Cracks in the Trump Coin Hype? Insights and Implications

In a world where cryptocurrency hype can turn on a dime, recent developments surrounding the Trump Coin have many investors and enthusiasts holding their breath. After weeks of growing anticipation and soaring headlines, a sudden withdrawal of $7.5 million from the TRUMP liquidity pool raises serious questions about the coin’s future. This significant move—suspected to be made by the core team—casts a shadow of uncertainty over what was once a fervently trending asset, closely aligned with the social clout of former President Donald Trump.

Following a presidential dinner aimed at high-profile holders, the Trump Coin has experienced a 45% decline from its peak in late May. With dwindling interest from retail investors, many are now asking: What does the future hold for this meme coin?

Whales and Withdrawals: What’s Really Happening?

New information from smart money tracker Lookonchain reveals that on June 25, the Trump Coin team executed a sizable withdrawal of $4.4 million in USDC, coupled with 347,438 TRUMP tokens valued at approximately $3.12 million. These funds were subsequently moved to a new wallet on Coinbase, kicking off a wave of speculation about insider sell-offs.

“The #Trump Meme Team removed 4.4M $USDC and 347,438 $TRUMP ($3.12M) in liquidity 6 hours ago. They then bridged 4.4M $USDC to #Ethereum and transferred 347,438 $TRUMP ($3.12M) to a new wallet.”

pic.twitter.com/okTk1u0Ow9

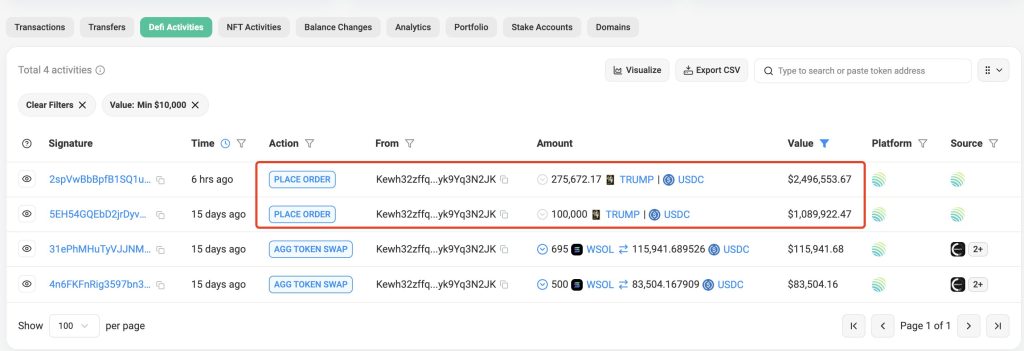

Moreover, a well-known whale has reportedly intensified profit-taking activities post-transfer, placing limit orders to sell 275,672 TRUMP tokens, valued at nearly $2.5 million. This pattern could serve as a precursor for future sell-offs, raising alarms among investors. Rather than mere risk management, it hints at a broader intention to exit the market.

Price Predictions: Is TRUMP Coin Headed for a Breakdown?

The recent sell-off of large holdings poses a pressing challenge for TRUMP Coin’s price stability. With its trajectory showing signs of a falling wedge since peaking in late May, the current market dynamics could spell trouble.

Additionally, broader market conditions are beginning to shift positively, evidenced by the MACD indicator crossing above its signal line—a promising sign of potential trend reversal. The Relative Strength Index (RSI) has also bounced back from oversold conditions, suggesting that seller fatigue may be setting in.

However, the pervasive fear, uncertainty, and doubt (FUD) stemming from these sell-offs could hinder buyers from stepping back into the fray. Currently, the TRUMP Coin grapples with a critical support level just above the $9.30 zone, representing a historic accumulation range aligned with Fibonacci retracement indicators.

Why This Matters: Understanding the Broader Implications

The uncertain fate of TRUMP Coin can’t be viewed in isolation. It reflects broader themes within the cryptocurrency landscape, where speculative plays often rise and fall with market sentiment. Observers are closely monitoring whether this sell-off will trigger a domino effect, impacting a variety of meme coins and speculative assets that thrive in buoyant market conditions.

Expert Opinions: Insights from Analysts

Crypto analysts are divided on the implications of this recent liquidity pullout. Some argue that it could drive prices down and diminish retail interest. Others, however, posit that once the dust settles, renewed focus on the political capital behind Trump Coin could lead to a resurgence. Analysts suggest maintaining a watchful eye on social media activity surrounding both Trump and the coin, as any significant mention may serve as a catalyst for renewed interest.

Future Outlook: What Lies Ahead for Trump Coin?

The current sell-off and price battle lends itself to a vital question: Can TRUMP Coin recover? If the bulls can defend crucial support levels and generate fresh social momentum, there is a potential for a breakout beyond the $14.50 mark, signifying a whopping 60% increase from current levels. Conversely, falling below that threshold could send the asset spiraling down to around $7.15—akin to mid-April lows—likely extinguishing any bullish sentiment.

Amidst these developments, interesting dynamics are unfolding in the Bitcoin ecosystem, notably with the introduction of Bitcoin Hyper—a Layer 2 solution designed to enhance speed and functionality. As Bitcoin addresses issues such as scalability, investors may pivot back toward more established assets, impacting the speculative trends in coins like Trump Coin.

Conclusion: Where Do We Go From Here?

The unfolding narrative around TRUMP Coin has left many intrigued by its potential and wary of its volatility. As we look forward, the crucial question remains: Can it reinvent itself amidst growing skepticism? For investors, staying informed and agile could be key. Engage with the community, monitor market conditions, and consider all aspects before venturing further into the world of cryptocurrencies. What are your thoughts on the Trump Coin saga? Let’s spark a discussion!