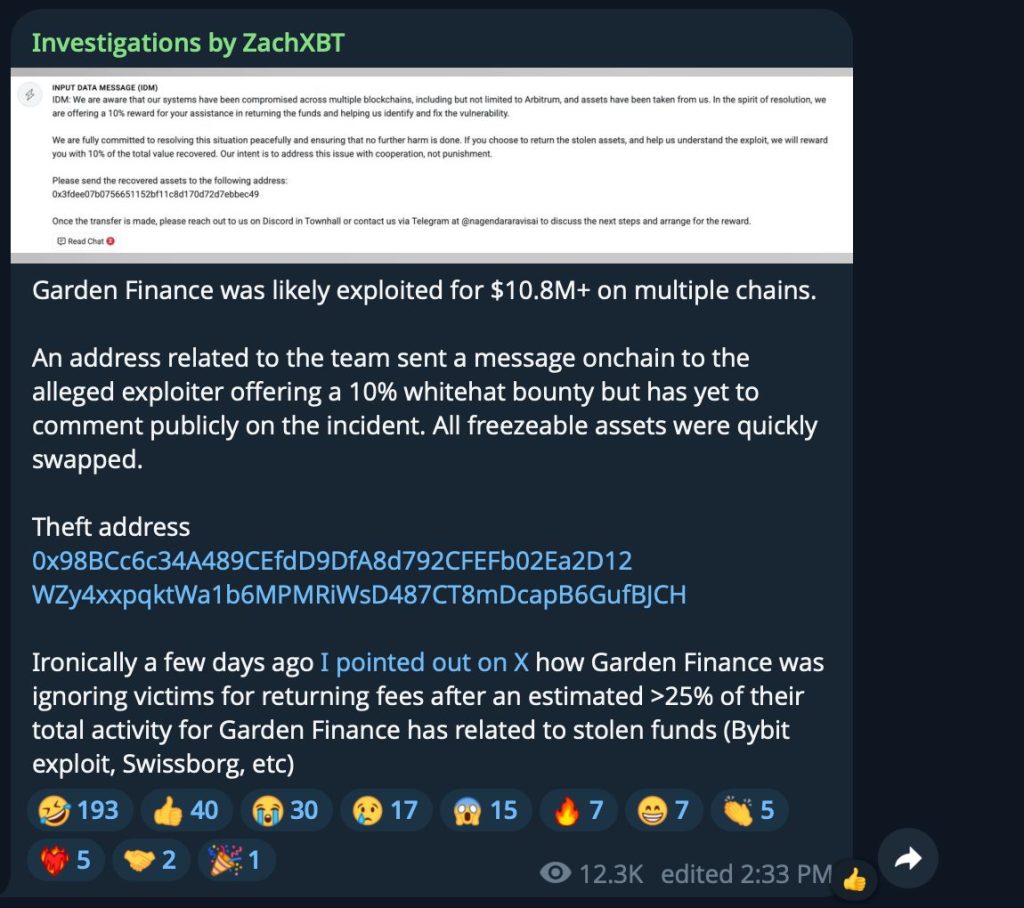

In a shocking turn of events, Garden Finance has been rocked by a devastating exploit, the repercussions of which are felt across the cryptocurrency landscape. This hack, which siphoned off a staggering $10.8 million from multiple blockchain networks, has intensified scrutiny on a platform that’s already mired in controversy. On-chain investigator ZachXBT has unearthed damning details, revealing that more than 25% of Garden’s entire activity appears linked to funds that have been illicitly obtained.

The scandal comes at a time when Garden is facing allegations of facilitating North Korean money laundering operations, drawing even more attention to its operations. In a surprising twist, an address associated with Garden’s team reached out to the alleged hacker, offering a 10% bounty for returning the stolen funds; however, the company has yet to release any public statement regarding the breach. Meanwhile, the attacker swiftly converted all freezeable assets through specific addresses on Ethereum Virtual Machine (EVM) chains and Solana, leaving a trail of damaged reputations in their wake.

Why This Matters

The implications of this exploit extend far beyond mere financial loss; they raise critical questions about the integrity and security of blockchain platforms. With a significant portion of Garden Finance’s volume tracing back to stolen funds, this incident serves as a glaring reminder of the vulnerabilities present within decentralized finance (DeFi) ecosystems. For users, investors, and developers alike, the incident calls for a re-evaluation of due diligence and security protocols in the crypto space.

🔥 Expert Opinions

The criticisms from ZachXBT are pointed and severe, particularly towards Garden’s co-founder, Jaz Gulati. Just days prior to the exploit, ZachXBT had lambasted Garden Finance for neglecting the concerns of users who sought refunds after the platform engaged with assets from major hacks such as the Bybit incident. He estimated that during a short period in 2025, over a quarter of Garden’s total trading volume stemmed from dubious sources, fueling a profit that soared into six figures. “I genuinely hope a government puts your team in prison with Diddy next cycle for ignoring victims,” ZachXBT stated, underscoring his frustration with the lack of accountability.

He also drew distinctions between Garden and other protocols, indicating that not all companies are created equal when it comes to commitment to security and community. He emphasized, “Tornado Cash is the only one in this space that I believe has passed my decentralization test,” highlighting the ongoing struggles for legitimacy within the realm of DeFi.

🚀 Future Outlook

The future of Garden Finance hangs in a precarious balance. Investigations reveal that its predecessor, Ren Protocol, has a long history of facilitating transactions for some of the most notorious hacking groups, including North Korea’s Lazarus Group, which has become infamous for its extensive cyber theft activities. According to blockchain intelligence firm Elliptic, Ren Protocol processed over $540 million in illicit funds between 2020 and 2025. Now, with Garden Finance positioned as the latest iteration, the question remains: will it break the cycle, or will it continue to serve as a conduit for criminal activity?

The patterns of laundering through Garden Finance are troubling, with reports indicating that a significant proportion of its transactions have roots in stolen assets. In fact, an estimated 75% of its total volume has been traced back to illicit activities, especially in the wake of high-profile hacks like the $1.4 billion Bybit breach. Impressive fee earnings of over $300,000 from these tainted transactions stand in stark contrast to its claims of decentralization.

ZachXBT’s meticulous tracking has illustrated how stolen Ethereum is converted to Bitcoin via Garden, which is then further obscured through various networks before reaching final destinations. This methodical approach has put Garden in the crosshairs of investigators who accuse it of complicity through negligence or ignorance, a claim that amplifies calls for regulatory scrutiny within the DeFi space.

As allegations mount concerning North Korean involvement in laundering schemes facilitated by Garden Finance, the cryptocurrency community is left questioning how deeply this issue runs. With hackers reportedly having stolen over $1.3 billion in 2024 and $2.2 billion in just the first half of 2025, the specter of organized crime looms large over the industry.

In conclusion, the fallout from the Garden Finance exploit is rippling through the cryptocurrency ecosystem, highlighting vulnerabilities that could undermine user confidence in DeFi platforms. The consequences of these revelations will likely shape the future landscape of governance and compliance in the crypto space. As stakeholders eagerly await further developments, it’s essential for the community to remain vigilant and proactive in addressing these challenges. We invite you to stay connected for more updates on this evolving story and engage actively in discussions about securing the future of decentralized finance!