Ripple’s XRP Rallies: A Closer Look at Recent Market Dynamics

In recent days, Ripple’s XRP has surged back into the cryptocurrency limelight, recording a notable 4% increase in intraday trading to hit $2.16. This uptick is underscored by robust market engagement, with a staggering 24-hour trading volume exceeding $3.1 billion. Such activity hints at a revitalized optimism enveloping the broader crypto landscape. However, XRP enthusiasts should brace themselves for a pivotal test looming ahead.

Technical Analysis: A Key Resistance Point

At present, Ripple’s XRP encounters a significant technical threshold at $2.23, as delineated by the 50-period Exponential Moving Average (EMA) on the two-hour chart. Historically, this level has acted as a ceiling for bullish momentum, suggesting that the outcome of this technical battle will be crucial in determining the sustainability of the recent upward trend.

The rebound from a recent low of $2.06 offers a glimmer of hope for short-term traders, but the Relative Strength Index (RSI) currently sits at a tepid 44.57. This suggests that buying momentum is still tepid and that traders should be cautious.

Should XRP manage to breach the $2.23 resistance with conviction, it could potentially unlock further upward targets at $2.29 and $2.38—areas historically characterized by robust selling pressure. Nonetheless, caution is warranted as a descending trendline from mid-March still looms overhead, underscoring the necessity for a confirmed breakout before sentiment can significantly shift in favor of the bulls.

📌 Why This Matters: The Impending Legal Resolution

While technicals offer a snapshot of the current trading environment, the long-term fundamentals underpinning Ripple’s value remain strong. A particularly noteworthy aspect is the stability in the number of Ripple wallets holding over 1 million XRP tokens. As of late March, this figure stands at 1,986, slightly down from 2,013 earlier this year, indicating a resilient base of whale activity.

This stability amidst market volatility may reflect high-stake holders’ long-term conviction in XRP as an investment vehicle. The interest from these wallets, typically comprising institutional and strategic investors, is indicative of ongoing accumulation rather than panic selling.

Furthermore, Ripple’s ongoing efforts to enhance its On-Demand Liquidity (ODL) platform are crucial as they continue to solidify XRP’s essential role in cross-border transactions. This evolution not only promises to increase the token’s utility but also builds a compelling narrative for potential investors.

“$XRP just bounced from $2.06 to $2.16—but here’s the catch:⚠️ RSI = 44.57 (weak momentum)📉 Descending trendline still in play🛑 $2.23 = key resistance (50 EMA)🚀 Breakout above = $2.29/$2.38 next What’s your call?”

— Arslan Ali (@forex_arslan) March 30, 2025

🔥 Expert Opinions: Market Sentiment Amid Legal Developments

Market analysts are closely monitoring Ripple’s ongoing legal tussle with the SEC, which could serve as a potential catalyst for price movements. A favorable ruling in this high-profile case could eliminate lingering legal uncertainties surrounding XRP, opening the door for its relisting on U.S. exchanges. The implications of this could be profound, leading to substantial new capital inflows into XRP and further affirming its standing in the cryptocurrency realm.

🚀 Future Outlook: Key Levels to Monitor

For traders, being cognizant of crucial price levels is paramount at this juncture:

- $2.23 – Immediate resistance (50 EMA)

- $2.29 / $2.38 – Next potential targets if bullish momentum is established

- $2.11 / $2.06 / $2.00 – Key support zones to watch

- RSI: 44.57 – Indicates subdued momentum; caution advised

A clean breakout above the $2.23 level, preferably supported by rising trading volume, could instigate a more sustained recovery in XRP. Conversely, without confirmation of this breakout, XRP remains susceptible to profit-taking and renewed selling pressures—especially in light of broader market headwinds.

Conclusion: A Critical Moment for XRP Traders

Ripple’s XRP is demonstrating signs of short-term strength; however, the road ahead is laden with challenges. All eyes are now sharply focused on the critical $2.23 resistance level. Traders and investors must navigate with caution, as a confirmed breakout here could herald a more bullish phase. Until then, the battlefield of resistance remains fierce, and participants in the market would be wise to remain vigilant as they explore their strategies.

What are your thoughts on XRP’s potential trajectory? Join the conversation and share your insights below!

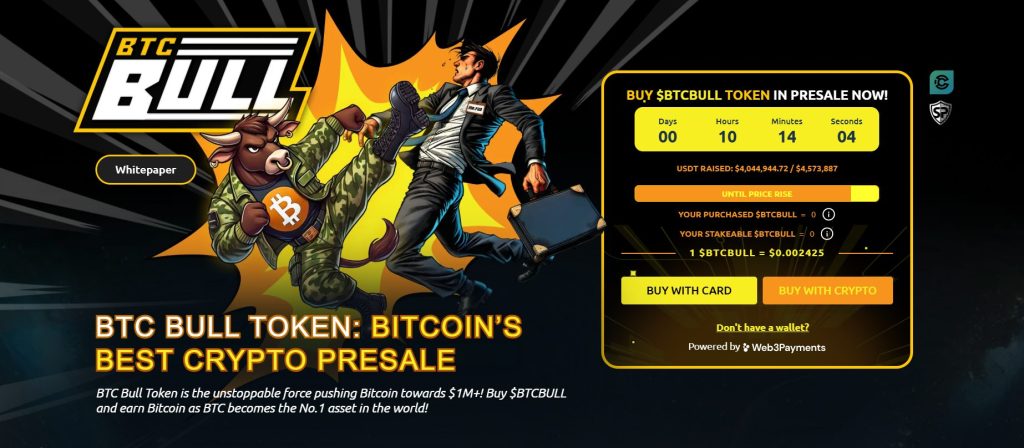

BTC Bull: Exploring New Opportunities

For those looking to venture into innovative projects, BTC Bull ($BTCBULL) is emerging as an intriguing option. This community-driven token rewards holders with real Bitcoin when BTC hits significant pricing milestones. Unlike many traditional tokens, BTC Bull aims to cater to long-term investors by providing tangible incentives through airdropped Bitcoin rewards and exciting staking opportunities.

Staking & Passive Income: A Closer Look

BTC Bull recently launched a high-yield staking program boasting an impressive 119% Annual Percentage Yield (APY). The staking pool has already attracted a whopping 882.5 million BTCBULL tokens, showcasing robust community engagement and interest in passive income strategies.

Latest Presale Updates: Timing is Everything

The current presale price for BTC Bull stands at $0.002425, with a total of $4 million raised towards a $4.5 million target. The increasing demand illustrates the project’s potential, allowing investors to secure BTCBULL tokens at advantageous early-stage pricing before the next price increase hits.

Engage with this evolving space and consider exploring opportunities like BTC Bull as part of your investment strategy!