UAE Authorities Clarify Stance on Crypto Golden Visa Rumors

In a recent turn of events, the UAE’s official entities have issued a firm rebuttal to the swirling rumors about a new golden visa program for cryptocurrency investors. The speculation stemmed from a bold announcement by Toncoin (TON), the cryptocurrency associated with The Open Network, which hinted at the possibility of securing long-term residency by merely staking crypto assets. This proclamation sent ripples across the crypto community but was swiftly quashed by government authorities.

📌 Why This Matters

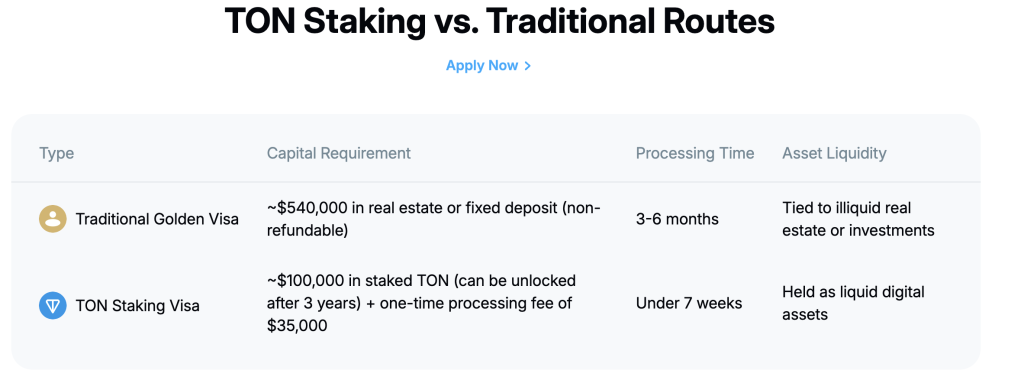

The allure of a golden visa has significant appeal for international crypto investors seeking opportunities in rapidly growing markets like the UAE. Toncoin’s proposition, which required a stake of $100,000 in TON paired with a processing fee of $35,000 for a 10-year residency, represented a transformative chance for many. However, the authorities’ swift denial highlights the necessity for investors to engage with authenticated information before making financial commitments. Misinformation can lead to misplaced trust and potentially substantial financial losses.

🔍 Official Refutation of Crypto Claims

According to a report from WAM news agency, several key authorities – the Federal Authority for Identity, Citizenship, Customs and Port Security (ICP), the Securities and Commodities Authority (SCA), and the Virtual Assets Regulatory Authority (VARA) – have collectively denied the validity of Toncoin’s claims. The SCA highlighted that cryptocurrency investments are established under structured regulations and are not associated with golden visa eligibility, urging investors to seek information solely from credible sources to avoid falling prey to scams.

Similarly, VARA made it clear that Toncoin is neither licensed nor regulated, reinforcing the importance of engaging with verified companies in the crypto space. They cautioned that any claims about golden visas linked to crypto investments are misleading.

🛑 The Actual Golden Visa Criteria

So, what are the actual requirements for obtaining a UAE golden visa? The ICP clarified that eligibility does not extend to crypto investors. Instead, the golden visa program favors categories such as:

- Real estate investors

- Entrepreneurs

- Exceptional talents, including scientists and specialists

- Top students and graduates

- Humanitarian pioneers and frontline workers

For a golden visa, foreign nationals must provide substantial public investments worth a minimum of 2 million UAE dirhams (approximately $544,000). This program offers holders long-term residency, enabling them to live, work, and study in the UAE for periods varying from five to ten years.

🔥 Expert Opinions on the Rumors

Even in the midst of this controversy, notable figures in the cryptocurrency world weighed in. Changpeng “CZ” Zhao, former CEO of Binance, posed a critical question on social media, casting doubt on the implications of Toncoin’s claim before the authorities clarified the facts. He expressed his desire for more concrete information, suggesting that if genuine, the program could open exciting avenues for crypto investors.

Is this 👇 real? It would be awesome IF it is true. But I got conflicting info so far. Some say: this is just so that they charge you $35k to pass your application to an agent, who usually only charge $1k fee…— CZ 🔶 BNB (@cz_binance) July 6, 2025

Zhao also mentioned that programs like these often need formal government backing and proper announcement channels, underscoring the complexity involved in such initiatives. Telegram CEO Pavel Durov, who shared Ton’s original announcement, inadvertently fueled the speculation, but even he found it prudent to verify the authenticity before committing to any actions.

🚀 Future Outlook: Implications for Crypto Investors

As the dust settles on these developments, the cryptocurrency market has begun to react accordingly. Following Toncoin’s announcement, the token surged by 10% before nosediving back to a 6% loss after the authorities debunked the claims. Trading at approximately $2.83 currently, this rollercoaster serves as a reminder of how quickly market sentiments can shift, particularly in response to regulatory clarifications.

Investors are advised to remain vigilant and informed as the crypto landscape continues to evolve. With regulatory frameworks becoming ever more established in jurisdictions like the UAE, the call for transparency and due diligence in investment practices cannot be overstated.

📢 Conclusion: Staying Afloat in Misinformation

The UAE government’s decisive actions reflect a broader commitment to safeguarding investors within the cryptocurrency space. As rumors circulate, it becomes more crucial for potential investors to distinguish between fact and fiction. We encourage readers to engage in discussion and share insights on the future of cryptocurrency investments in the UAE and beyond. What implications do these recent changes hold for aspiring crypto investors? Let us know your thoughts!