One year ago today, a groundbreaking moment in the cryptocurrency world unfolded with the launch of the very first spot Ethereum exchange-traded funds (ETFs) in the United States. Fast forward to today, and these innovative financial products have made impressive strides, amassing over $8 billion in net inflows, igniting investor enthusiasm, and hinting at the possibility of staking becoming a reality. What does this mean for the future of Ethereum and its investors? Let’s dive in.

When the U.S. Securities and Exchange Commission (SEC) finally greenlit these nine spot Ethereum ETFs, trading commenced on July 23, 2024, marking a pivotal shift in the crypto landscape. On their launch day alone, these ETFs generated more than $1 billion in trading volume, demonstrating an immediate appetite from investors eager to tap into Ethereum’s potential.

$ETH ETF inflow + $533,800,000 yesterday. Smart money is accumulating the Ethereum dip. pic.twitter.com/vxsgHYjevA— Ted (@TedPillows) July 23, 2025

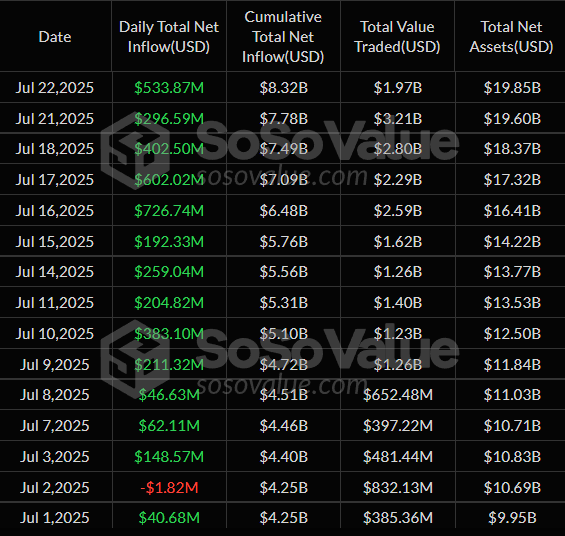

As of July 23, 2025, the total net inflow into these funds has reached an impressive $8.32 billion. Although this figure lags behind Bitcoin ETFs, which boast a staggering $54.55 billion in inflows, the momentum for spot Ethereum ETFs is undeniable. Recent data shows a string of consecutive days with positive inflows and record-breaking daily investments, showcasing a growing interest from institutional investors.

Source: SoSoValue – Ethereum ETF Flow Data

In an exciting turn of events, during one particularly strong trading session earlier this week, the funds experienced inflows of $533.87 million, marking the third-highest daily total recorded. This upward trend follows the previous all-time high of $726.74 million on July 16. The cumulative data on inflows is encouraging, with Tuesday marking the thirteenth consecutive day of positive movement for these funds, a significant bounce back after a minor dip of $1.82 million on July 2. Even more striking is the rising total net asset value, which reached an all-time high of nearly $19.85 billion last Tuesday.

Source: SoSoValue – Ethereum ETF Data History

The performance of the nine ETFs varies from one to another, with BlackRock consistently leading the pack in terms of inflows. In the recent uptick, BlackRock’s product brought in $426.22 million, followed by Grayscale and Fidelity with inflows of $72.64 million and $35.01 million, respectively. Notably, during the prior all-time high, BlackRock had reported $499.25 million in inflows alone, showcasing the fierce competition among these funds.

Katherine Wu, COO of ENS Labs, emphasized the importance of these figures, stating, “These are massive numbers that speak volumes: institutions aren’t just paying attention; they’re allocating.” This sentiment underlines the growing institutional interest in Ethereum, transforming it into a cornerstone of modern investment strategies.

What’s next for this Ethereum momentum? As the market responds and adapts, analysts are predicting a robust second half for 2025. Sean Dawson, Head of Research at Derive.xyz, noted that Ethereum’s recent price surge beyond $3,500 doesn’t just involve Bitcoin; it signals a pivotal shift favoring Ethereum. “What we’re observing is not just a spike; it represents a regime change,” he commented, highlighting an increasing wave of institutional interest. Dawson suggests that we may be on the verge of a new era for Ethereum investments, especially with emerging ETF opportunities like staking.

While Ethereum is currently trading at $3,677—a modest drop of 0.7% in the last day—it has appreciated by 19% over the past week. Analysts are optimistic, anticipating a potential rebound to the coveted $4,000 mark as adoption continues to grow.

Wu further remarked on the significance of the Ethereum ETF approval, calling it a definitive moment for the crypto industry. “With the Ethereum ETFs, institutions aren’t just stepping into a scarce asset; they’re gaining access to a versatile, programmable asset that fuels numerous financial applications and mechanisms,” she explained. This perspective highlights the transformative role that Ethereum plays within the broader financial ecosystem.

But it doesn’t stop there. As companies are exploring beyond mere BTC and ETH, the landscape is ripe for ETFs involving altcoins, tokens, and even NFTs. There’s a buzz about staking, with regulatory dynamics shaping potential futures. BlackRock’s recent initiative to enable staking within its Ethereum ETF could redefine how traditional finance interacts with crypto, paving the path for lucrative yield opportunities.

#Staking could come to Ethereum ETFs. Hong Kong regulators may approve the widely anticipated staking features for spot Ether ETFs this year, ahead of the US, according to a Blockdaemon executive. Discover how this could drive greater adoption⬇️https://t.co/Y9icfuq6u9— Sygnum Bank (@sygnumofficial) September 20, 2024

As we look ahead, the potential approval of staking-enabled ETFs could significantly enhance Ethereum’s value proposition, enticing more investors and integrating TradFi with DeFi in previously unparalleled ways. The conversation among crypto commentators remains vibrant, as they ponder both the promise and the pitfalls of regulatory approvals that could reshape the crypto landscape.

In conclusion, the last year has undeniably proven to be a monumental journey for Ethereum spot ETFs. With a seismic shift in institutional interest and potential new product offerings on the horizon, it seems clear that Ethereum is not only validating its presence in financial markets but also redefining investment paradigms. Whether you’re an experienced trader or a curious newcomer, this evolving landscape is one to watch. What role will you play in this unfolding narrative?