In the dynamic world of cryptocurrency, Solana (SOL) has recently caught the attention of investors once again, showing a noteworthy 4.5% boost this week as it hovers around $193.33. This price surge comes amid regulatory uncertainties surrounding U.S.-based exchange-traded funds (ETFs) linked to the Solana ecosystem. In a recent announcement, the Securities and Exchange Commission (SEC) revealed that it would extend its review period for Solana ETF applications from Bitwise and 21Shares until October 16, 2025, a crucial deadline before the SEC must decide to approve or reject these filings. Despite this apparent setback, the resilience of Solana within the marketplace is hard to ignore.

🚨 CMC News: $SOL ETF Approvals Delayed Until October by SEC.🔗 https://t.co/e3mGzFLlTh pic.twitter.com/WyqZfj0RrU— CoinMarketCap (@CoinMarketCap) August 16, 2025

Why is this significant? Regulatory delays often unsettle investors, creating hesitancy in the market. However, the SEC’s caution appears methodical, as they seek deeper insights into market integrity, investor protection, and the classification of Solana – is it a security or a commodity? This approach is reminiscent of the path taken with Bitcoin and Ethereum ETFs, which faced similar roadblocks before eventually gaining approval. Yet, the narrative around Solana is tinged with concerns regarding its network maturity and the centralization of control, which continue to surface in discussions among market participants.

Excitingly, even with these hurdles, institutional investment in Solana is surging, signalling strong confidence in its future potential. The REX Shares Solana Staking ETF, for instance, has already amassed over $150 million in assets under management. Remarkably, it registered a single-day inflow of $13 million alongside a trading volume spike of $66 million, suggesting that investors are eager to capitalize on limited regulated financial products associated with Solana.

🚨JUST IN: The first 🇺🇸U.S. Solana staking ETF, $SSK, by @REXShares recorded $13M in inflows today, while also hitting a record $66M in trading volume. It was the highest volume day since launch, reflecting growing demand for the ETF. pic.twitter.com/8SWjTedIKj— SolanaFloor (@SolanaFloor) August 15, 2025

This burgeoning interest is not limited to REX Shares. Major players in the financial landscape, including Grayscale, Fidelity, and ProShares, have filed applications for Solana-related ETFs, showcasing a variety of strategies and approaches. In a stark contrast, financial titan BlackRock has opted to stay away from Solana, focusing solely on Bitcoin and Ethereum products. This divergence of strategies illustrates the distinctive risk-reward profile that Solana presents to institutional investors.

For crypto enthusiasts, there are a few stand-out takeaways worth noting:

- Institutional investment remains robust despite regulatory headwinds.

- The performance of the REX Shares ETF suggests strong initial confidence in Solana’s market outlook.

- Institutional giants are divided in their approach, with BlackRock taking a wait-and-see stance.

When we analyze Solana’s technical landscape, the outlook appears promising. After a rebound from $190, the token is currently trading above its 50-day simple moving average (SMA) of $188, which maintains its bullish narrative. The price action reflects a consistent pattern of higher lows, indicative of sustained buying momentum.

Currently, the Relative Strength Index (RSI) sits at 53, which suggests that there’s still room for growth before entering overbought territory. Moreover, the MACD histogram is poised near zero, hinting at a potential bullish crossover. These indicators imply that the momentum could be building for a significant price breakout. The critical resistance mark is at $198; a successful close above this level could open doors to targets around $205 and $214, further solidifying Solana’s upward trajectory. On the flip side, if the price fails to exceed $198, traders should keep a close eye on the support zone between $188 and $186, with a clear drop below $174 signaling potential weakness in the trend.

Looking ahead, it appears the market is treating the SEC’s extended review as a procedural formality rather than a cause for alarm. Analysts from Bloomberg currently estimate a staggering 95% chance of ETF approval for Solana, and prediction markets echo this optimism. Should approval materialize within the specified timeframe, Solana might swiftly join Bitcoin and Ethereum in the U.S. ETF landscape, potentially attracting billions in inflows during the inaugural year.

In summary, the market is collectively looking beyond regulatory delays in anticipation of a favorable outcome. With a solid technical foundation and increasing institutional interest, Solana is strategically positioned for its next substantial growth phase—one that could establish its standing among the crème de la crème of digital assets.

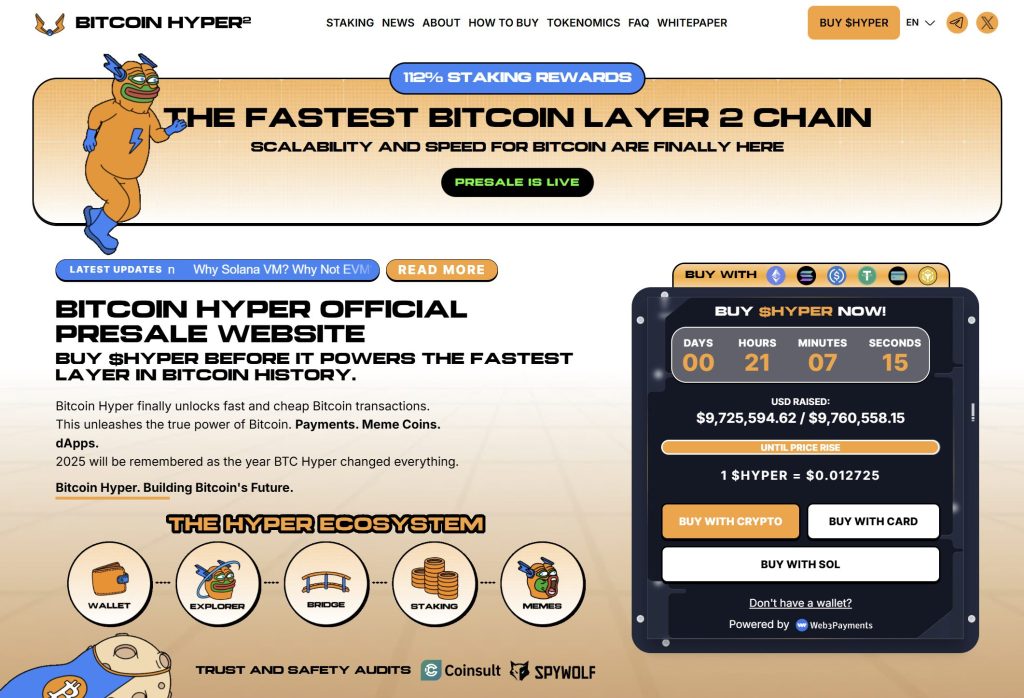

On the horizon, there’s another intriguing player: Bitcoin Hyper ($HYPER)—the first Layer 2 solution native to Bitcoin, powered by Solana’s Virtual Machine. This project promises to supercharge Bitcoin’s ecosystem, enabling swift, low-cost smart contracts, decentralized applications (dApps), and even the creation of meme coins. By synergizing Bitcoin’s security with Solana’s speed, it opens new avenues for innovation—all while ensuring seamless BTC bridging.

With the presale already crossing $9.7 million and limited allocations remaining, interest in $HYPER is escalating. Currently, tokens are available for just $0.012725, but this rate is poised to rise. If you’re looking to be part of this innovative venture, check out the official Bitcoin Hyper website to participate in the presale using either crypto or bank card options.

As we navigate this ever-evolving landscape, keeping an eye on Solana’s journey and the implications of upcoming regulatory decisions will be key for investors and enthusiasts alike.