TRON (TRX) Shows Bullish Momentum Amid Major Corporate Adoption

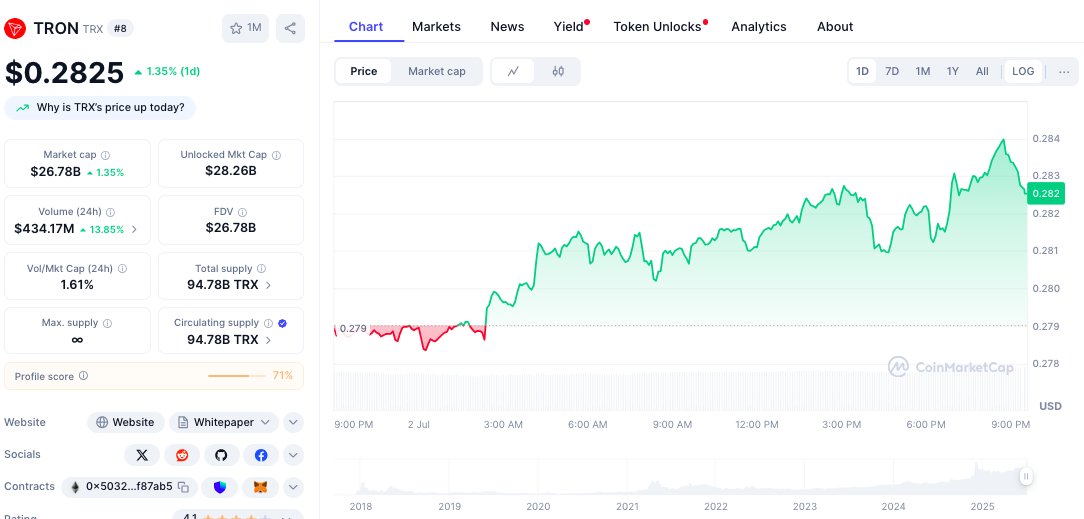

The cryptocurrency market is buzzing with excitement as TRON (TRX) recently surged by 0.93%, reaching a price of $0.2814. This surge is supported by robust technical indicators and noteworthy corporate activity, notably the completion of a groundbreaking $100 million treasury launch by SRM Entertainment. This initiative involves the staking of 365 million TRX tokens, promising a lucrative 10% annual yield, indicating a strong shift towards institutional adoption. Let’s dive deeper into the factors propelling TRON’s momentum and explore what this means for its future.

📌 Why This Matters

The importance of this upward price action cannot be overstated. TRON’s current market valuation stands at an impressive $26.7 billion, with a daily trading volume holding steady at approximately $390.53 million. This stability lends credibility to TRX as a serious contender in the cryptocurrency space, moving beyond mere speculation to positioning itself as a viable asset for corporate balance sheets. The successful staking initiative represents a shift in how corporations perceive and utilize cryptocurrencies, potentially paving the way for broader corporate treasury implications across the cryptocurrency landscape.

🔥 Expert Opinions

Market analysts have weighed in on TRON’s recent movements, noting the significance of its technical indicators. “TRON is not just riding the wave of popular cryptocurrencies; it’s carving its niche by appealing to corporate interests,” observed a cryptocurrency analyst. “The combination of a solid technical foundation and institutional buying pressure positions TRX to capitalize on the growing altcoin treasury movement. We could see TRX reach unprecedented heights if this momentum continues.”

🚀 Future Outlook

Looking ahead, TRON’s trajectory could take several forms. Analysts project potential price points based on current momentum and market conditions:

- Corporate Treasury Expansion (Bull Case – 40% Probability): A wave of corporate adoptions following SRM’s success could propel TRX toward $0.35 to $0.40, representing significant potential upside. This scenario hinges on sustained yield generation and institutional onboarding.

- Gradual Appreciation (Base Case – 45% Probability): Continued stability and structured growth within established channels could see prices aiming for $0.32 to $0.35. This scenario envisions steady market conditions without explosive growth.

- Technical Correction (Bear Case – 15% Probability): A potential downturn below the 50-day EMA may prompt a retracement to $0.2450-$0.2600, which would necessitate caution from investors.

Technical Analysis: Bullish Structure Above All EMAs

TRON’s price movement has repeatedly established itself above key exponential moving averages (EMAs), including the 20-day, 50-day, 100-day, and 200-day EMA. This alignment signifies a bullish trend that is not only sustainable but also reinforced by robust trading volumes. The current RSI is at a healthy 58.87, indicating ample room for further growth, while MACD indicators are exhibiting early bullish signs by trading comfortably above zero, hinting at sustained positive momentum ahead.

Corporate Treasury Shift: SRM Entertainment Leading the Way

SRM Entertainment’s successful launch of its $100 million TRON treasury strategy is a clear indicator that corporate entities are starting to embrace cryptocurrency’s potential for yield generation. By staking 365 million TRX tokens through the JustLend protocol, SRM is not just diversifying its investment portfolio but also reshaping perceptions of how corporations can utilize cryptocurrency. The incorporation of crypto treasury strategies within traditional business models, such as those of SRM—which also produces souvenirs for major entertainment firms—demonstrates a significant crossover into the mainstream business world.

SRM Entertainment, Inc. (Nasdaq: SRM) announced the completion of its $100 million TRON treasury strategy deployment. The company has staked 365,096,845 TRX on JustLend to earn up to 10% annualized returns, combining staking rewards and energy rental income.…— Wu Blockchain (@WuBlockchain) June 30, 2025

Market Metrics: Supporting Sustainable Growth

The data supports TRON’s current position as an emerging infrastructure powerhouse within the cryptocurrency ecosystem. Boasting a market capitalization of $26.7 billion, TRON holds a market share of 1.35%. Moreover, its substantial daily trading volume of $434 million ensures ample liquidity, essential for institutional investment. Additionally, the circulating supply of 94.78 billion TRX is entirely distributed, alleviating concerns of supply issues that can plague other projects. This transparency makes TRON particularly appealing to treasury managers looking for predictable tokenomics in their portfolios.

Conclusion: The Path Ahead for TRON

In conclusion, TRON stands at a crucial juncture, where a combination of technical strength, corporate treasury validation, and stablecoin infrastructure creates a strong case for long-term investment. With the groundwork being laid by significant corporate players like SRM Entertainment, TRX seems primed for continuous appreciation throughout 2025. As we watch how the institutional landscape unfolds and more companies adopt similar treasury strategies, TRON’s potential for growth seems not just promising but altogether feasible. What are your thoughts on TRON’s future? Join the conversation and share your insights!