Introducing the Digital Dirham: A Revolutionary Leap for the UAE

The financial landscape in the United Arab Emirates (UAE) is on the verge of a transformative shift. The Central Bank of the UAE (CBUAE) has announced plans to launch its Digital Dirham, a state-of-the-art blockchain-based currency slated for retail use by the end of 2025. This leap into the digital currency realm represents not just an evolution of money but a fundamental change in how transactions will be conducted across the nation.

According to reports from Khaleej Times, the Digital Dirham promises cutting-edge features that include robust security, tokenization, and smart contract capabilities. This means transactions could be executed with unmatched speed and efficiency, transforming the way people and businesses engage in financial interactions.

A New Era for the #UAE #Dirham 🇦🇪Central Bank of UAE Unveils the New Dirham Symbol.📢 In a historic move, the Central Bank of the UAE (CBUAE) has introduced a modern symbol for the UAE Dirham (AED) – now represented globally with a sleek, bold identity.💱 The updated Dirham… pic.twitter.com/kQ3QxqpSz5— Ghazanfar (@GhazanfarTweets) March 27, 2025

Why This Matters: The Significance of the Digital Dirham

The introduction of the Digital Dirham is not just a modern convenience; it is a crucial step toward enhancing financial stability and inclusion within UAE’s diverse economy. By facilitating universal acceptance through licensed financial institutions—ranging from banks to fintech companies—the Digital Dirham aims to empower individuals and businesses alike.

- Enhanced Security: Operating on blockchain technology, the Digital Dirham is designed to offer unparalleled security against fraud and cyber threats.

- Instant Transactions: With smart contracts, the currency enables real-time settlements, making transactions quicker and more efficient.

- Wide Accessibility: It will be available through various channels, ensuring that all segments of the population can utilize it seamlessly.

Stablecoin Adoption: Paving the Way for a Digital Future

The move towards the Digital Dirham follows significant steps taken in 2024, when the UAE launched a regulatory framework for stablecoins. This initiative established a clear pathway for the creation and operation of Dirham-backed stablecoins, attracting interest from major players in the crypto space.

Tether, for instance, announced plans to issue an AED-backed stablecoin on the TON blockchain. Meanwhile, in February 2025, the Circle organization received approval from the Dubai Financial Services Authority (DFSA) to operate stablecoins like USDC and EURC within the Dubai International Financial Centre (DIFC). These developments signify the UAE’s commitment to becoming a global leader in the digital currency space.

The Visionary Perspective: Insights from Leadership

CBUAE Governor Khaled Mohamed Balama envisions the Digital Dirham as a game-changer in the region’s financial dynamics. He asserts that this digital currency will reinforce monetary stability, enhance inclusiveness, and fortify efforts against financial crimes. “The Digital Dirham will open doors to innovative products and services, reducing operational costs and broadening access to international markets,” he notes.

Future Outlook: Embracing the Digital Currency Revolution

The potential for widespread adoption of the Digital Dirham is promising. The UAE has emerged as a frontrunner in cryptocurrency engagement, with reports indicating that 25.3% of its population identifies as crypto enthusiasts as of 2025. This statistic places the UAE among the top nations globally in terms of crypto ownership, setting a fertile ground for the new digital currency.

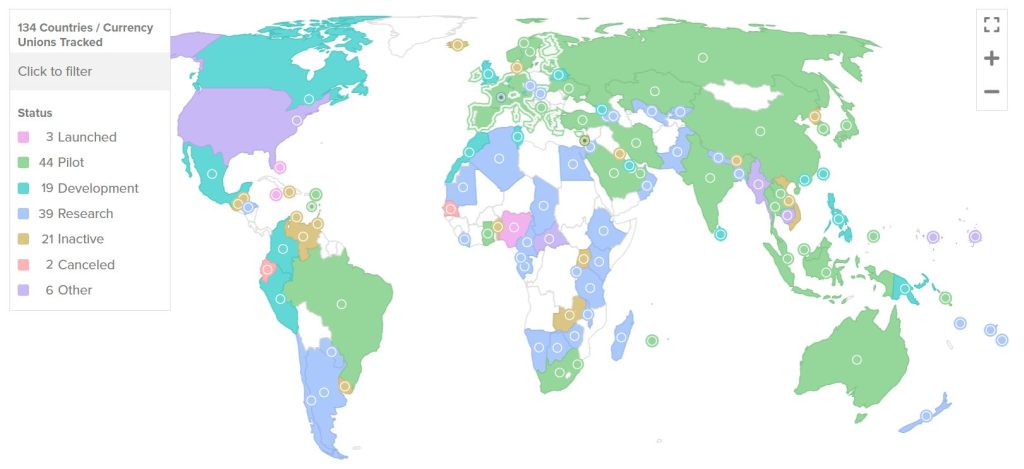

As the Digital Dirham continues its testing phase, it joins a global movement where over 43 countries are piloting their Central Bank Digital Currencies (CBDCs). Notably, the European Central Bank is in the midst of a years-long trial for the Digital Euro, illustrating a worldwide push toward central bank-issued digital assets.

Countries worldwide are advancing toward their own CBDCs, with the UK aiming to establish a regulatory framework for stablecoins by 2026. Meanwhile, US lawmakers have recently introduced the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act, indicating a growing consensus on regulating this new financial frontier.

Conclusion: Join the Conversation

The Digital Dirham’s arrival represents an exciting chapter in the evolution of financial intercourse within the UAE and beyond. As we witness these developments unfold, it’s essential to engage in discussions about the implications of digital currencies on our daily lives. What are your thoughts on the impact of the Digital Dirham? Are you ready for a more digital future in finance? Join the conversation in the comments below!