Gemini Breaks New Ground with Groundbreaking Drone Display

In a stunning display of innovation and creativity, Gemini, one of the leading cryptocurrency exchanges, has set a Guinness World Record for the largest drone formation featuring a Bitcoin logo. This momentous event took place in Austin, Texas, on March 13, illuminating the night sky and captivating the audience with a spectacular formation consisting of 1,000 drones. This historic display not only celebrated Bitcoin’s ascent in the financial landscape but also marked a significant milestone for the US Strategic Bitcoin Reserve program.

The evening’s highlights included:

- A massive Bitcoin logo lighting up the sky, symbolizing the cryptocurrency’s expanding influence.

- A captivating depiction of a rocket launch and lunar landing, which illustrated Bitcoin’s ambitious mission to reshape global finance.

- The impactful phrase “Go where dollars won’t,” underscoring Bitcoin’s potential as a borderless currency.

🚨BREAKING NEWS 破 : Gemini sets a Guinness World Record with the largest Bitcoin drone display in Austin, celebrating the US Strategic Bitcoin Reserve pic.twitter.com/bPYlPQAZPW— Crypto Beat (🎧,💹) (@0xCryptoBeat) March 15, 2025

📌 Why This Matters: A Step Towards Mainstream Adoption

This remarkable achievement is not just about record-breaking spectacle; it has profound implications for the cryptocurrency landscape. The event serves to:

- Enhance public awareness of Bitcoin, encouraging broader acceptance and understanding of cryptocurrency.

- Attract institutional interest in Bitcoin, as initiatives like this add credibility to digital currencies.

- Provide a boost in price confidence, with Bitcoin stabilizing above $84,270, hinting at robust market sentiment despite earlier volatility.

🔥 Expert Opinions: Diverging Views on Bitcoin’s Future

The cryptocurrency community has been buzzing with discussion following remarks from Jason Calacanis, an early investor in Uber, who suggests that Bitcoin may be on the brink of being overshadowed by a superior technology. This assertion raises questions many are eager to answer: Can Bitcoin truly be replaced, or is it too entrenched in the economy to disappear? Industry veterans have weighed in:

Brady Swenson, co-founder of Swan Bitcoin, asserts that while winning protocols adapt, they do not simply vanish.

David Marcus from Lightspark argues that layer-2 solutions enhance Bitcoin’s functionality rather than supplant it.

Matt Cole, CEO of Strive Funds, believes that underestimating Bitcoin’s resilience is a miscalculation.

Despite conflicting opinions, Bitcoin triumphantly continues to occupy the market above $84,300, maintaining its status as the gold standard of digital currencies.

Why Bitcoin’s Dominance is Unshakable

Several factors confirm Bitcoin’s ongoing supremacy in the cryptocurrency space:

- **Unmatched Security:** Bitcoin’s decentralized network is the most robust in the industry.

- **Institutional Backing:** Leading financial institutions, such as BlackRock and Fidelity, are increasingly endorsing Bitcoin.

- **Innovative Scaling Solutions:** Technologies enhancing Bitcoin functionality support its growth without undermining the core protocol.

When considering its first-mover advantage and the expanding network community, the challenge of finding a viable replacement seems almost insurmountable.

UK Crypto Regulations: A Double-Edged Sword

As the UK’s Financial Conduct Authority (FCA) imposes stringent marketing regulations, the impact on the cryptocurrency sector is palpable. Introduced one year ago, these regulations require firms to gain approval before advertising, resulting in:

- Increased compliance costs that hinder smaller startups from thriving.

- A mandatory 24-hour wait for new users to register, driving many traders to look for options beyond UK borders.

- Restrictions for content creators and influencers, limiting the scope of crypto-related discussion online.

Impact of Regulation: Navigating a Changing Landscape

The FCA’s regulations have compelled numerous startups to relocate to more favorable jurisdictions, raising concerns about:

- Increased susceptibility to scams as users flock to unregulated platforms.

- Reduced consumer choice, allowing only larger companies to comply effectively.

Nevertheless, Bitcoin maintains steady global adoption, underscoring its growing significance in a tumultuous regulatory environment.

Bitcoin Price Analysis: Bulls Eye $86K Threshold

Currently, Bitcoin (BTC/USD) is consolidating around $84,250, facing resistance near the $84,500 to $86,000 range. With support from the 50-period exponential moving average at $83,550, Bitcoin appears to be in an upward trend from the recent low of $79,900.

A successful breakout above $86,000 could set the stage for a bullish surge towards $89,600, potentially even reaching $92,700 if positive momentum persists. Conversely, failure to breach this resistance could see BTC pull back to $83,500, with robust support resting at $79,900. As the trendline indicates, buyers remain committed, but validating a breakout requires increased buying volume.

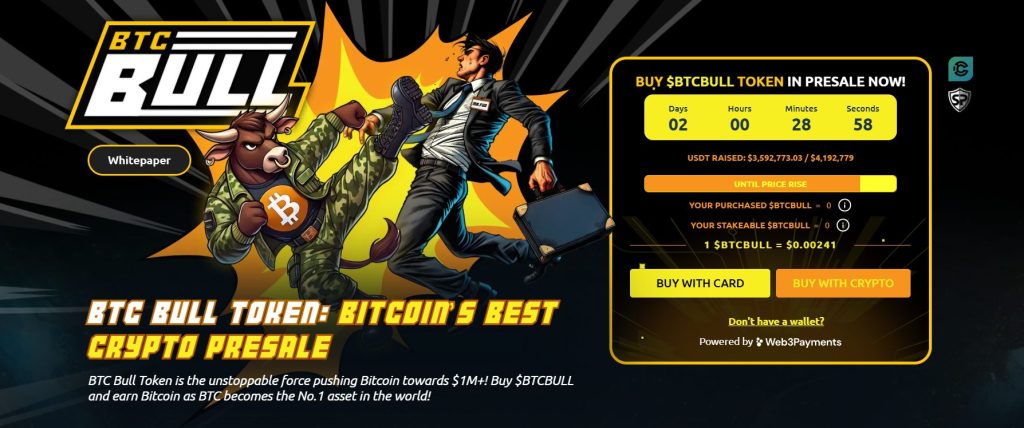

🚀 Future Outlook: The Growing Promise of BTC Bull

Amidst all this excitement, BTC Bull ($BTCBULL) is generating buzz as a community-focused token that rewards holders with actual Bitcoin when price milestones are achieved. Unlike typical meme tokens, BTCBULL is designed for long-term benefits, offering real incentives through Bitcoin rewards and staking options.

With a high-yield staking program providing an attractive 119% APY, BTC Bull is seeing robust community engagement, with nearly 883 million tokens already staked. Here are the latest highlights:

- **Current Presale Price:** $0.00241 per BTCBULL

- **Total Funds Raised:** $3.5 million towards a $4.1 million target

As demand surges, this presale presents an exciting opportunity for investors to secure BTCBULL at an advantageous price before the next increase.

Conclusion: The Future is Bright for Bitcoin

With transformative events like Gemini’s record-setting drone display, ongoing discussions about Bitcoin’s future, and innovative projects like BTC Bull emerging in the space, it’s clear that Bitcoin continues to reshape the financial landscape. What are your thoughts on Bitcoin’s trajectory? Join the conversation and share your insights on this dynamic subject.