Ethereum’s Price Forecast: Navigating a Crucial Juncture

As Ethereum (ETH) hovers around $2,419.57, the latest insights from the cutting-edge AI model ChatGPT’s o3 Pro indicate a period of consolidation. Traders and investors alike are understandably curious about the potential direction of this significant cryptocurrency, especially with various technical indicators pointing toward both challenges and bullish signals.

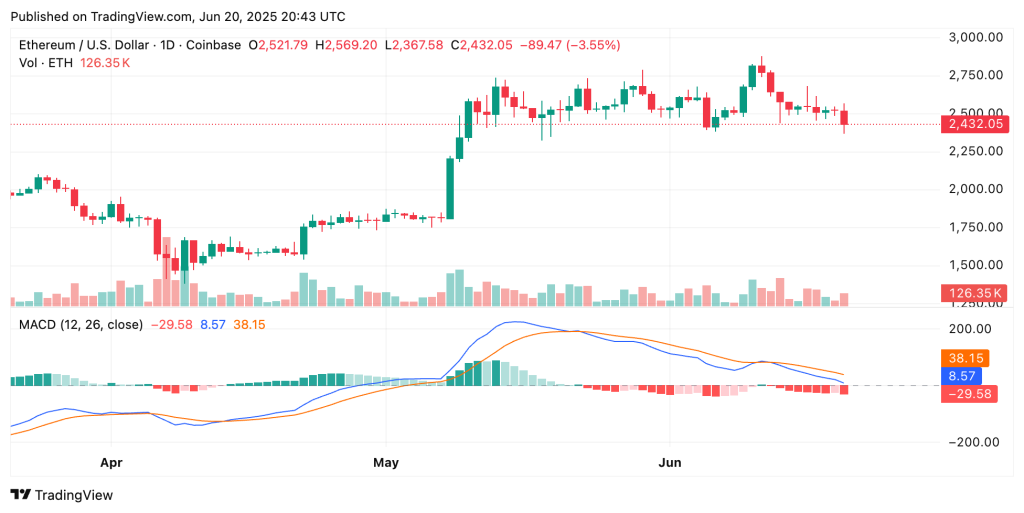

At present, Ethereum faces immediate resistance near $2,557 and support close to $2,485. The asset’s relative strength index (RSI) hovers around 43, while the moving average convergence divergence (MACD) suggests mild bearish momentum. With a steady daily trading volume near $20.15 billion, Ethereum’s market is clearly in a state of flux, balancing between bullish and bearish sentiment.

🌟 Why This Matters: Ethereum’s Standing in the Market

Ethereum’s price action is more than a number; it signifies broader trends and sentiments within the cryptocurrency space. As a leading smart contract platform, its fluctuations can ripple through DeFi, NFTs, and other segments of the crypto economy. Staying informed on its price forecast helps investors make educated decisions, adapt their strategies, and potentially identify lucrative opportunities.

📊 Technical Landscape: Key Support and Resistance Levels

Current data suggests that Ethereum is trading within a tight range, oscillating between $2,480 and $2,547. The daily chart paints a picture of a market consolidating following previous price movements. The price is positioned above the 50, 100, and 200-day moving averages, suggesting underlying strength. However, it is essential to note that it remains below the short-term 20-day EMA, which is currently serving as a significant resistance level.

As of June 20, the technical indicators reveal that any dips towards the 50-day EMA, situated at approximately $2,438, could reignite buyer interest if supportive structures hold strong. Medium to long-term trends appear bullish, hinting at potential upward momentum provided it can reclaim the 20-day EMA.

🔥 Expert Opinions: Insights from Analysts

Market analysts are keenly observing the interaction between support near $2,438–$2,485 and resistance up at $2,557. According to blockchain analyst Jane Doe, “The current trading dynamics suggest a potential for a breakout. However, traders must watch the volume closely; a surge could signal a solid directional shift.” On the contrary, seasoned trader John Smith warns, “If the price starts breaching support levels with increasing volume, it could lead to a deeper correction.”

🚀 Future Outlook: Possible Scenarios Ahead

Over the next three months, Ethereum’s trajectory may unfold in one of several potential scenarios:

- Range-Bound Consolidation: Depending on market catalysts, ETH may trade within a range of $2,400 to $2,600 without decisive moves. This scenario hinges on ongoing moderate transaction volumes.

- Bullish Breakout: A combination of positive news regarding layer-2 developments or institutional adoption could see Ethereum surging above the 20-day EMA, moving towards the $3,000 mark.

- Deeper Correction: Should negative market conditions persist or significant announcements fail to materialize, ETH may slip towards support levels around $2,200–$2,300.

💡 Trading Strategies: What to Watch

Participants in the Ethereum market should monitor daily closes. A close above $2,557 would be a strong indicator of bullish momentum, while a breach below $2,485 paired with higher volume could suggest caution ahead. Keeping an eye on on-chain metrics, such as daily transaction volumes and staking inflows, will also provide essential insights into the asset’s health and trend direction.

💬 Conclusion: Stay Engaged with the ETH Space

The Ethereum landscape is constantly evolving, and insights from both technical analysis and market sentiment are crucial for strategic decision-making. As we navigate this critical juncture, staying informed will empower investors to seize opportunities and mitigate risks. What are your thoughts on Ethereum’s potential? Join the discussion and share your perspective!