In a remarkable turn of events in the cryptocurrency arena, TRON has emerged as the leading platform for USDT, dethroning Ethereum in both stablecoin liquidity and user transactions. This transformation, unveiled in a recent report by CryptoQuant, has sent ripples throughout the crypto community, sparking discussions about what it means for the future of stablecoins.

Ethereum lost the stablecoin crown. TRON now leads in USDT supply, fees and daily transfers. Join our Space with @trondao on July 30, 10 AM PT to unpack how they pulled it off. Set your reminder ⤵️https://t.co/Uz25njT1sW— CryptoQuant.com (@cryptoquant_com) July 28, 2025

At present, TRON boasts a staggering USDT supply of $80.8 billion, surpassing Ethereum’s $73.8 billion, marking an impressive 35% growth since the beginning of 2025. This shift underscores TRON’s position as the preferred blockchain for stablecoin transactions, effectively solidifying its stature in the crypto landscape.

As user activity increasingly migrates to TRON, the daily transaction volume for USDT on this blockchain is between 2.3 to 2.4 million—an astonishing six to seven times higher than that of Ethereum. Financially, this translates to an impressive processing rate of over $24.6 billion in USDT each day, more than doubling Ethereum’s capacity, according to CryptoQuant’s findings.

This surge isn’t merely a statistic; it represents a significant shift in user preferences and reliability on the part of TRON as the infrastructure for dollar-pegged transactions. In the first half of 2025, a whopping 98% of the top 10 token transfers on TRON were directly related to USDT, aggregating to an extraordinary 384 million transactions. The numbers speak for themselves, reflecting TRON’s growing attractiveness as a robust platform for stablecoin financial activities.

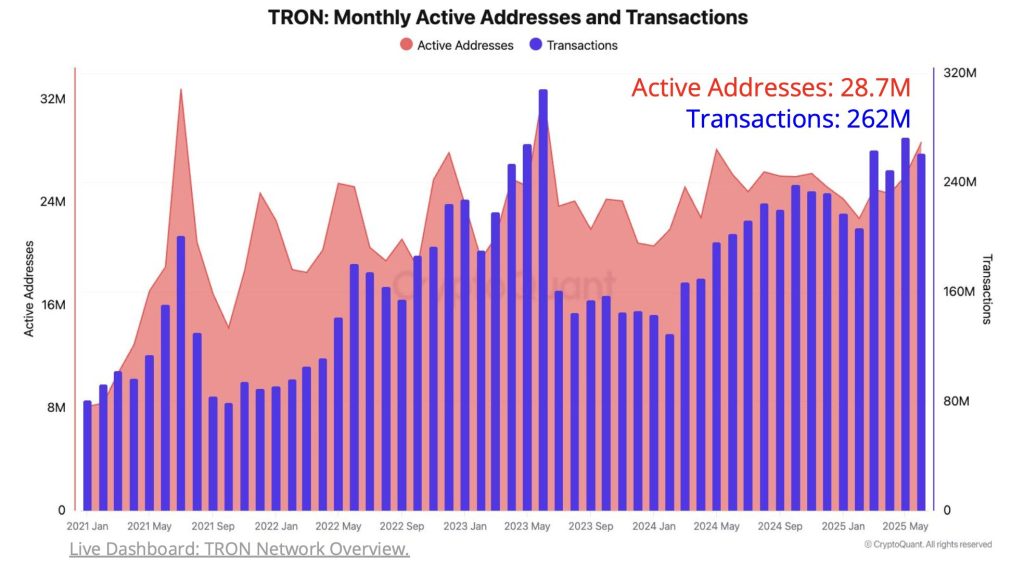

The expansion of the TRON network has been nothing short of noteworthy. In May 2025 alone, TRON processed an incredible 273 million transactions, its second-highest monthly figure to date. By June, the number of active addresses soared to 28.7 million—the largest since mid-2023. This growth is largely attributed to TRON’s innovative gasless transaction model, which now constitutes 75% of all network activity, up from 60% in late 2023. By eliminating transaction costs, TRON has made it easier for users to access on-chain services.

TRON’s decentralized exchange, SunSwap, has also witnessed remarkable activity, maintaining monthly swap volumes consistently above $3 billion and peaking at $3.8 billion during May. The number of transactions on SunSwap surged to an average of 516,000 per month, a significant jump from the 316,000 recorded in the previous year. While Wrapped TRX (WTRX) continues to dominate swap volumes, its market share has decreased from an impressive 98% to 70%, indicating a diverse usage of stablecoins and other assets across the platform. Not to be outdone, the lending protocol JustLend is also making headway, with both deposits and borrowing volumes increasing substantially, primarily fueled by USDT and USDD. Borrowing transactions alone have risen by 23% compared to 2024, demonstrating a stronger appetite for stablecoin-backed decentralized finance (DeFi) lending.

In a remarkable feat, TRON’s fee revenue hit an all-time high of $308 million in June 2025, despite the rise in fee-free transactions. This surge showcases the growing utilization of advanced services within the network, particularly within DeFi. The ability to scale gasless transactions while simultaneously driving up fee revenue speaks volumes about the maturing ecosystem and the layered activity it fosters beyond mere transfers.

As TRON continues to assert its presence in the realm of stablecoins, the importance of this shift cannot be emphasized enough. With enhanced liquidity, skyrocketing transaction volumes, and a burgeoning DeFi ecosystem, TRON is solidifying its role in the evolving digital asset economy.

Looking at the bigger picture, the overall stablecoin market has seen explosive growth as well. The first half of 2025 witnessed the total stablecoin supply surge from $204 billion to $252 billion. Monthly settlement volumes reached an astonishing $1.39 trillion, according to CertiK. Even though USDT has held its ground as the market leader in liquidity—especially on TRON’s platform—USDC is swiftly narrowing the gap. The recent acquisition of a MiCA license, completion of an IPO, and an expanded supply to $61 billion has positioned USDC as a formidable competitor.

As we move forward, the evolution of stablecoins is poised to reshape the financial landscape dramatically. Keep a close eye on how TRON’s ascendancy impacts the broader crypto market, and consider how these developments may influence your interactions with digital assets.

For further insights into stablecoins and the latest developments in cryptocurrency, explore articles from trusted sources like [CoinDesk](https://www.coindesk.com) and [CoinTelegraph](https://cointelegraph.com).