The cryptocurrency market is experiencing another wave of volatility, with the total market capitalization falling by 5.6% over the last 24 hours—shaving its value down to an unsettling $3.91 trillion. This decline has left the majority of the top 100 digital currencies painted red on the charts, as Bitcoin (BTC) and Ethereum (ETH) grapple with notable price shifts amidst a backdrop of changing market sentiment. Currently, the overall trading volume in the crypto space stands at approximately $264 billion, leaving many investors on edge.

In summary, the recent developments can be distilled as follows:

- The total crypto market cap has slipped below $4 trillion.

- Most of the top 100 cryptocurrencies have seen declines over the past day.

- Bitcoin is currently trading at $118,256, reflecting a minor 0.2% decrease.

- Ethereum has dipped 2.6%, resting at $3,574.

- Noteworthy outflows have been observed in U.S. BTC spot ETFs, whereas ETH spot ETFs are seeing continued inflows.

With a downturn in market sentiment colliding with the undeniable appeal of Bitcoin and Ethereum, what does this mean for investors and the broader market landscape?

This decline in crypto values, though concerning, may not signal a lasting trend. Investors and analysts alike are taking a closer look at these developments, reflecting on the inherent volatility of the cryptocurrency sector. For example, Bitcoin’s stability, having only had a minuscule 0.2% adjustment, underscores its resilience in the face of market fluctuations. It remains firmly above the psychological threshold of $118,000, a level which many traders are keen to monitor closely.

Meanwhile, Ethereum has faced slightly more turbulence, experiencing a 2.6% drop. Still, Ethereum’s trajectory remains compelling, especially following a period of strong performance that raises expectations for future price movements. Observers remain optimistic, with some analysts suggesting that ETH could push toward the coveted $4,000 mark in the coming weeks.

Interestingly, among the top 10 coins, XRP suffered the most significant decline, plummeting by 12.1% to a price of $3.05. Dogecoin also took a hit, dropping 10.7% to settle at $0.2303. On the wider spectrum of the top 100 cryptocurrencies, double-digit declines were rampant, and only a handful managed to maintain some upward momentum, like Story (IP), which saw a commendable 3.8% increase.

In a noteworthy development, Alon Cohen, founder of Pump.Fun, announced a 20% drop of their token, prompting discussions about upcoming airdrops. “We want to ensure that it is a meaningful airdrop executed well,” Cohen mentioned, indicating a cautious approach to not underwhelm their community. As the crypto landscape fluctuates, the call for well-considered launches and strategic outreach is more pertinent than ever.

Allon speaks about the pumpfun airdrop live on threadguy stream,”We want to reward OG pumpfun users” pic.twitter.com/gdfE7H4oRV— ً (@0xsyste) July 23, 2025

As we dissect this market downturn, James Harris of Tesseract emphasizes the importance of perspective: “The recent drop, while significant, reflects a broader structural change in the market due to regulatory clarity, macroeconomic easing, and corporate adoption of cryptocurrencies.” Harris points to the potential where investors may no longer view crypto as mere speculative assets but as serious contenders within their portfolios. Still, he cautions that the momentum could reverse swiftly, advocating for prudent risk management among investors.

Meanwhile, Ethereum ETFs are celebrating remarkable inflows, marking the third-largest inflow day in history this week. Investors who felt they missed the bullish rally of Bitcoin are snapping up ETH, which has been outshining Bitcoin in recent performances. This trend indicates a robust appetite for both blockchains, further reinforcing the argument that “the real opportunity lies at the intersection of Bitcoin and Ethereum,” as stated by co-founder Dom Harz of BOB.

Looking ahead, many are closely monitoring Bitcoin’s performance against critical resistance levels. Negotiating through its current price of $118,256, market analysts suggest that the coin’s next pivotal threshold lies at $120,094. Successfully surpassing this could set the stage for a climb toward $122,000 or even $128,000. However, if Bitcoin succumbs to further downward pressure, a retreat towards the $116,700 level may be witnessed.

For Ethereum, the day began at $3,689, fluctuating within a range that saw it manage a brief recovery above $3,660 before retreating back to its current price of $3,574. Market watchers are keenly observing whether Ethereum can break its current barriers and make a run toward higher valuations.

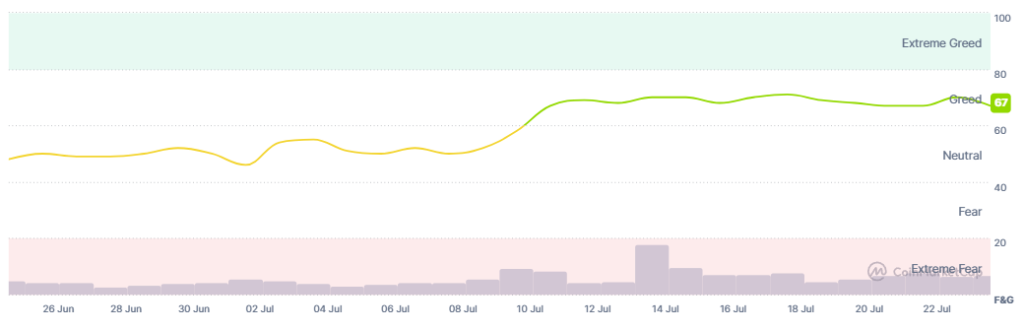

Today’s market sentiment has dipped slightly, moving into the 67 range of the greed index, down from 70 yesterday. While the current mood indicates a slight unease, it does not imply an imminent broad market correction.

On the ETF front, Bitcoin spot ETFs recorded another $85.96 million in outflows, while Ethereum spot ETFs continued to demonstrate resilience. Ethereum has seen a vibrant inflow spanning 14 consecutive days, adding $332.18 million just on Wednesday. What does this mean for the future? As analysts scrutinize these movements, the appetite for both Bitcoin and Ethereum remains significant, with institutions increasingly looking to bolster their holdings in Ethereum.

In closing, it’s essential to remember that the cryptocurrency market is no stranger to fluctuations. Investors must stay vigilant and educated as they navigate these waters. With the interconnection between Bitcoin and Ethereum setting the stage for new opportunities, the future remains promising yet requires careful watching for shifts in sentiment and market dynamics. As we observe the interplay between these leading cryptocurrencies, one might ask: where will the convergence of technology, finance, and innovative blockchain solutions drive the next wave of investment opportunities?