gradual adoption, emerging markets are rapidly embracing cryptocurrency for payments, primarily due to the speed and efficiency it offers. Data from Bitget Wallet indicate that 46% of users in these regions favor crypto payments over traditional fiat options. Most notably, respondents from Africa and Southeast Asia expressed significant interest in using cryptocurrencies, noting their ability to circumvent existing banking barriers.

Rich Rine, an initial contributor at Core DAO, pointed out that for many in developing regions, cryptocurrencies are not merely an alternative; they fill a void in financial infrastructure. This effectively transforms access to financial systems, providing opportunities where they previously did not exist.

As Rine emphasized, for crypto payments to gain traction in more developed markets like the US and Europe, these systems must compete head-to-head against traditional financial offerings, which often come with added security measures like fraud protection.

Building Trust and Expanding Opportunities

The ongoing efforts to simplify cryptocurrency payments signify a broader shift towards creating secure and inclusive financial services. As traditional banks and digital currencies collaborate, they are working to establish a marketplace built on trust and accessibility. This synergy has the potential to empower individuals, foster community engagement, and reshape our economic landscape.

Imagine a future where the fusion of traditional and digital finance not only streamlines transactions but also opens doors to opportunities that were once unimaginable. How will this new paradigm affect the way you think about money and transactions? Join the conversation!

Conclusion: The Future of Crypto Payments

As we look to the future, it is clear that the merging of traditional banking methods with digital currencies holds vast potential for transforming how we conduct transactions. With improvements in security, regulatory frameworks, and ease of use, cryptocurrencies may soon become a staple in the payment landscape. As industry leaders and regulators continue to work together, wider adoption seems not just possible, but inevitable.

Frequently Asked Questions (FAQs)

How will combining traditional banking with crypto payments alter consumer use? Integrating established banking methods with digital assets creates a smoother transaction experience, merging the reliability of traditional processes with the speed of crypto transfers.

What benefits can merchants and users expect from a streamlined crypto process? A simplified approach minimizes transaction friction for both consumers and merchants, drawing on secure banking practices to enhance the efficiency of digital trade.

How can regulators and industry leaders collaborate to build trust in simplified crypto payments? Establishing clear, consistent regulations that integrate established security practices with modern digital innovations will foster user confidence and promote widespread adoption.