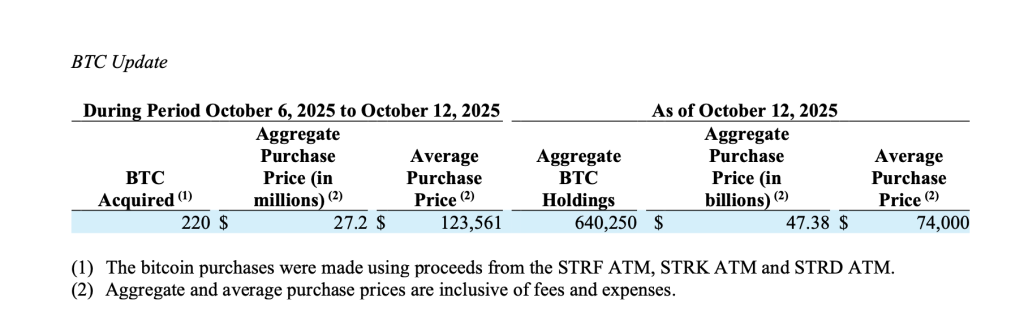

In a noteworthy move that has captured the attention of the cryptocurrency world, Strategy Inc. has significantly bolstered its Bitcoin reserves. Over the week of October 6-12, the company acquired an impressive 220 BTC for a staggering $27.2 million, at an average price of $123,561 per Bitcoin. This substantial purchase exemplifies Strategy’s steadfast faith in Bitcoin as a foundational treasury asset and cements its position in the growing landscape of institutional cryptocurrency investments.

Strategy has acquired 220 BTC for ~$27.2 million at ~$123,561 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 10/12/2025, we hodl 640,250 $BTC acquired for ~$47.38 billion at ~$74,000 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/Ft9ZCh1EGx— Strategy (@Strategy) October 13, 2025

This latest acquisition propels Strategy’s total Bitcoin holdings to a staggering 640,250 BTC, acquired at an aggregate cost of approximately $47.38 billion, translating to an average purchase price of around $74,000 per Bitcoin. Such a robust treasury not only showcases the confidence in Bitcoin’s long-term potential but also highlights the strategic vision that underpins this crypto-centric approach.

What’s particularly intriguing is how Strategy has financed these purchases. Utilizing proceeds from its various At-The-Market (ATM) programs—namely the STRF, STRK, and STRD ATM programs—the company has effectively turned equity sales into a significant vehicle for Bitcoin accumulation. During the recent reporting period alone, these offerings generated around $27.3 million in total proceeds, thereby allowing them to enhance their crypto treasury.

How do these ATM programs work? The STRF ATM, which is linked to Strategy’s 10.00% Series A perpetual strife preferred stock, successfully sold 170,663 shares for net proceeds of about $19.8 million. Meanwhile, the STRK ATM, tied to the 8.00% Series A perpetual strike preferred stock, brought in an additional $1.7 million from 16,873 shares, while the STRD ATM contributed $5.8 million from 68,775 shares. This innovative strategy of converting equity into digital assets not only bolsters their crypto holdings but also reflects a growing trend among corporations exploring the potential of Bitcoin as a treasury asset. For more on equity financing strategies in crypto, consider checking this [detailed guide](https://www.investopedia.com/cryptocurrency-financing-5111254).

Looking forward, Strategy enjoys a formidable capacity for further equity offerings, with $1.7 billion, $4.1 billion, $20.3 billion, and $15.9 billion available for issuance across its preferred and common stock categories as of October 12. This financial flexibility suggests that the company could be poised for additional Bitcoin purchases in response to evolving market conditions. It signals an intriguing prospect for investors and enthusiasts alike, given Strategy’s commitment to increasing its Bitcoin reserves further.

For those watching the cryptocurrency market closely, it’s no surprise that Strategy’s assertive strategy has positioned them among the world’s largest corporate holders of Bitcoin, akin to well-known peers like MicroStrategy. The firm is not just accumulating Bitcoin but is also setting a precedent on how corporations can integrate crypto into their financial frameworks. With the backdrop of tightening monetary policies and enhanced regulatory frameworks, Strategy emerges as a beacon of institutional confidence in Bitcoin’s future.

In summary, Strategy Inc.’s latest Bitcoin acquisition demonstrates robust growth and an unwavering belief in the digital asset’s potential. As they continue to redefine the landscape of corporate investments in cryptocurrency, it’s an exhilarating time for investors and proponents of Bitcoin. Will other corporations follow suit? Only time will tell, but Strategy’s journey underscores an evolving narrative in the world of finance where digital assets are becoming an integral component of corporate strategy.

Stay tuned with us to learn more about how companies are navigating these uncharted waters in the crypto space and what it means for the future of digital currency.