In an exciting development for the world of finance, UBS has achieved a significant milestone: the successful execution of the first end-to-end tokenized fund transaction utilizing the Chainlink Digital Transfer Agent (DTA) technical standard. This groundbreaking moment not only underscores UBS’s commitment to innovation in financial technology but also highlights the increasing role of blockchain in institutional finance.

We’re thrilled to announce that @UBS has successfully completed the world’s first in-production, end-to-end tokenized fund workflow leveraging the Chainlink Digital Transfer Agent (DTA) technical standard. https://t.co/h5wCdqaXIhUBS—one of the world’s largest private banks with… pic.twitter.com/smfbwOptx4— Chainlink (@chainlink) November 4, 2025

This achievement is particularly significant as it marks an important step in bridging traditional finance with modern blockchain capabilities. Following a pilot initiative with Swift and Chainlink last year aimed at facilitating the settlement of tokenized fund investments, UBS is now showcasing real-world applications that could redefine how investment funds operate.

At the center of this groundbreaking transaction is UBS Tokenize, the bank’s forward-thinking initiative dedicated to digital assets, in conjunction with DigiFT—a regulated decentralized exchange focused on real-world assets. Together, they demonstrated an innovative ecosystem where fund operations—including order placement, execution, and settlement—can occur seamlessly on blockchain platforms.

In this instance, the transaction involved the UBS USD Money Market Investment Fund Token (uMINT), designed on Ethereum’s distributed ledger technology. Utilizing the Chainlink DTA protocol, DigiFT served as the on-chain fund distributor, marking a historic moment in automating fund lifecycles entirely on-chain.

But why does this matter?

The implications are profound. With the new tokenized fund workflow, financial institutions can process transactions in real-time, ensuring compliance, security, and scalability. The DTA protocol facilitates efficient communication between on-chain and off-chain systems, paving the way for enhanced transparency and operational efficiency. Mike Dargan, UBS’s Group Chief Operations and Technology Officer, noted, “This transaction represents a key milestone in how smart contract-based technologies and standards improve fund operations and enhance the investor experience.”

As the world increasingly embraces digital finance, the integration of smart contracts and blockchain protocols is becoming essential. This transition is not merely a technological upgrade; it’s about reshaping the future of investment opportunities.

Industry experts echo this sentiment. Sergey Nazarov, Co-Founder of Chainlink, said, “This industry milestone with UBS and DigiFT illustrates how Chainlink enables secure and scalable workflows for tokenized assets, setting a new benchmark for institutional finance on-chain.” His words highlight the growing recognition of blockchain solutions in mainstream finance.

Thinking ahead, what does this mean for the investment landscape? With successful proof of concepts like this, we can expect a wave of innovation across capital markets. The streamlined processes demonstrated here could be a precursor to broader adoption of blockchain technologies, enhancing not only efficiency but also democratizing access to investment opportunities for a more diverse group of investors.

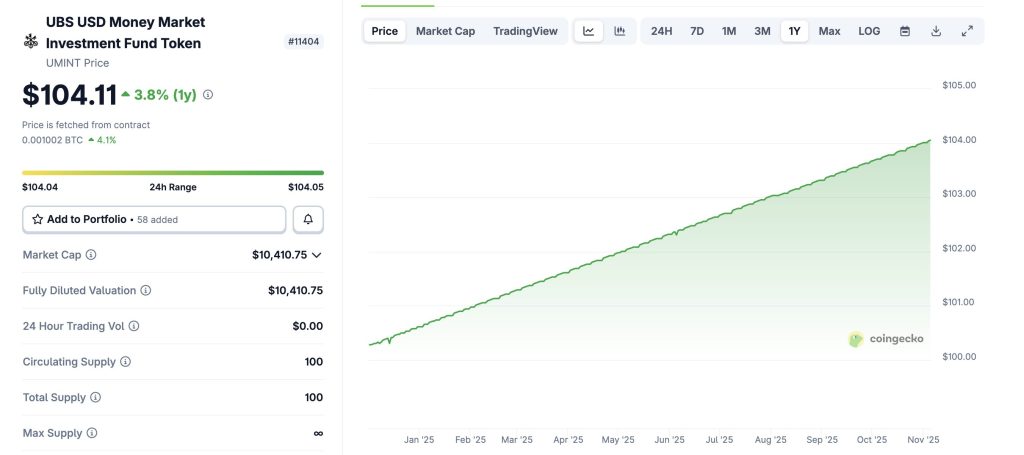

The value of the UBS USD Money Market Investment Fund Token (uMINT) is currently around $104.11, reflecting a steady increase of 3.8% over the past year—a testament to the resilience and stability typical of money market instruments. As the landscape evolves, the potential for such hybrid products becomes clearer, signaling that the traditional finance world is beginning to embrace digital asset innovations.

As we continue to explore the vast possibilities of blockchain technology within the financial sector, it’s evident that UBS’s leap into this space is paving the way for a transformative era in asset management. The future certainly looks promising for investors and institutions alike, as the lines between conventional finance and digital assets blur more each day.