Market Dynamics: TRUMP Coin and the Ripple of Global Events

The ongoing military exchanges between Iran and Israel have sent shockwaves through the cryptocurrency market, particularly affecting TRUMP coin’s price trajectory. Following reports earlier this week that Iran accepted U.S. terms for a ceasefire, excitement surged, resulting in a 12% spike in TRUMP coin’s value. However, recent developments have left peace talks hanging by a thread, casting a shadow over the coin’s prospects.

Despite the recent uptick, TRUMP coin is still woefully trailing its late-May highs, hovering 40% below the peak prompted by a high-profile presidential dinner attended by top investors. The coin is yearning for a fresh social catalyst to draw retail investors back into the fold, but uncertainty continues to reign.

Speculators in Limbo: The Impact of Global Tensions

Market hesitation stems from claims of misconduct from both Iran and Israel, exacerbated by U.S. intelligence assessments suggesting that strikes on Iranian nuclear facilities were ineffective. This narrative, coupled with fears of an escalating conflict resembling a “World War 3” scenario, has sidelined potential retail inflows. According to data from Coinglass, the derivatives market has stagnated, with open interest flatlining around $330 million, indicating a tepid response from traders.

“They don’t know what the fuck they’re doing.” ~President, Donald J Trump~

— Aaron Rodgersburgh (@QuillionWatts) June 24, 2025

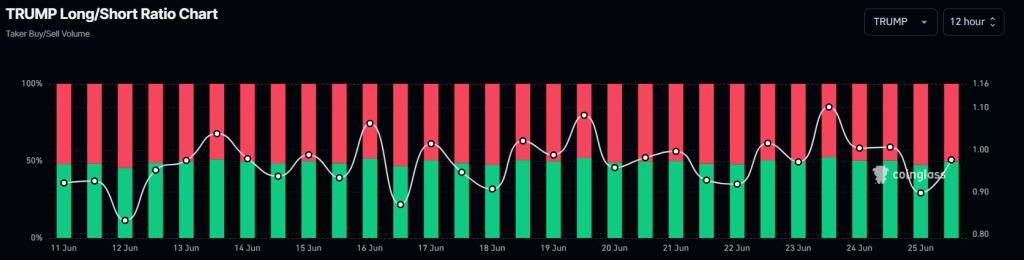

As tensions heighten, the market has seen a near 50-50 split between long and short traders, a sign that many speculators are standing on the sidelines rather than actively engaging with TRUMP coin’s price shifts.

Will a Ceasefire Spark a Market Rebound?

The potential for a long-term ceasefire could serve as a significant turning point for TRUMP coin, breaking it free from the downward trend dictated by the “falling wedge” pattern that has gripped the asset since its May high.

Recent bullish momentum has emerged, as indicated by the MACD line crossing above the signal line in a golden cross—a promising sign of a trend reversal. This resurgence signals a shift after a long period of bearish sentiment, with the Relative Strength Index (RSI) bouncing back from an apparent oversold condition at 30. Although it has levelled off around 36 due to the breaking news of a ceasefire collapse, early signs of buyer engagement are evident.

Crucially, the price has touched a historically significant accumulation zone near the $9.30 mark—this zone aligns perfectly with the wedge’s lower support and the 0.236 Fibonacci retracement level, creating a confluence area poised for a potential breakout. If bullish momentum can be sustained, the next target may approach the 0.786 Fibonacci level, presenting an opportunity for a whopping 60% increase from current levels. However, without more vigorous speculative engagement, the ambitious target of a 10x multiplier remains an elusive dream.

In the event of a downturn, should the $9.30 support fail, the next major support level drops to $7.15—a significant decline that could invalidate this bullish narrative.

Bitcoin Dominance: A Game Changer?

In light of the evolving landscape, many investors who flocked to more speculative options like TRUMP coin may find themselves reconsidering their strategy as Bitcoin evolves to tackle one of its primary challenges: scalability. Slow transaction speeds, high fees, and limited programmability have long hindered Bitcoin’s ability to compete effectively with networks like Ethereum and Solana, but this could soon change.

The introduction of Bitcoin Hyper ($HYPER), a Layer 2 solution offering real-time capabilities akin to Solana, aims to address these limitations. This innovation enables efficient, cost-effective decentralized applications (dApps) while maintaining Bitcoin’s inherent security.

Expert Opinions: Insights from the Market

Analysts are cautiously optimistic about TRUMP coin’s trajectory in light of potential geopolitical stability. Some experts suggest that while immediate gains might be limited without broader retail participation, the market’s sentiment can shift rapidly—especially if peace is firmly established. One analyst noted, “Traders are waiting for concrete assurances about geopolitical stability before committing substantial capital into the market.”

Conclusion: The Path Forward

As TRUMP coin navigates this turbulent landscape shaped by international relations, all eyes remain on the possibility of a lasting peace settlement. If achieved, it could provide the catalyst this cryptocurrency needs to revitalize investor interest and make its way back to higher price points. However, the unpredictability of the market, compounded by geopolitical unrest, underscores the importance of staying informed and agile.

What do you think lies ahead for TRUMP coin? Could geopolitical stability serve as a reinvigorating force, or are we in for more volatility? Join the conversation and share your thoughts!