Solana (SOL): A Silent Powerhouse in the Altcoin Arena

As Solana (SOL) continues to trade at approximately $139, it has been stealthily surpassing many of its major altcoin competitors. This surge isn’t a mere fluke; it is fueled by increasing institutional interest and strategic long-term acquisitions. One of the key players in this narrative is Janover Inc.—now branded as the DeFi Development Corporation—which has made headlines by bolstering its treasury with an impressive $5 million investment in SOL.

This latest acquisition saw Janover purchase 44,158 SOL tokens, pushing their cumulative holdings to 83,084 SOL, currently valued at around $9.6 million. This marks Janover’s second major investment in Solana, underscoring a remarkable 109% increase in the value of SOL per share, which now sits at $6.59.

Janover’s Strategic Move: A Closer Look

This strategic accumulation follows a significant leadership restructuring at Janover in April, when former Kraken executives stepped in to steer the company toward Solana staking and DeFi infrastructure after securing $42 million in funding. Their aggressive stance on SOL illustrates a broader trend of institutional conviction in the Solana ecosystem, indicative of the growing faith in its potential.

Here’s a quick snapshot of Janover’s current Solana holdings:

- Total Holdings: 83,084 SOL (~$9.6M)

- SOL per Share: 0.06 SOL → $6.59

- Growth: 109% increase in per-share crypto value

Whale Accumulation: The Big Fish Are Back

Janover is not alone in its bullish outlook for Solana. SOL Strategies Inc. (CSE: HODL), a Canadian crypto investment firm, demonstrated its commitment to the SOL ecosystem in March by adding 24,000 SOL to its portfolio, bringing their total holdings to an impressive 267,151 SOL, valued at over $30 million. Notably, almost all of these tokens are being staked across the firm’s validator network, emphasizing a focus on active participation in Solana’s proof-of-stake economy.

“In March, SOL Strategies (CSE: HODL) acquired 24,000 SOL, bringing total holdings to 267,151 SOL—nearly all of which is staked across our validator network. Our commitment to Solana continues.” — SOL Strategies (@solstrategies_) April 8, 2025

Interestingly, despite the robust fundamentals backing their investments, SOL Strategies’ stock has witnessed a 67% decline year-to-date, starkly contrasting the 36% drop experienced by SOL itself. Nonetheless, CEO Leah Wald remains unfazed, expressing intentions to expand their staking operations to include other chains like SUI, Monad, and Archway.

Adding another layer of intrigue, on-chain data reveals that a whale—one who previously purchased 30,541 SOL at $216 during the previous bull cycle—scooped up an additional 32,000 SOL (worth approximately $3.72 million), signaling strong bullish sentiments returning to the market.

Technical Insights: Solana’s Price Patterns and Predictions

From a technical perspective, Solana remains on a bullish trajectory. After briefly testing a resistance level at $145, the price retraced to $139, yet crucial support zones at $136 to $131 still hold firm. The 50-day Exponential Moving Average (EMA) sitting around $131 adds additional weight to this support.

Indicators like the Moving Average Convergence Divergence (MACD) signal that buyers are still in control. If SOL manages to confidently breach the $145 mark, potential upside targets could rise to $153 and $161. Traders should look for entry points around these key breaking zones and keep a keen eye on the pivotal support levels.

Why This Matters: The Bigger Picture for Investors

The significance of these developments for investors is monumental. With a blend of institutional accumulation, whale activity, and a favorable technical backdrop, Solana is positioning itself for a potential breakout. As market attention flits to other cryptocurrencies, savvy investors are beginning to notice the quiet accumulation of SOL—hinting that a significant rally may be on the horizon.

Expert Insights: Analysts Weigh In

In light of these movements, analysts suggest that the recent trend indicates growing institutional confidence in Solana’s long-term vision. “We’re seeing a shift in sentiment around SOL; it’s not just about quick gains anymore. The focus has moved to sustainable growth and infrastructure development,” one market analyst noted. Such endorsements bolster the case for Solana as a key player in the evolving crypto landscape.

Conclusion: Preparing for Solana’s Next Big Move

As Solana navigates this period of strategic accumulation, investors are advised to stay vigilant. The confluence of institutional interest, whale movements, and robust technical indicators indicates that Solana could be gearing up for its next major leap. Whether you’re a seasoned investor or just dipping your toes into crypto, the time to engage with Solana is right now. What are your thoughts? Will SOL break through and reclaim higher ground? Join the conversation below!

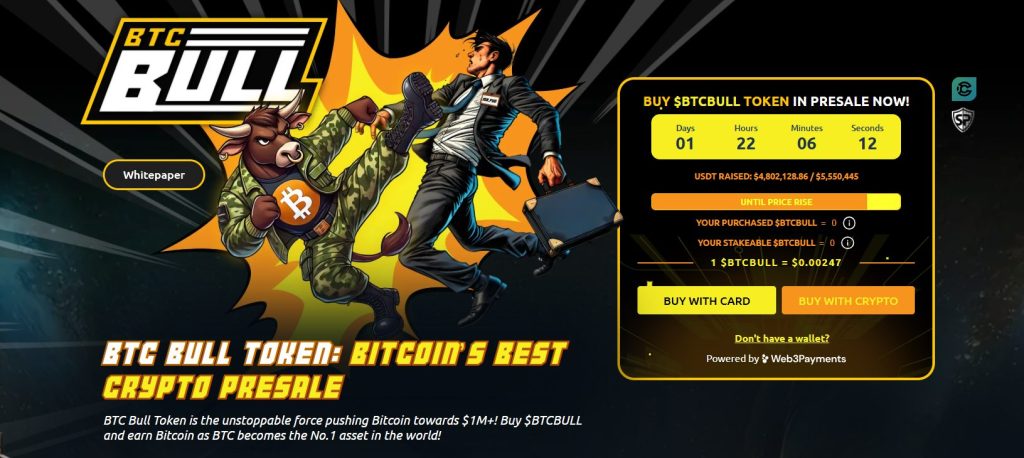

Additional Insights: The Rise of BTC Bull Token

As a side note, the cryptocurrency scene is buzzing around BTC Bull Token ($BTCBULL), which has seen presale numbers soar to over $4.8 million. This Ethereum-based meme token uniquely positions itself by offering real Bitcoin airdrops at pivotal BTC price milestones, aligning perfectly with crypto investors wanting to take advantage of Bitcoin’s upward trajectory.

With high-yield staking options reaching up to 86% APY, and a growing ecosystem, BTC Bull Token is making waves in a crowded market. Investors are drawn to its staking rewards and Bitcoin utility—a formula that could signal the next big shift in the meme coin domain.

With the presale nearing its target of $5.55 million, and the token price set to rise as demand increases, those looking to capitalize on BTCBULL’s unique offerings may want to act quickly before the window closes. Are you ready to join the Bitcoin future through BTC Bull Token? Let us know your thoughts!