Is Solana ETF Approval on the Horizon? Analysts Predict Major Developments

Excitement is building in the cryptocurrency world as analysts from Bloomberg, James Seyffart and Eric Balchunas, have increased the odds of a Solana (SOL) spot ETF being approved by the U.S. Securities and Exchange Commission (SEC) to an impressive 90% before the year closes. Their recent insights mark a pivotal shift in focus from “if” to “when” this approval will materialize, highlighting a growing acceptance of cryptocurrencies in mainstream finance.

Solana price trends with potential ETF impacts.

📌 Why This Matters

The anticipated approval of Solana’s spot ETF represents a significant milestone not only for the token itself but for the altcoin market as a whole. With precedents set by Bitcoin and Ethereum ETFs, which have remarkably gathered billions in assets, institutional engagement could fundamentally reshape market landscapes. Investors are keenly eyeing how a Solana ETF might provide direct access to this thriving blockchain ecosystem, potentially opening the floodgates for substantial capital inflow.

🔥 Expert Opinions: A Changing Landscape

Industry experts are buzzing about what a Solana ETF could mean for institutional investment. Brian Rudick, Chief Strategy Officer at Solana-focused Upexi, notes that if approved, the dynamics could resemble those we witnessed with Bitcoin. “The immediate surge in Bitcoin’s value following the ETF filings was astronomical. A similar demand surge for Solana could set the stage for significant price growth,” he explains.

Furthermore, the context of rising crypto legitimacy in Washington has fostered a conducive environment for the SEC’s engagement with altcoin ETF filings. This is evidenced by ongoing discussions around updated S-1 forms from major players like Fidelity, Grayscale, Bitwise, and VanEck.

🚀 Future Outlook: What Lies Ahead for SOL

As Solana continues to navigate its path toward ETF approval, some analysts point to the recent CFTC futures approval for SOL as yet another positive signal. This not only underscores market maturity but indicates a growing regulatory openness toward innovative crypto assets.

However, as momentum builds, traders must remain vigilant. Currently, SOL faces significant technical resistance. Trading around $140.40, it’s encountering hurdles just below the critical resistance zone pegged between $144.49 and $145.49. Analysts are closely monitoring these levels, with some suggesting that a breakthrough here could ignite a bullish reversal.

SOL is stuck below key resistance at $144.49–$145.49, with a bearish engulfing candle and MACD in the red. If $138.39 support breaks, eyes on $135.74 and $132.57 next.#Solana #Crypto #SOL #TechnicalAnalysis pic.twitter.com/UTWYK9JnOA— Arslan Ali (@forex_arslan) June 21, 2025

The Road Ahead: Technical Challenges

Despite the bullish news surrounding potential ETF approval, Solana’s short-term technical indicators portray a cautious view. According to experts, SOL currently battles a bearish engulfing pattern that has placed it in a consolidation phase. Should the $138.39 support level falter, the price could conceivably dip towards $135.74 or even $132.57—a move that could dampen the positive sentiment surrounding the ETF narrative.

Key Takeaways

- Bloomberg’s analysts estimate a 90% chance of a Solana ETF approval before year-end.

- Increased institutional interest is expected to parallel the growth seen with Bitcoin’s ETF launch.

- Potential staking features for Solana ETFs could enhance returns for investors.

- Critical resistance and support levels are key for short-term price stability and breakout potential.

As we look toward the future, it becomes clear that the approval of a Solana ETF could serve as a long-term catalyst for growth within the cryptocurrency arena. For traders and investors alike, keeping a watchful eye on key price levels will be essential, setting the stage for potentially explosive market movements as the year draws to a close.

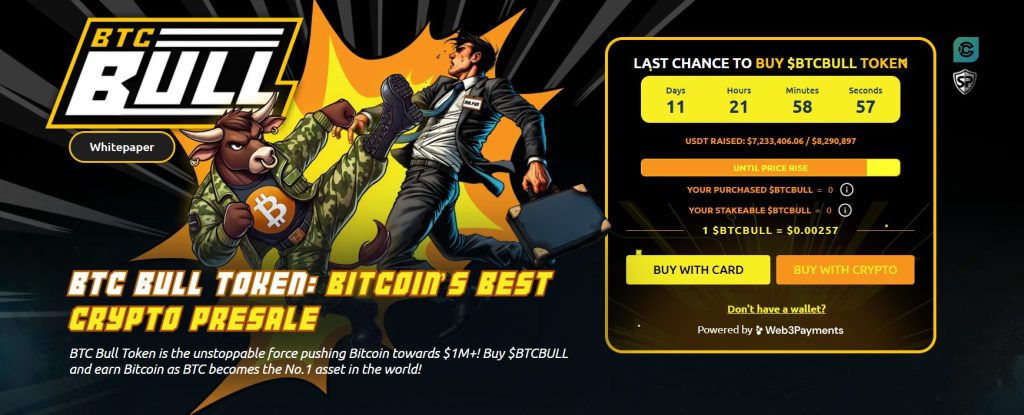

BTC Bull Token: A New Contender on the Horizon

While all eyes are on Solana, another intriguing opportunity is emerging in the form of BTC Bull Token ($BTCBULL). With Bitcoin trading near $104,000, the project has already raised over $7 million of its $8.29 million cap. Investors are eager to see how BTCBULL will leverage its connection to Bitcoin with enticing staking options featuring an attractive 58% annual percentage yield (APY).

Overview of BTC Bull Token features and roadmap.

This innovative approach incorporates a dual mechanism of BTC airdrops for early participants and automatic supply burns that enhance scarcity each time Bitcoin’s price rises by $50,000. With excellent demand and less than a million remaining before the hard cap, BTCBULL could be a compelling option for both seasoned and novice investors seeking reliable passive income.

Conclusion

The cryptocurrency market is brimming with potential opportunities as it continues to mature. With Solana on the verge of possibly securing ETF approval, the landscape could become even more dynamic. Will institutional interest translate into a price surge for SOL? And can BTC Bull Token sustain its impressive momentum? These are questions worth exploring as we navigate the fast-evolving world of digital assets. Join the conversation—where do you see the future of these tokens heading?