Bitcoin’s Recent Slide: What’s Really Happening?

Bitcoin has recently dipped to $82,516.97, marking a 1.55% drop within just 24 hours. This decline has ignited worries among investors about a potential deeper correction in the market. However, Samson Mow, an influential figure in the cryptocurrency realm, offers a different perspective. He characterizes this downturn as a “bear trap”—a seemingly negative move intended to shake out less committed investors before a significant rise. Mow remains steadfast in his bold prediction that Bitcoin could eventually reach a staggering $1 million.

Despite the recent sell-off, Bitcoin maintains a robust market presence, boasting a total market cap of $1.64 trillion and nearly 19.84 million BTC in circulation. But as we delve deeper into the technical aspects, the shadows of concern loom larger.

Two words: bear trap.— Samson Mow (@Excellion) March 28, 2025

The Technical Landscape: A Cautionary Tale

The current technical setup for Bitcoin reveals a compelling but precarious picture. Bitcoin has recently broken below a symmetrical triangle formation, transforming the critical support level of $83,650 into a formidable resistance zone. This shift has put a damper on hopes for a swift rebound. Compounding the issue is the formation of a bearish engulfing candle beneath this resistance, which signals ongoing selling pressure.

Here are some critical metrics to keep an eye on:

- Current Price: $82,516.97

- 24H Trading Volume: $19.93 billion

- Key Resistance Levels: $83,650, $85,231, $86,841

- Key Support Levels: $82,000, $81,278, $79,990

- 50-day EMA: $85,231 (above current price)

- RSI (14): 27.63 (currently oversold)

While the RSI indicates that Bitcoin is oversold, it lacks the bullish divergence needed to suggest a reversal is imminent. If Bitcoin breaches the triple bottom support around $83,000, we could be looking at deeper lows, with $81,278 and $79,990 becoming the next focal points. Additionally, the current trading volume remains tepid, which reflects a lack of strong buyer engagement—a red flag for potential bullish sentiment.

What Lies Ahead for Bitcoin?

The central question looms: is the recent price drop genuinely a bear trap as Mow suggests, or is it the onset of a more significant correction? The overall sentiment surrounding Bitcoin is undeniably mixed, punctuated by macroeconomic pressures and tightening liquidity that typically burden high-risk assets.

A decisive reclaim of the $83,650 level, coupled with a breakout above the 50-day EMA at $85,231, could signal the start of a bullish recovery. Conversely, continued failures at these critical levels might set the stage for Bitcoin to slide below the $80,000 threshold.

Essential Signals to Watch

Here are the key indicators that could guide investor decisions in the coming days:

- Break and close above $83,650

- RSI divergence or recovery above 30

- Increased trading volume during any bounce attempts

- Support at $81,278 or $79,990 holding steady

Until these conditions materialize, Bitcoin’s future remains uncertain. The unfolding market behaviors will be pivotal, determining if Mow’s thesis gains traction or if market pessimism prevails.

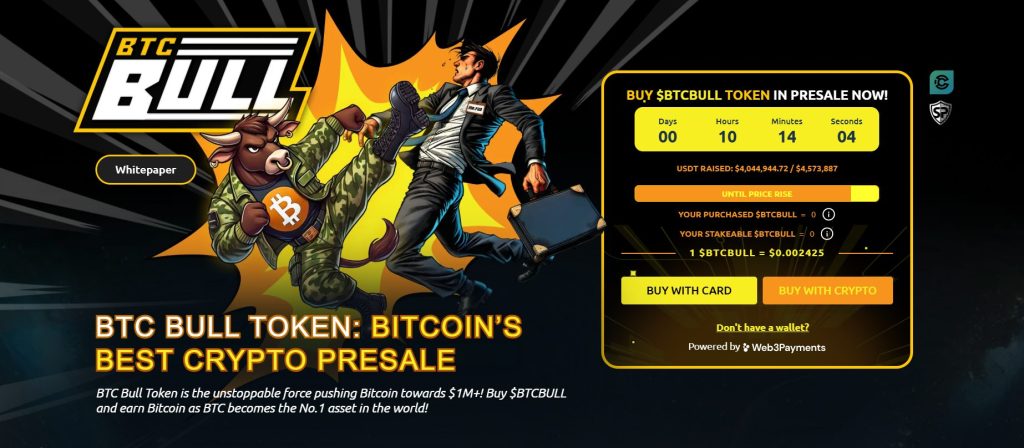

Spotlight on BTC Bull: A Rewarding Alternative

Introducing BTC Bull ($BTCBULL), a community-driven token poised to disrupt the market by incentivizing holders with genuine Bitcoin rewards as the cryptocurrency hits significant price milestones. Unlike conventional meme tokens, BTCBULL is tailored for long-term investors, with features like airdropped Bitcoin rewards and attractive staking opportunities.

Staking & Passive Income Options

BTC Bull presents a high-yield staking program with an impressive annual percentage yield (APY) of 119%, enabling users to generate passive income. With 882.5 million BTCBULL tokens already staked, community engagement is on the rise.

Latest Presale Updates:

- Current Presale Price: $0.002425 per BTCBULL

- Total Raised: $4M out of a $4.5M target

As demand surges, this presale offers an excellent opportunity for early investors to acquire BTCBULL at a favorable rate before anticipated price increases.

In Conclusion

The cryptocurrency market is as turbulent as ever, with Bitcoin’s recent price action sparking varied opinions and predictions. Are we witnessing a bear trap as Samson Mow claims, or is it the beginning of a deeper correction? The coming days will reveal the trajectory of Bitcoin as key levels and macroeconomic indicators are tested. Join the conversation in the comments below—what do you think lies ahead for Bitcoin?