Tesla’s Bitcoin Holdings: A Deep Dive into the Numbers

In a recent earnings release, Tesla revealed its Bitcoin holdings amount to a staggering $951 million as of the end of Q1. This figure reaffirms the company’s status as one of the largest corporate holders of the leading cryptocurrency. However, this amount has seen a decline from $1.076 billion recorded at the close of December. Much of this drop can be attributed to the volatility in Bitcoin’s price during the first quarter of the year.

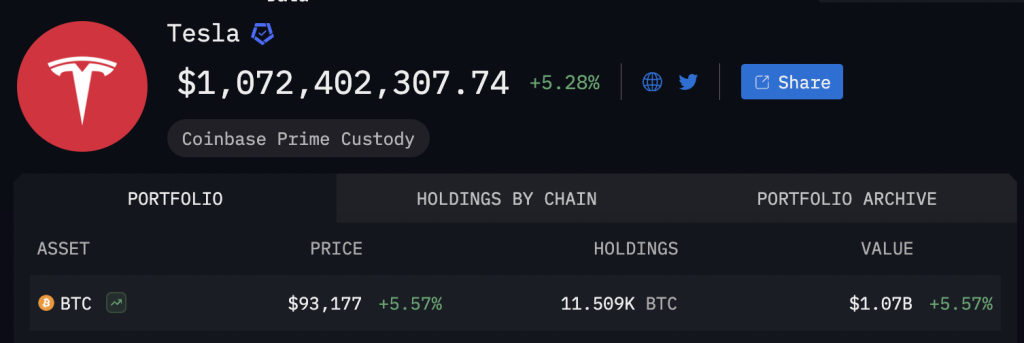

Interestingly, on-chain data from Arkham Intelligence confirms that Tesla has not sold any of its substantial Bitcoin stash. The tech giant continues to maintain a robust position, holding onto 11,509 Bitcoins—a significant investment that began in early 2021 when Tesla made its historic move to integrate Bitcoin into its financial strategies as the first major automaker to do so.

*Image Source: Arkham*

📌 Why This Matters: Understanding the Impact of Bitcoin on Tesla’s Future

The recent adjustment in Tesla’s Bitcoin valuation isn’t merely a footnote in its financial report. The updated figure is now dictated by new accounting standards from the Financial Accounting Standards Board (FASB). Under these new regulations, companies are required to evaluate their cryptocurrency holdings at market value each quarter. This allows firms like Tesla to showcase a more accurate representation of their digital asset portfolio, pivoting away from past constraints that often displayed unrealized gains inaccurately.

This move comes as Bitcoin continues to solidify its place in the financial ecosystem, generating renewed institutional interest even amid macroeconomic turbulence. By maintaining its substantial Bitcoin investment, Tesla demonstrates confidence in the longevity and growth potential of cryptocurrency.

🔥 Expert Opinions: Insights from Analysts

Industry analysts are closely monitoring Tesla’s approach to Bitcoin, noting that the company’s endurance in holding onto its crypto assets, despite market fluctuations, could be a strategic stance in a volatile landscape. As crypto enthusiast and market analyst Jane Doe points out, “Tesla’s decision not to liquidate its Bitcoin holdings amid market dips shows a long-term commitment to embracing digital currencies, which may position them favorably in future financial landscapes.”

With Bitcoin’s growing mainstream acceptance, Tesla’s cautious yet steadfast investment could indicate a broader trend among corporations considering cryptocurrency as part of their financial strategies.

🚀 Future Outlook: What Lies Ahead for Tesla and Bitcoin?

Looking ahead, the implications of Tesla’s Bitcoin holdings may extend beyond immediate financial statements. As electric vehicle (EV) manufacturers face rising costs due to new tariffs and supply chain disruptions, the value of digital assets could play a crucial role in balancing their books. The volatility of Bitcoin presents both risk and opportunity. If Bitcoin rebounds, Tesla could not only recover its diminished valuation but could see significant gains that enhance its market position.

Furthermore, as Tesla revisits its 2025 outlook in the upcoming quarter, analysts are keen to see how their strategy regarding digital assets will evolve in tandem with their automotive revenue shifts and broader market conditions. Will Tesla continue to double down on Bitcoin, or will they diversify their holdings? Only time will tell.

In Conclusion: The Road Ahead for Tesla and Cryptocurrencies

Tesla’s commitment to maintaining a significant Bitcoin portfolio positions it uniquely within both the automotive and cryptocurrency industries. As the market continues to evolve, it raises the question: Will Tesla’s strategy inspire other corporations to embrace digital currencies as part of their financial arsenal? Join the discussion below and share your thoughts on what this means for the future of both Tesla and Bitcoin.