🚀 Tether Gold Soars to New Heights Amid Market Turbulence

In an era marked by economic unpredictability, Tether Gold (XAUT) is breaking barriers, recently achieving an impressive 14% increase since the peak of the cryptocurrency market in late February. As gold prices reach a staggering $3,040, the rise of Tether Gold signals a pivotal moment for investors seeking stability amidst broader market chaos.

The landscape of investment is ever-shifting. Ongoing economic instabilities—spurred by Trump’s controversial trade policies, rising NATO tensions, and looming recession fears—have plunged the overall cryptocurrency market down by 30%. In such daunting times, the conversation surrounding the “best crypto to buy” becomes increasingly complex, especially with retail liquidity rapidly evaporating under the weight of market fears.

📌 Why This Matters: The Shift Towards Safe Havens

Gold, often regarded as a safe haven asset, has emerged as a beacon of security in today’s investment climate. With an inflationary U.S. dollar facing its worst performance since the 2008 financial crisis—showing a decline of 5.4% year-to-date—investors are seeking refuge in assets that offer both stability and growth potential. The S&P 500 Index recently entered a technical correction as it plummeted more than 10% from last month’s all-time high, further exacerbating fears in riskier asset classes like cryptocurrencies.

The recent performance of gold, captured in a revealing tweet from the Kobeissi Letter, underscores this transition. “Another day, another record high in gold. This doesn’t happen in ‘normal and healthy’ markets,” the tweet emphasized, highlighting the gravity of gold’s rally amidst volatility.

Another day, another record high in gold. This doesn’t happen in “normal and healthy” markets. pic.twitter.com/GkjKBvUTfA— The Kobeissi Letter (@KobeissiLetter) March 18, 2025

🔥 Expert Opinions: Analyzing Gold’s Potential

As analysts turn their attention to gold’s trajectory, a critical evaluation of its price action indicates that we may soon encounter a pivotal moment. Currently, gold is bumping against the upper resistance of an ascending channel, a pattern that has consistently influenced market highs since April.

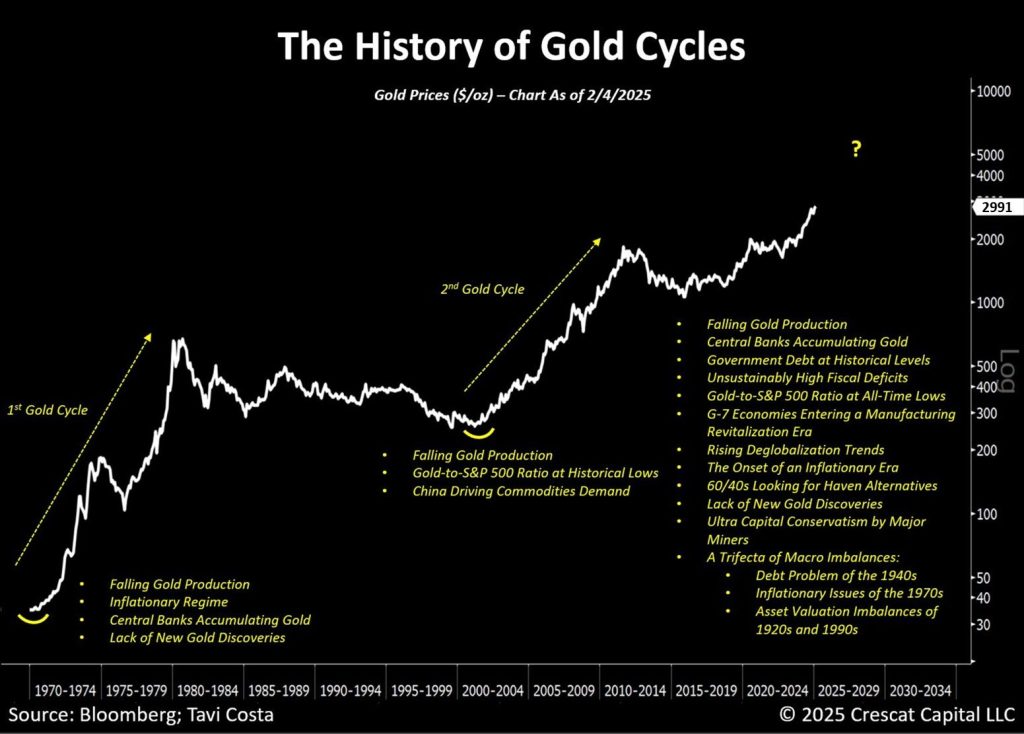

The Relative Strength Index (RSI) currently hovers above the overbought level at 75. While this suggests potential buyer fatigue, some experts maintain that this could merely signify a brief pause in momentum before gold embarks on its next bullish leg. With many citing robust fundamentals in the lead-up to a potential third gold cycle, the future could be bright for this coveted metal.

🚀 Future Outlook: Where Does Tether Gold Go from Here?

Looking ahead, if gold succeeds in breaking out from its current channel, we could be eyeing new peaks as high as $3,560—a dazzling 17% increase from current levels. However, this prediction is based on long-term projections and dependent on market movements and sentiments.

While Tether Gold offers a reliable store of value, its slower growth might not satisfy aggressive crypto traders seeking higher returns. Enter MIND of Pepe ($MIND)—an emerging player in the crypto realm poised for explosive growth. By tapping into the frenetic energy surrounding meme coins and the AI narrative, $MIND could very well be the ticket for savvy investors aiming for quick gains.

💰 Seize the Moment: Join the MIND of Pepe Presale

For those keen on striking early in potentially lucrative markets, the MIND of Pepe presale has already garnered nearly $7.5 million. By leveraging the popularity of the Pepe meme and incorporating cutting-edge AI engagement strategies, this token aims to stir excitement within the crypto community.

Interested investors can stay updated and take part in the presale via the official MIND of Pepe website. As the crypto landscape continues to evolve, one thing is clear: opportunities abound for those ready to seize them!

🔚 Conclusion: What’s Next for Your Portfolio?

The volatility of the crypto market is tempered by traditional assets like gold, which continue to show resilience. With Tether Gold’s recent climb and the emergence of new players like MIND, investors must navigate their choices wisely. What will your next move be in this dynamic landscape? Join the conversation in the comments below and share your insights!