A Remarkable Surge: Uniswap (UNI) Skyrockets Over 24%

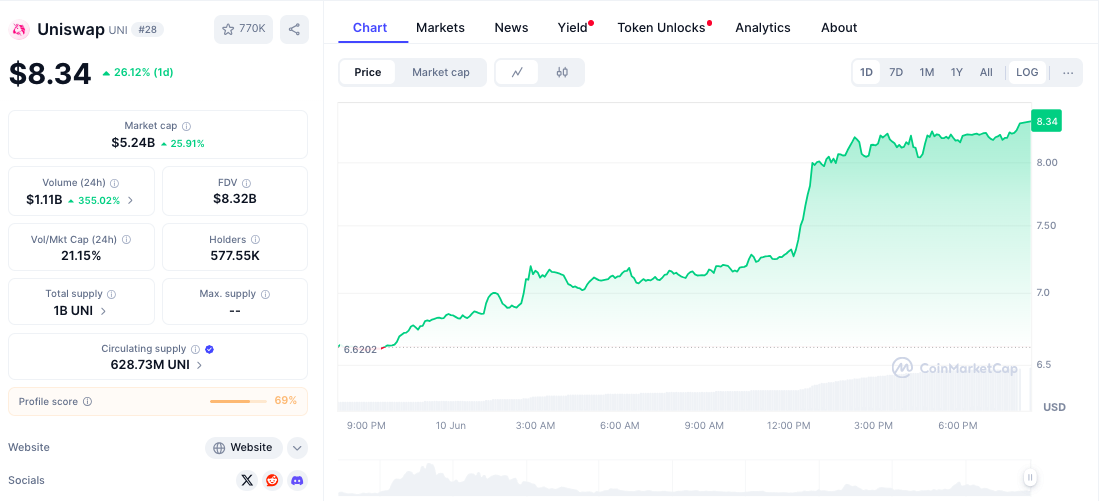

In the ever-fluctuating world of cryptocurrency, standout performances are often celebrated, but few are as striking as Uniswap’s (UNI) latest feats. Just recently, the Ethereum-based decentralized exchange witnessed a staggering 24% surge in a single trading session, elevating its price to an impressive $8.34. This remarkable recovery showcases Uniswap’s resilience, having rebounded over 90% from a low of $4.60 in April.

Breaking Barriers: Uniswap’s Positioning in the Market

This robust growth has catapulted Uniswap back into the league of the top 30 cryptocurrencies by market capitalization, reclaiming its status amid a competitive decentralized finance (DeFi) landscape that includes rivals like PancakeSwap, Aave, and Jupiter. Notably, it remains the second-largest DEX by trading volume, trailing only BNB Chain’s PancakeSwap. The latest surge has left many wondering — is this the dawn of a new DeFi Summer?

Why This Matters: The Implications of Regulatory Changes

What’s fueling this surge is more than just market enthusiasm. Coinciding with Uniswap’s rally, the U.S. SEC made waves with statements indicating that DeFi platforms may receive exemptions from certain regulatory frameworks. Such news has heightened optimism, sparking sentiments of a potential revival reminiscent of the DeFi Summer in 2021, which saw explosive growth in the sector.

Monthly trading volume on @Uniswap was close to all-time highs in May ’25. pic.twitter.com/2VkTkGbt80— Token Terminal 📊 (@tokenterminal) June 9, 2025

Trading Volume: A Key Indicator of Strength

Uniswap’s recent trading activity further underscores its resurgence. As of May 2025, monthly trading volume on the platform soared to over $88 billion, eclipsing its 2021 peak of $80 billion. Remarkably, approximately half of this volume stemmed from Ethereum layer-2 solutions like Arbitrum, Optimism, and Base, showcasing the growing traction of layer-2 protocols.

Expert Opinions: Analysts Weigh In on Future Price Targets

With the groundwork laid for potential growth, analysts are eyeing ambitious price targets for UNI. Bitcoin educator Bitcoinsensus pointed out that UNI has been navigating a Right-Angled Ascending Broadening Wedge for three years, and its present trajectory suggests it may soon breach the upper bounds of this pattern. This breakout, according to the analyst, could signal a parabolic move corresponding with a renewal in DeFi activity, projecting a target price of approximately $27.40.

$UNI Breakout Watch 📈🚨 After 3 YEARS inside a Right-Angled Ascending Broadening Wedge, Uniswap is making its way towards the upper line of the channel. This move that historically precedes is likely to break out above the top line and go parabolic once DeFi season starts 📈… pic.twitter.com/QvNdWfB45D— Bitcoinsensus (@Bitcoinsensus) June 10, 2025

Technical Analysis: Breaking Down the $UNI Chart

The technical indicators paint an exhilarating picture. Uniswap’s daily chart reveals a significant breakout after a prolonged consolidation phase in the $5.50 to $6.50 range. This upward momentum, characterized by strong trading volume that hit $1.44 billion, reinforces a shift in market sentiment toward a bullish trend.

With a MACD indicator displaying a bullish crossover, signaling sustained upward pressure, market watchers are now closely monitoring the immediate resistance level at $11.60. Should $UNI maintain its trajectory and break this threshold, a climb to $15.50 and beyond becomes a plausible scenario.

The Future Outlook: Will $UNI Reach New Heights?

As we look ahead, many anticipate that the evolving landscape of DeFi and the introduction of favorable regulatory conditions could provide the catalyst for Uniswap’s continued growth. If the stars align, could we see an upward shift to past highs of nearly $44? With analysts optimistic and market confidence rising, the crypto community is abuzz with possibilities.

Conclusion: Engage with the Community

Uniswap’s recent surge is not just about price movement; it’s a reflection of renewed market dynamics and potential transformative growth in the DeFi landscape. As more traders and analysts turn their eyes to UNI, the discussion is heating up. What do you think — will Uniswap reclaim its former glory, or is volatility around the corner? Join the conversation and share your insights as we navigate these thrilling times in cryptocurrency!