In a dramatic turn of events on October 29, 2025, Thai law enforcement apprehended Liang Ai-Bing, a Chinese national implicated in an audacious $31 million cryptocurrency Ponzi scheme. His arrest took place in an upscale Bangkok residence, marking a significant victory for authorities following an intense intelligence operation that united both Thai and Chinese forces. Liang had been living a seemingly quiet life in a three-story home office within the Wang Thonglang district, where he reportedly paid around $4,645 each month in rent since December 2024.

Adding to the intrique, during the raid, authorities uncovered an unlicensed Beretta pistol along with 20 rounds of ammunition, compounding the charges against him and spotlighting the more sinister undertones of his alleged fraud operation.

At the heart of the scandal lies a scheme known as FINTOCH, which Liang is accused of helping establish between December 2022 and May 2023 alongside four accomplices: Al Qing-Hua, Wu Jiang-Yan, Tang Zhen-Que, and Zuo Lai-Jun. FINTOCH promised unsuspecting investors a tantalizing daily return of 1%, while deceitfully claiming ties to the reputable investment firm Morgan Stanley. This elaborate ruse drew in victims from across Asia before crumbling under the weight of its own false promises.

The intricacy of the operation showcased a well-structured approach to deception. Liang and Tang took charge of the technical aspects of the platform, while Al and Wu were responsible for public relations and promotional efforts. Zuo managed marketing operations until his arrest by Chinese authorities, adhering to a carefully orchestrated division of labor that concealed their true intentions from the investors.

It appears the team behind the ponzi @DFintoch has likely exit scammed with 31.6m USDT on BSC after the funds were bridged to multiple addresses on Tron/Ethereum and people reported being unable to withdraw Fintoch advertised 1% daily ROI & claimed to be owned by Morgan Stanley pic.twitter.com/UD3KKfkG97— ZachXBT (@zachxbt) May 23, 2023

In May 2023, on-chain investigator ZachXBT blew the whistle on FINTOCH’s implosion, revealing that the criminal syndicate had executed a classic exit scam, siphoning off a staggering 31.6 million USDT from the Binance Smart Chain. As the last of the funds vanished, countless investors found themselves unable to access their money, igniting outrage and disbelief.

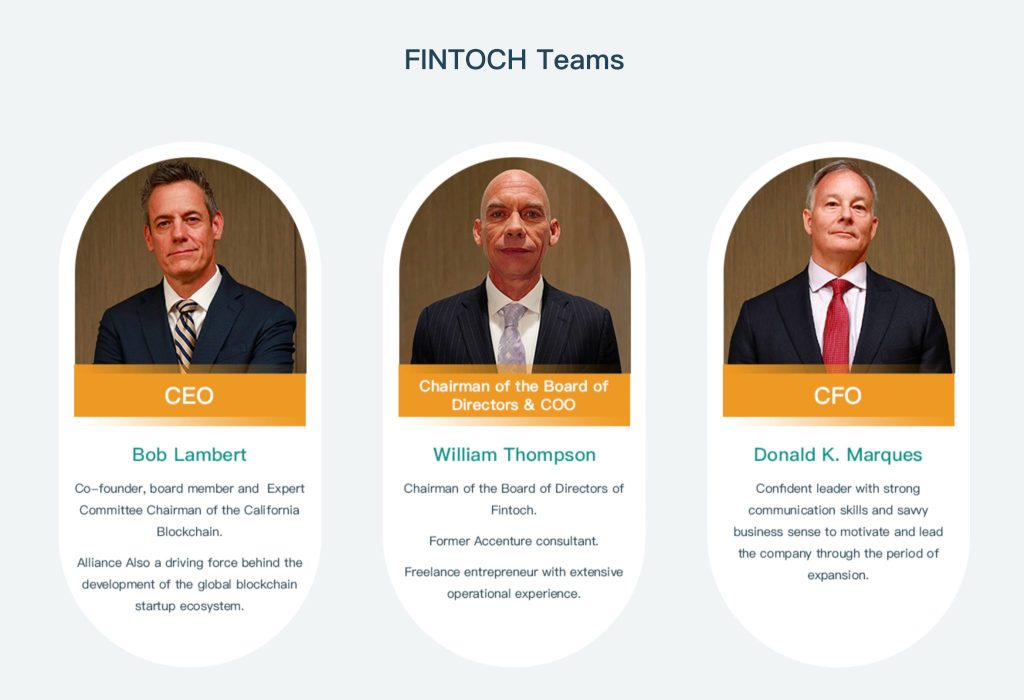

The fraudulent network’s façade was bolstered by an array of deceptive tactics. They not only employed a fabricated CEO, “Bobby Lambert”—who was merely an actor—but also secured a CertiK audit to enhance their dubious credibility. This level of deception extended to hosting promotional events in Dubai, which falsely showcased blockchain “experts” and attracted representatives from 19 different countries, punctuating an elaborate act designed to lure in more unwitting investors.

As their scheme unraveled, the fraudsters pivoted to rebranded projects, launching platforms like FinSoul which ostensibly aimed to exploit the gaming sector. However, this venture reportedly ended with yet another exit scam, totaling around $1.6 million in fraudulent transactions as the perpetrators manipulated the market before disappearing once more. Security firms like CertiK found alarming connections between these projects and the original FINTOCH scheme, with similar actors at the helm, confirming that the individuals responsible were not seasoned financial experts but rather entertainers posing as authorities in finance.

Liang now faces a slew of serious charges, including illegal possession of firearms and potential extradition to China, where he could confront accusations of defrauding nearly 100 victims of over 100 million yuan (approximately $14 million). However, the overall losses when accounting for international victims might surpass $31 million, heightening the urgency for justice as financial crimes plague the region.

Liang’s apprehension unfolds amid a surge of cryptocurrency-related fraud cases across Asia. Earlier this year, Thai officials also detained Wu Di, a young Chinese woman linked to a scheme that defrauded victims of over $17.7 million via Facebook. Moreover, allegations against Zhimin Qian, another Chinese national in the UK, have brought to light the staggering scale of crypto-related crimes, with her connection to the world’s largest seizure of cryptocurrency valued at over $6.7 billion.

👮 A Chinese national has pleaded guilty to her role in the world’s largest crypto seizure, totaling more than £5 billion ($6.7 billion). #China #Bitcoin https://t.co/3byVtWlilX— Cryptonews.com (@cryptonews) September 30, 2025

As this story continues to evolve, it raises critical questions about the integrity and security of the cryptocurrency landscape. Are investors taking the necessary precautions to safeguard their funds? What lessons can other countries learn from the fallout of these high-profile scams? The world watches closely, as the implications of Liang’s case and others like it shape the future of cryptocurrency regulation and investor trust.

Stay informed about the latest developments in the cryptocurrency space by following our updates and engaging with us to share your thoughts on how to navigate this ever-evolving landscape.