In a bold declaration, former TD Ameritrade chairman Joe Moglia has made waves in the financial world by predicting that within five years, every conceivable financial asset will be tokenized. This statement, delivered during a recent CNBC appearance, underscores a seismic shift that Moglia believes traditional finance is not yet ready to embrace fully. He stated emphatically, “Five years from now, there’s not going to be a stock, there’s not going to be an option, not going to be a mutual fund, ETF, anything that’s not in effect tokenized.”

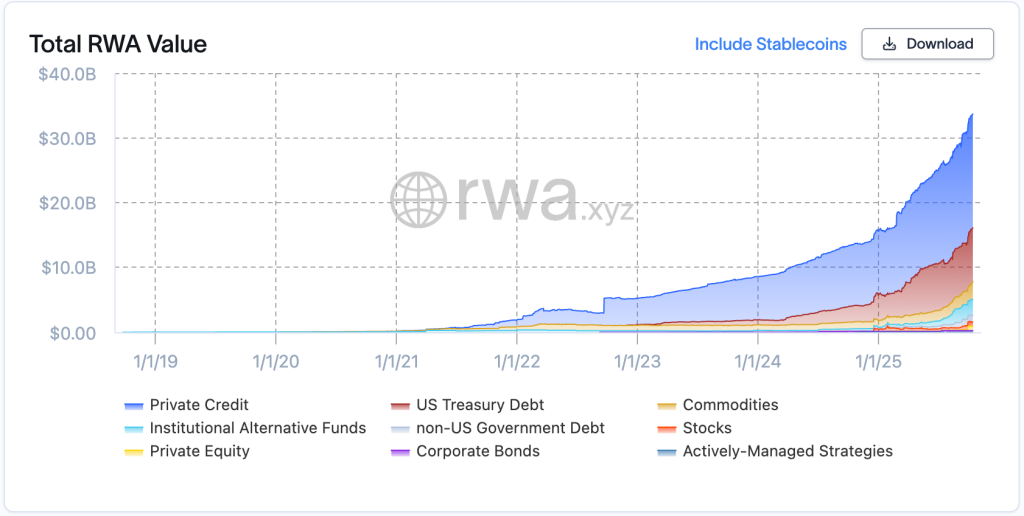

Moglia’s prediction emerges amidst a flourishing landscape of real-world asset tokenization, which has surged past a staggering $33.91 billion, reflecting an impressive 10.14% growth just in the past 30 days. Notably, the number of asset holders has climbed to nearly 484,000, as per statistics from RWA.xyz. This rapid increase signals not just a trend but a transformative evolution in how investors interact with assets.

When it comes to the leading categories, private credit tops the charts with an impressive $17.5 billion. Close behind are U.S. Treasury debt at $8.3 billion and commodities, which total $2.8 billion, driven in large part by tokenized gold, now valued at over $3 billion.

As the chair of FG Nexus, a company harnessing Ethereum’s potential, Moglia’s journey mirrors that of BlackRock’s CEO Larry Fink, who transitioned from skepticism to staunch advocacy for cryptocurrency. “That’s because he used to be a real traditional finance guy. Now he’s a DeFi guy,” Moglia noted, highlighting a broader acceptance of decentralized finance (DeFi).

Ethereum currently leads the tokenization race with a colossal $12.1 billion in assets, claiming a 57.55% market share. By contrast, Solana, despite demonstrating remarkable growth of 35.34% in just a month, holds a relatively minor position at $686.3 million. This disparity raises critical questions about uniform global adoption in Moglia’s predicted timeline.

Meanwhile, major developments are brewing in the Ethereum and Solana ecosystems. Ethereum has recently initiated a “privacy cluster” aimed at implementing protocol-level privacy features, signifying its intent to maintain market leadership. Shawn Young, chief analyst at MEXC Research, remarked on how Ethereum’s innovations could entice traditional financial institutions seeking a balance between transparency and confidentiality.

Conversely, Solana has showcased consistent revenue strength, even leading all major networks in Q3 revenue, a feat it has accomplished for four consecutive quarters. CEO Ray Youssef of NoOnes confirmed Solana’s performance, noting it recorded over 4% gains in September while Ethereum experienced a decline. With treasury reserves climbing to $4 billion, Solana’s growth trajectory raises the possibility of soaring to $300 by Q1 2026, provided its developments align with favorable market conditions.

Tokenization is notably reshaping stock exchanges, with tokenized stocks skyrocketing to $677 million, marking an astounding 22.62% increase over the last month. Tesla, in particular, has emerged as a frontrunner in this space, amassing over $25 million held by 14,000 unique investors on Solana. This demonstrates a keen interest in blending traditional equity with innovative blockchain solutions.

.@Tesla now has 14,000 new investors, holding $25 million collectively on Solana. 👉 https://t.co/j22z9hy4Pb— Solana (@solana) October 15, 2025

On the horizon, Moglia’s FG Nexus is setting its sights on tokenizing its reinsurance company, indicating a strong pivot towards institutional tokenization. As commodities continue to lead the ramp-up in real-world asset growth, surpassing $3.3 billion, Moglia asserts that these advancements are merely the beginning of a broader acceptance of digital assets.

Citing statistics from RWA.xyz, the monthly transfer volume for tokenized assets skyrocketed to an astonishing $5.08 billion, showcasing a massive shift from ETFs towards on-chain solutions amid worsening macroeconomic conditions. As stablecoin market capitalization exceeds $300 billion with nearly 200 million holders, Moglia has mentioned projections of a potential “$2 trillion market” within just two years, envisioning Ethereum capturing around 60% of this activity.

However, Moglia’s predictions come with caution, especially regarding the unequal distribution of blockchain assets. Ethereum alone accounts for 435 RWA assets worth a whopping $12.1 billion, while its closest competitor, ZKsync Era, holds just over $2.36 billion. This concentration could pose risks, suggesting that widespread tokenization may not occur as promptly as Moglia anticipates.

As we navigate the future of finance, the potential for every asset to become tokenized presents both opportunities and challenges. Will traditional finance evolve quickly enough to keep pace with these changes? The next five years promise to be pivotal, shaping the landscape of how we perceive and invest in assets across the globe.

As developments unfold, be sure to stay tuned to get the latest insights and analyses on the evolving world of cryptocurrency and digital finance. The future is more than just tokens; it’s about how we adapt to a new era of financial interaction.