Major Regulatory Win: SEC Takes Down CLS Global for Market Manipulation

In a groundbreaking move that reverberates through the cryptocurrency landscape, the U.S. Securities and Exchange Commission (SEC) recently achieved a decisive victory in its case against CLS Global FZC LLC, a crypto market maker operating out of the United Arab Emirates. This case, decided in the U.S. District Court for the District of Massachusetts, unfolds like a high-stakes drama, signaling a pivotal moment in regulatory enforcement against fraudulent practices in the digital asset arena.

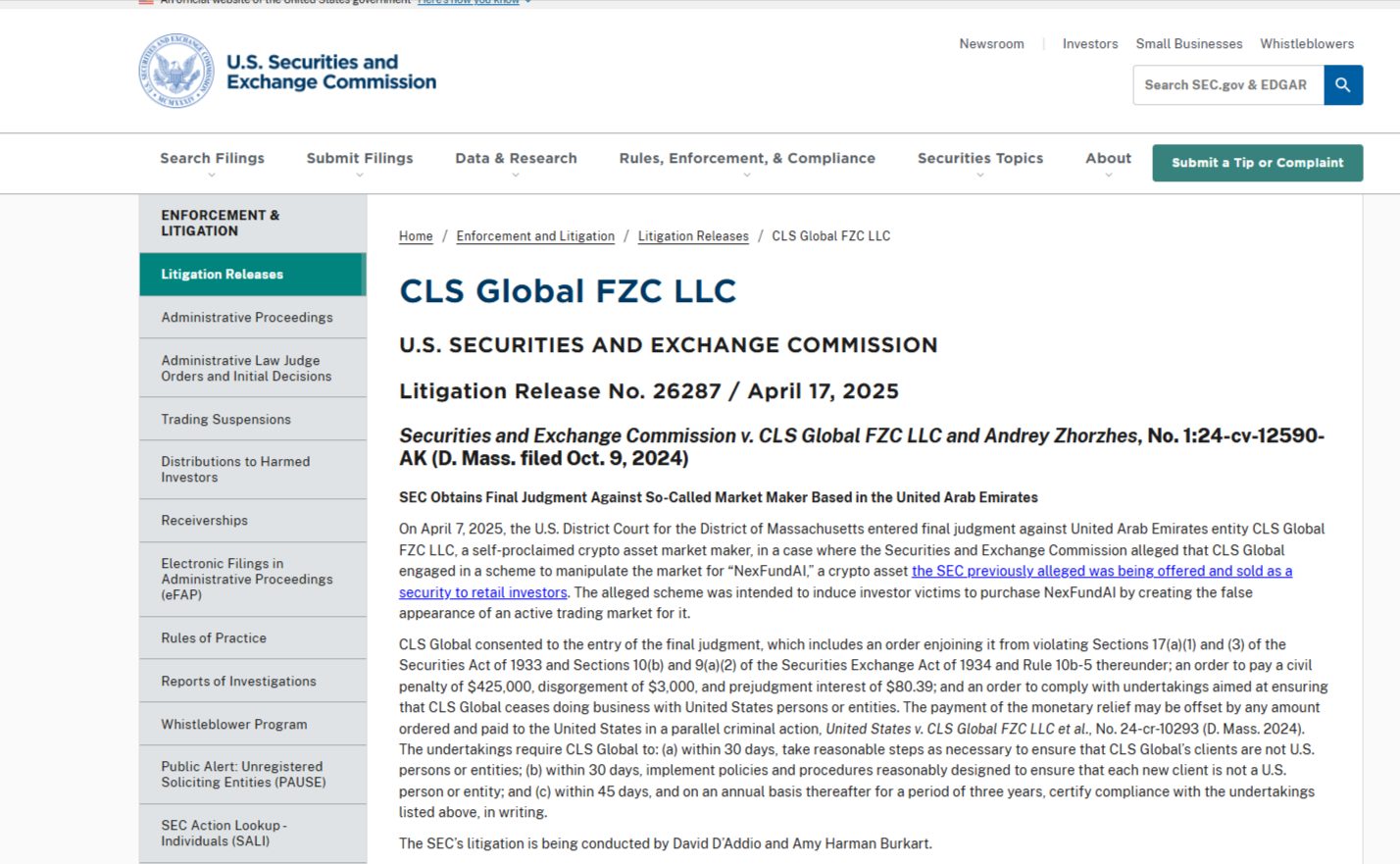

Understanding the SEC’s Case Against CLS Global

CLS Global, which presents itself as a player in the crypto asset market-making sphere, was charged with executing a manipulation scheme centered around a token known as “NexFundAI.” The SEC alleged that the firm created an artificially inflated perception of trading activity to lure unsuspecting retail investors, falsely suggesting that there was robust demand for the asset. The SEC classified NexFundAI as a security, which is crucial for regulatory scrutiny.

Source: SEC website

Wash Trading: The Tactics Uncovered

According to the SEC, an astonishing 98% of NexFundAI’s trading volume during the investigation stemmed from wash trading—a practice where traders buy and sell the same asset without any real change in ownership, creating the illusion of market activity. These orchestrated trades took place on Uniswap, a decentralized exchange (DEX), showcasing the challenges regulators face in monitoring and enforcing compliance in less regulated environments.

Consequences for CLS Global and Broader Implications

The final judgment against CLS Global came with significant repercussions. While the firm did not admit to the allegations, it voluntarily agreed to an injunction that prohibits future securities law violations, a $425,000 civil penalty, and a requirement to forfeit $3,000 in profits along with interest payments. Furthermore, CLS Global is now barred from engaging with U.S. persons or entities and must implement thorough compliance checks within 30 days, including annual certifications to the SEC for the next three years.

This case not only closes a chapter for CLS Global but also serves as a stern warning to other international market makers that deceptive trading tactics can lead to serious legal troubles, especially when dealing with the U.S. market.

Innovative Policing: The Role of Trap Tokens

The SEC’s strategy, which involved the FBI’s creation of the “trap token” NexFundAI, highlights the evolving nature of regulatory tactics. This innovative approach is designed to snag fraudulent actors by turning their own tactics against them, revealing the cleverly disguised manipulations at play in the crypto market.

NonWitnessNews Report‼️🚨 FBI OUTSMARTS CRYPTO FRAUDSTERS WITH THEIR OWN TOKEN Imagine getting scammed by the FBI… LOL That’s exactly what happened when CLS Global fell for a fake crypto token, NexFundAI, set up to catch scammers in the act. CLS Global took the bait,… pic.twitter.com/6rWkSBRUXk— Ven Doe (@XsyLocke) January 26, 2025

Insight into Market Trends and Future Challenges

As the SEC cemented its stance against CLS Global, experts noted that this judgment underscores a growing crackdown on market manipulation within the cryptocurrency sector. Analysts predict that this case could pave the way for increased regulatory scrutiny across global markets, prompting companies to adopt stricter compliance protocols to mitigate risks.

David D’Addio, one of the SEC attorneys involved, commented, “With this final judgment, the SEC reinforces its commitment to holding market manipulators accountable and protecting investors from deceptive practices.” This reflects a wider shift in the regulatory landscape where market integrity is being prioritized over rapid innovation.

What This Means for Investors and the Crypto Market

📌 Why This Matters: The SEC’s decisive action against CLS Global not only fosters a more transparent trading environment but also raises awareness among retail investors about the potential pitfalls of trading volume manipulation. Investors must now tread carefully, understanding the distinctions between real market activity and artificially generated hype.

🔥 Expert Opinions: Analysts suggest that firms engaged in market-making must consider reassessing their operations. The enforcement of stringent compliance measures may lead to a significant overhaul of client engagement strategies, particularly when dealing with U.S. entities.

🚀 Future Outlook: As more cases like CLS Global arise, the potential for coordinated international regulatory efforts to combat crypto manipulation could increase. This could fundamentally reshape how traders and investors approach the decentralized finance landscape.

Final Thoughts: A Call to Action

The SEC’s triumph over CLS Global serves as a vital reminder of the importance of integrity within the financial markets. For traders and investors alike, it encourages a skeptical and informed approach—one that prioritizes due diligence over blind trust in trading volume statistics. As the cryptocurrency market continues to evolve, remaining vigilant against market manipulation will be crucial for fostering a healthy, sustainable environment. What are your thoughts on the SEC’s actions? Join the discussion below!