In a striking turn of events, the landscape of cryptocurrency mining in Russia has undergone a remarkable transformation. Recent statements from senior lawmakers highlight a significant surge in the number of legally registered crypto mining firms in the country. What does this trend mean for Russia’s economic future and the global crypto landscape? Let’s dive in.

According to a report by the Russian media outlet RBC, the number of firms officially recognized as crypto miners by the Federal Tax Service (FTS) skyrocketed a staggering tenfold in just six months. The head of the New People Party, Alexey Nechaev, proudly revealed that over 1,000 firms are now operating within the legal framework, and he argues that this shift presents a promising opportunity for many businesses across Russia.

Nechaev’s optimism stems from a new law implemented last year, which mandates that any mining operations consuming more than 6,000 kWh of electricity monthly register with the FTS. This proactive regulation approach has significantly altered the mining landscape, allowing operators to work within the law rather than resorting to clandestine operations.

🔥 **Why This Matters**

The sharp increase in registered miners and the forthcoming payment of taxes on their earnings could potentially generate over $500 million annually for the Russian Treasury. This financial boost could play a crucial role in bolstering Russia’s economy amid various global sanctions. Nechaev emphasized that regulation, rather than prohibition, is essential for nurturing the industry. “Driving people into the shadows with fines and bans is not an effective strategy,” he said, calling for a more inclusive approach to cryptocurrency.

Prior to this legal framework, many miners operated in a grey area, unable to comply with tax obligations. This lack of regulation often led to severe repercussions, including blackouts in entire municipalities as miners tapped excessive amounts of power from the grid.

🚀 **Expert Insights**

Looking ahead, it appears that miners are now prioritizing local investments, with reports suggesting that over $63 million has been directed towards artificial intelligence (AI) development within the sector. This pivot not only underscores a commitment to innovation but also emphasizes a strategic inclination to retain investments within Russia’s borders.

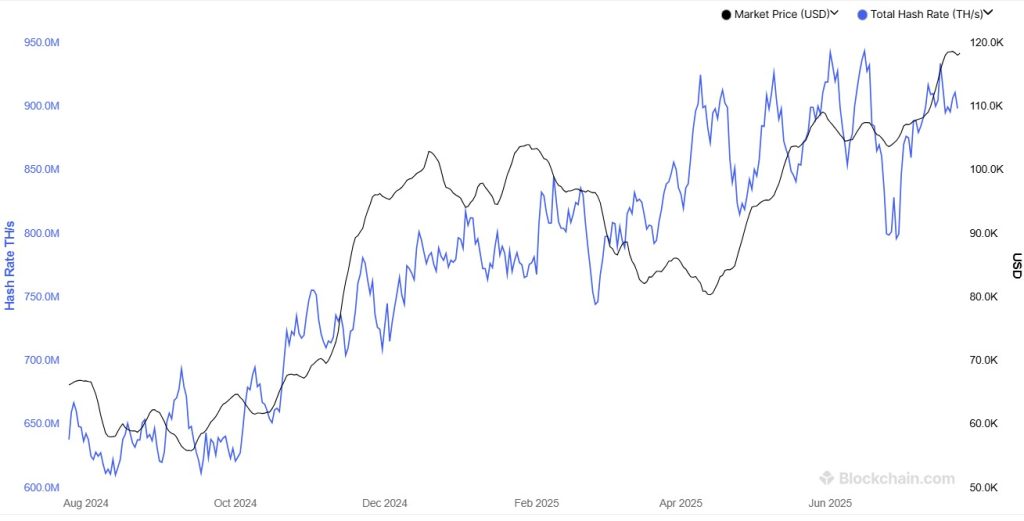

Moreover, Russia’s mining industry is establishing itself strongly on the global stage. The Association of Industrial Miners claims the nation consistently ranks as the second-largest contributor to Bitcoin’s global mining output, trailing only behind the United States. This surge in activity has pushed Russia’s hashrate beyond a remarkable 150 EH/s, making up 16.6% of the worldwide total.

In a surprising twist, a high-ranking policymaker recently called for the state to take action against illegal miners by seizing cryptocurrency assets. Advocating for the formal recognition of cryptocurrencies as intangible property, the move could significantly enhance government authority when dealing with non-compliant operations.

🔥 **Future Outlook**

As the Russian cryptocurrency mining scene continues to evolve, the balance between regulation and innovation may define the nation’s economic prospects. With robust activity and participation expected to rise, the government’s ongoing shift toward a regulated framework could pave the way for a flourishing future for Russia in the global crypto arena.

With such dynamic developments unfolding, it’s clear that the implications for Russian businesses and the broader cryptocurrency sector are tremendous. How will these changes affect global cryptocurrency trends? Only time will tell, but one thing remains certain: Russia’s strategic pivot toward regulation is a significant moment that could reshape the future of crypto.