UK Authorities Freeze £6 Million in Illegitimate Crypto: A Major Move Against Cybercrime

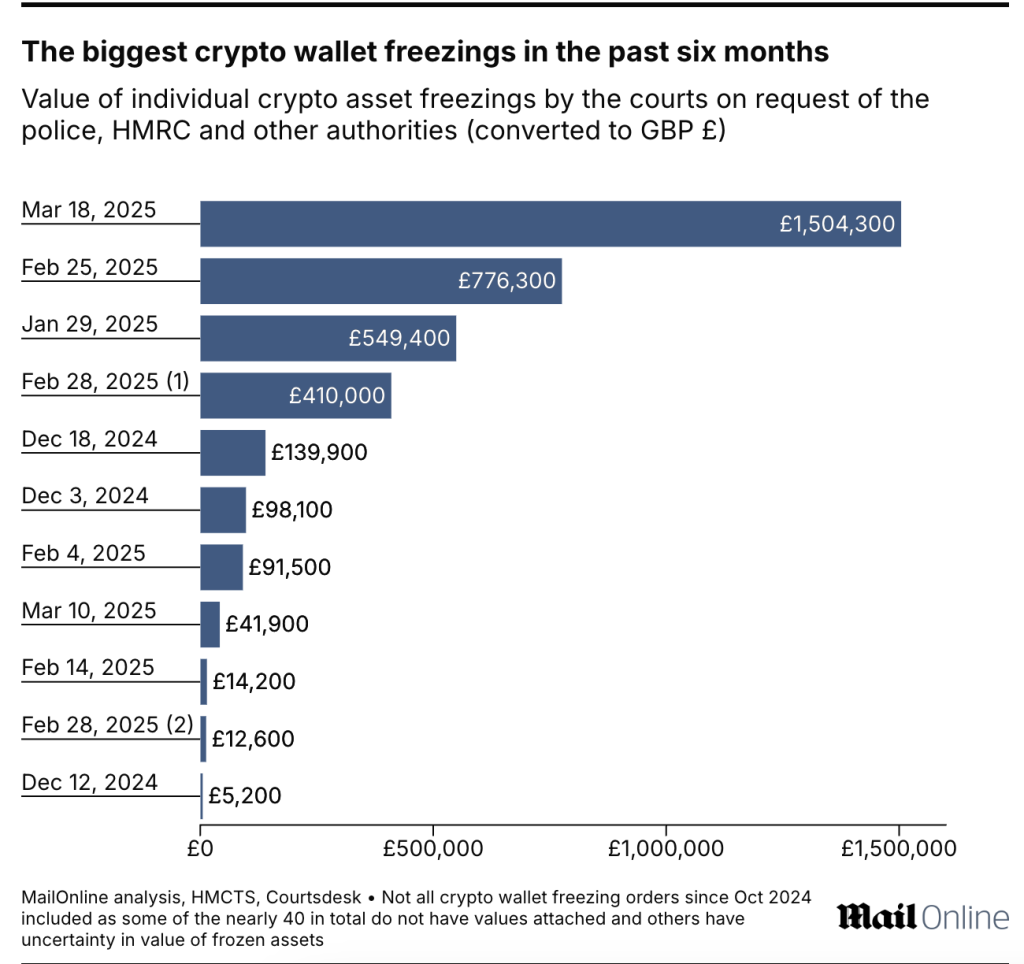

In a bold stride towards combating cryptocurrency-related crime, UK law enforcement has successfully frozen approximately £6 million ($7.76 million) derived from illicit activities since the dawn of 2024. This proactive measure is part of an ongoing investigation unveiled by MailOnline, showcasing the power of enhanced enforcement mechanisms brought into play last year. With UK police and other authorities on high alert, the crackdown on suspicious digital assets has escalated significantly since its inception.

Details of the Enforcement Action

The legal framework established last April enabled authorities to freeze suspicious cryptocurrency wallets for a duration of up to three years. Notably, within the last six months, the most substantial single freeze order amounted to £1.5 million ($1.94 million). This order, filed in the Newcastle Upon Tyne Magistrates’ Court on March 18, pertains to funds held in a wallet managed by the crypto exchange Coinbase.

📌 Why This Matters

The significance of these developments extends beyond mere monetary values. The UK’s rigorous approach underlines the increasing seriousness with which governments are treating cryptocurrency abuse. As the digital currency market evolves, so do the methods employed by criminals. By freezing these assets, authorities are not only hitting financial criminal enterprises where it hurts but also sending a clear message that digital miscreants cannot operate unchecked.

Expert Opinions: Insights from the Industry

Legal experts are weighing in on the current state of crypto regulations in the UK. Nick Barnard, a distinguished partner at Corker Binning, asserts that while the amounts being frozen may appear modest now, they represent the UK’s nascent steps in a much larger battle. “This is just the beginning,” he remarked, suggesting that the framework is still finding its footing. Barnard highlighted that the situation requires time to mature as law enforcement agencies adapt to the ever-changing landscape of cryptocurrency crime.

Siobhain Egan, a leading lawyer from Lewis Nedas Law, elaborates on the proactive measures being taken: “The authorities are moving aggressively to combat money laundering.” Egan believes we might soon witness what she describes as a “tsunami of crypto freezing orders,” especially if ongoing investigations into organized crime persist.

🚀 Future Outlook: What Lies Ahead for Crypto Regulation

Looking ahead, the UK’s landscape for cryptocurrency regulation is likely to undergo significant changes. The recent proposal of the Crime and Policing Bill aims at enhancing law enforcement’s abilities to confiscate illicit crypto assets more effectively. As the Financial Conduct Authority (FCA) also pushes for stricter regulatory measures to address inherent risks in the digital assets sector, it’s clear that the UK is prepared for a long-term commitment to safeguarding the integrity of cryptocurrencies.

As authorities further strengthen their grasp on these digital assets, analysts predict a ripple effect across the industry, potentially leading to increased transparency and compliance requirements that could reshape how cryptocurrencies are managed and traded in the UK.

Conclusion: The Significance of Continuous Vigilance

The UK’s assertive action against illicit cryptocurrencies marks a pivotal shift in the battle against financial crime. As authorities adapt to the complexities of digital currency, it becomes imperative for the entire ecosystem—regulators, exchanges, and users—to remain aware of the evolving legal landscape.

With ongoing advancements and proposed legislation, now is a crucial time for stakeholders within the cryptocurrency space to engage in discussions about compliance, ethical practices, and the overall future of digital currencies. How do you see the future of crypto regulation shaping up? Share your thoughts below!