Surging Activity on Solana: A Fresh Wave of Interest

In the world of cryptocurrency, few events capture attention quite like a significant surge in trading activity. Recently, Solana has been at the forefront, experiencing an impressive influx of over $125 million in bridged assets from various blockchains in just the past week. This lively escalation is not merely a statistic—it’s a reflection of renewed investor enthusiasm, driven by both a strategic pivot towards established meme coins and dynamic liquidity flows from Ethereum.

Ethereum Leads the Charge with Major Liquidity Influx

The recent spike in volume can largely be attributed to Ethereum’s overwhelming contribution. According to data from Artemis, over $70 million—representing nearly 56% of the total bridged amount—has flowed from Ethereum into Solana. Other blockchain players such as Arbitrum ($14.1 million), Polygon ($7.5 million), and BNB Chain ($2.6 million) have also added to this liquidity list, showcasing a robust week-over-week growth rate of almost 40% in bridged assets.

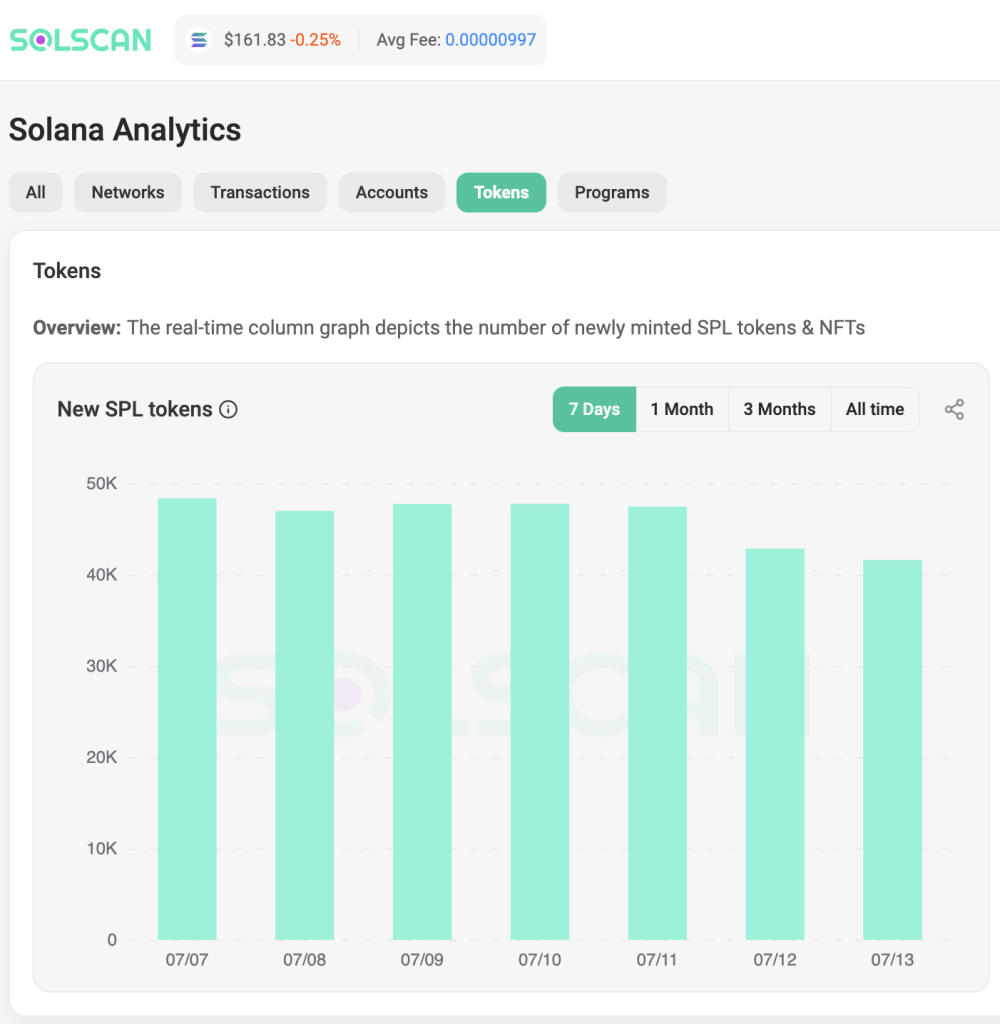

Decline in Meme Coin Launches: A Strategic Shift

Interestingly, this wave of capital seems linked to a significant cooling of the meme coin frenzy that once dominated trading discussions. Over the last week, there were only 322,000 new token launches on Solana, a stark contrast to previous peaks, suggesting that traders are recalibrating their approach towards more established names. In this context, even amidst competition between newer meme tokens like LetsBONK and Pump.fun, trading activity has remained subdued.

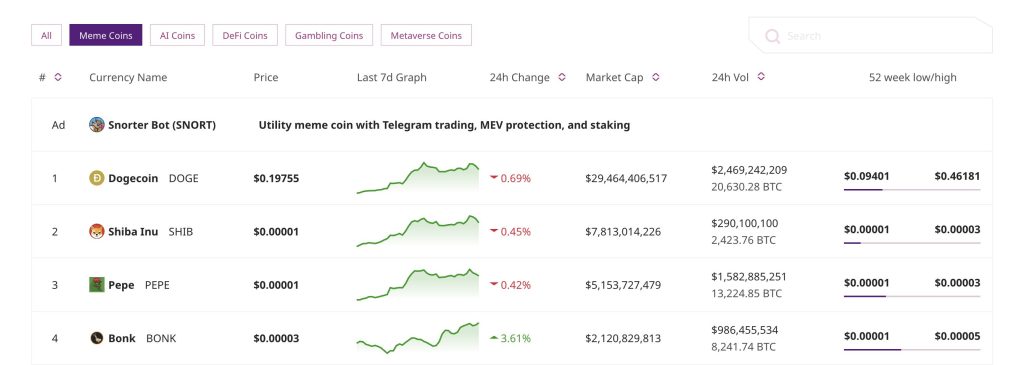

Instead of chasing the next big thing, traders appear to be redirecting their liquidity towards recognized contenders such as Pepe (PEPE), Shiba Inu (SHIB), Dogecoin (DOGE), and others, indicating a clear market preference for stability amid saturation.

The Old Guard Rises: Meme Token Dynamics

The revival of older meme tokens is noteworthy, with notable gains in their market metrics. Pepe, for instance, has surged 23.73% in market capitalization to reach around $5.12 billion, with a trading volume that recently hit $5.87 billion. Shiba Inu has also garnered attention, reporting a 14.9% increase and securing a market cap of $7.83 billion. Meanwhile, Dogecoin remains the market leader, boasting an 18.5% rise over the week.

Furthermore, Bonk’s trading activity has skyrocketed, with a dramatic increase of 70% over the last ten sessions, pushing its market cap to approximately $1.465 billion. The surprise endorsement from TRON founder Justin Sun has undoubtedly amplified the excitement around the Pudgy Penguins token, which recorded a remarkable 48.2% hike in its market cap over the same period.

Why This Matters: A Shift in the Crypto Landscape

This shift towards established meme coins highlights a crucial trend in the cryptocurrency landscape: as the market matures and becomes increasingly saturated with new projects, investors are prioritizing known entities over speculative ventures. This has implications for both market stability and long-term investment strategies, as traders seek to navigate the volatile waters of meme tokens.

Solana’s Impressive Metrics: Outperforming Peers

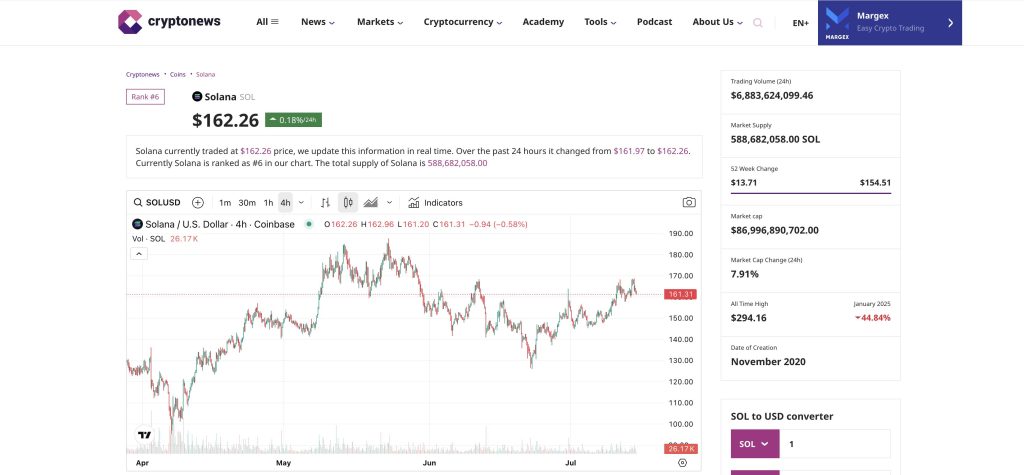

While investors flock back to familiar faces, Solana itself continues to shine on several fronts. In Q2 2025, it generated over $271 million in revenue, surpassing even Ethereum and Bitcoin for the third consecutive quarter. This strong financial performance is echoed in the transaction metrics: a 32% rise in transaction volume last week pushed the total to 590 million, outperforming other major networks in activity and innovative transaction fees, which soared by 44% to reach $7.68 million.

The ETF Effect: Institutions Eye Solana

Amidst this wave of interest, expectations are also high regarding the potential approval of Solana ETFs. Current predictions suggest a staggering 99% likelihood that the U.S. Securities and Exchange Commission will greenlight spot Solana ETFs by the end of the year. Major firms like VanEck and Grayscale are already in the application process, indicating a growing institutional appetite for Solana assets—a scenario that could dramatically reshape the investment ecosystem.

Future Outlook: What Lies Ahead for Solana?

Looking towards the future, market analyst Ali Martinez has identified an intriguing cup-and-handle formation on Solana’s weekly chart—a pattern often indicative of substantial upward movements. According to his analysis, a confirmed breakout above the critical resistance level of $170 could pave the way for Solana to retest its all-time highs, and potentially soar to impressive new heights.

However, traders need to remain vigilant; a failure to break through $170 might prompt a downward shift, redirecting prices towards support levels around $135 or even $100. The dynamic nature of this market necessitates a careful and strategic approach as solana continues to maneuver through its recovery journey.

In Conclusion: Engaging with the Evolution of Solana

As Solana navigates these pivotal moments, the blend of increased investor interest in established tokens and significant liquidity influx presents a fascinating picture of the evolving cryptocurrency landscape. Will this trend continue to favor established players in the meme coin segment? How will Solana leverage institutional interest to bolster its growth? These questions remain at the forefront as we watch Solana’s next moves. Join the conversation—what are your thoughts on the direction of Solana and the broader crypto market?