Senator McCormick: Congress’s Bitcoin Vanguard

In a bold move that underscores the growing intersection of politics and cryptocurrency, U.S. Senator Dave McCormick, a Republican from Pennsylvania, has emerged as the most significant Bitcoin investor in Congress. With a keen eye for innovation and an impressive background as the former CEO of hedge fund Bridgewater Associates, McCormick’s investment choices reflect a commitment to embracing the digital asset revolution.

Investments That Make Waves

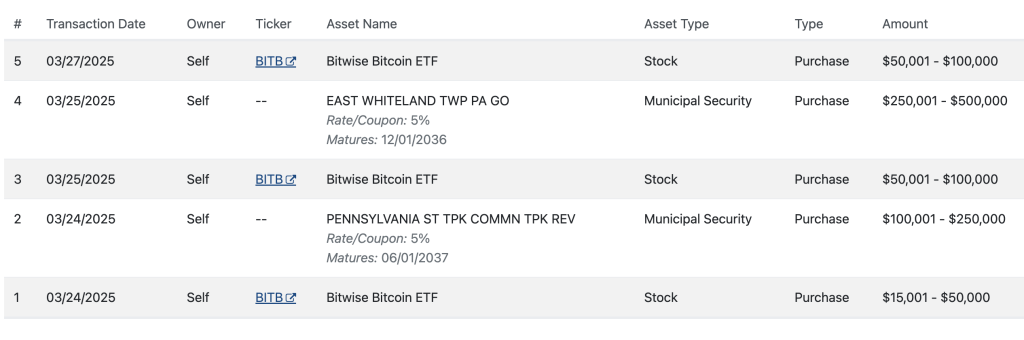

Recent financial disclosures reveal that McCormick has made substantial investments in Bitwise’s spot Bitcoin ETF, totaling nearly $250,000 in the latest round. In March alone, his investments ranged between $310,000 and $700,000, adding to an impressive portfolio that may soon approach the $1 million mark. Before the notable announcements regarding crypto policy, he had invested between $65,000 to $150,000 in the Bitwise Bitcoin ETF, positioning himself strategically just days before former President Trump’s Executive Order to explore a Strategic Bitcoin Reserve.

Championing Cryptocurrency

McCormick’s connection to the cryptocurrency world extends beyond mere investments. His forward-thinking approach has garnered attention and support from influential figures in the industry, including Coinbase CEO Brian Armstrong. Armstrong endorsed McCormick during his campaign, stating that he was the “better candidate on crypto,” a sentiment that helped secure him a narrow victory in the competitive 2024 Senate race.

In a recent address to the Senate Banking Subcommittee on Digital Assets, McCormick emphasized his vision for 2025, positing that “the year will be pivotal for digital assets.” He articulated a compelling narrative that positions blockchain and digital currencies as not just financial tools but as vital components in enhancing national security and stimulating economic growth.

Why This Matters

With Bitcoin adoption on the rise, Senator McCormick’s investments and active participation in crypto discussions signify an important shift in political attitudes toward digital assets. His willingness to take significant financial risks is not only a personal financial strategy but also a bold statement that could influence the legislative landscape surrounding cryptocurrencies.

Additionally, as more lawmakers recognize the potential economic benefits of embracing crypto technologies, we may see an expedited development of regulations that could encourage further investment in the sector. This evolution in policy could redefine financial landscapes, both nationally and globally.

The Ripple Effect: Other Senators in Crypto

Senator McCormick is not alone in his crypto endeavors. Notable peers, such as Senator Steve Daines of Montana, have had stakes in various ETFs before selling them off. These include prominent products like the ProShares Bitcoin Strategy ETF and the Amplify Blockchain Leaders ETF, showcasing a broader interest among lawmakers. Similarly, Georgia’s Republican Representative Marjorie Taylor Greene recently disclosed shares in the iShares Bitcoin Trust ETF—actions that illustrate a growing acceptance of digital assets among politicians.

Moreover, with figures like Justin Sun, an advisor to Trump’s World Liberty Financial, claiming to be the largest shareholder of Valkyrie, it is clear that the cryptocurrency wave is making its way into political corridors.

Expert Insights: What Analysts Are Saying

Industry experts are watching Senator McCormick closely. Many analysts suggest his strategic investments and vocal support for cryptocurrency legislation may set a precedent for other lawmakers. One analyst noted, “McCormick’s backing signals confidence in the long-term viability of cryptocurrencies and could inspire a legislative framework conducive to innovation in the sector.”

Looking Ahead: The Future of Crypto in Politics

As we gaze into the future, the trajectory of cryptocurrency in American politics appears promising. Senator McCormick’s proactive approach, combined with the increasing number of politicians recognizing the importance of digital assets, indicates we might soon witness a favorable regulatory environment emerging for cryptocurrencies and blockchain technology.

With the implications of this momentum potentially altering the financial fabric of the nation, the question remains: How will these developments influence the average consumer and the overall economy?

Conclusion: Join the Conversation

As cryptocurrency continues to evolve and gain traction within the halls of political power, it’s essential to stay informed and engaged. How do you view the intersection of crypto and politics? Will this lead to a more robust financial future or increased speculation? Let us know your thoughts in the comments below!