Bitcoin Investment: SBC Medical Group’s Bold Move

In an exciting development for both the beauty and cryptocurrency sectors, SBC Medical Group Holdings, a prominent Japanese clinic operator listed on the NASDAQ, has made a significant foray into the world of Bitcoin (BTC). The company recently announced the purchase of 5 BTC, valued at over $418,000, solidifying its commitment to integrating digital currencies into its financial strategy.

Major Announcement and Strategic Intent

SBC Medical Group Holdings, renowned for its Shonan Beauty Clinic chain specializing in dental, cosmetic surgery, and dermatology services, revealed this purchase in an official statement. Back in February, the firm expressed plans to invest approximately 1 billion yen, equivalent to over $7 million, into Bitcoin, highlighting a shift towards a “flexible financial strategy” that includes cryptocurrencies.

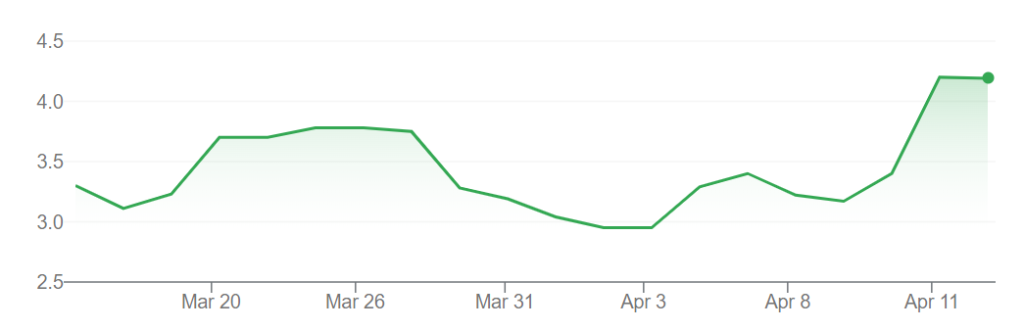

With the completion of this initial Bitcoin purchase on April 14, the company is poised to leverage part of its operations through the US-based crypto exchange Coinbase. This strategic move signals SBC’s intent to not only diversify its asset portfolio but also to stay ahead in an increasingly digital financial landscape.

Why This Matters: A Shift in Corporate Finance

The trend of corporations adopting Bitcoin as an asset is gaining traction, and SBC Medical Group is no exception. By investing in BTC, the company is not only working towards asset diversification but is also preparing to utilize Bitcoin as a hedge against inflation. As global economic conditions fluctuate, holding Bitcoin could serve as a safeguard to maintain asset value and liquidity.

In a market often impacted by inflationary pressures, SBC is capitalizing on the idea that Bitcoin might provide a buffer against deteriorating economic conditions. This shift reflects a broader movement within various industries, as corporations recognize the potential advantages of incorporating digital currency into their financial practices.

Expert Opinions: Insights on SBC’s Strategic Move

Analysts are closely observing SBC’s Bitcoin investment, viewing it as a significant indicator of the evolving landscape of corporate finance. “SBC is setting a precedent by adopting Bitcoin to bolster its financial strategy,” says crypto analyst Sarah Takahashi. “This move could pave the way for other traditional companies to embrace digital assets as a means to enhance liquidity and mitigate risk.”

Experts predict that as more companies share similar sentiments, the traditional business model may increasingly align with the innovations offered by blockchain technology.

Future Outlook: What’s Next for SBC and Cryptocurrency Adoption?

Looking ahead, SBC plans to continue its BTC buying spree, aiming to complete the process by the end of May. The firm has committed to updating the public on its cryptocurrency acquisition progress on its official website, indicating a transparent approach as it navigates this new terrain.

As inflation remains a pressing concern for many businesses, it is likely we will see an uptick in such investments across various sectors. With SBC’s commitment to adaptive financial strategies, it could emerge as a leader in the integration of cryptocurrency within traditional industries.

A Broader Trend: Japanese Corporations Embracing Bitcoin

SBC is not alone in its venture into Bitcoin. Many Japanese companies such as Metaplanet and the real estate giant Value Creation have also made headlines by integrating Bitcoin into their operations. This growing list of corporations is a testament to the increasing acceptance of cryptocurrencies in the business world, particularly in the land of the rising sun.

The Bank of Japan will probably leave aside raising interest rates for now as uncertainties stemming from U.S. tariff measures could deal a blow to Japan’s economy, a former executive director said. https://t.co/y4r4cIgSn4— The Japan Times (@japantimes) April 15, 2025

Conclusion: Join the Conversation!

As SBC Medical Group moves forward with its cryptocurrency investment strategy, the implications for the broader financial landscape are immense. This bold step reaffirms the transformational power of digital currencies in corporate finance. What do you think about SBC’s acquisition of Bitcoin? Will we see more companies follow suit? Share your thoughts in the comments below and join the discussion about the future of cryptocurrency in business!

Visited 5 times, 1 visit(s) today