Bitcoin Faces Significant Decline: A Closer Look at the $107,177 Drop

Bitcoin, the flagship cryptocurrency, has recently stumbled below the crucial support level of $108,000, landing at $107,177 amid growing selling pressure. This downturn has sent ripples through the crypto community, sparking warnings from veteran traders such as Peter Brandt, who forecasts a possible plunge of 75% down to approximately $27,290—echoing echoes of past market turmoil.

📌 Why This Matters

This downturn is more than just a number on a chart; it encapsulates underlying vulnerabilities in the cryptocurrency market. Peter Brandt’s warning serves as a clarion call to investors who may not be taking current market dynamics seriously. The significance of a potential 75% correction could reshape not just Bitcoin’s trajectory, but also the broader financial landscape for cryptocurrencies.

🔥 The Market Sentiment: Patterns of Caution

Brandt has noted that the breakdown below Bitcoin’s ascending channel and the pattern of lower highs bears an unsettling resemblance to previous bear markets. The chilling memory of Bitcoin plummeting from $69,000 in late 2021 looms large. Market sentiment is further strained as geopolitical tensions escalate, eroding investor confidence.

🧐 NEW: Peter Brandt hints at a 75% #Bitcoin crash repeat — but crypto analysts aren’t buying it. 📉 pic.twitter.com/h8cAB5IQXE— Coinpaper (@coinpapercom) June 12, 2025

As global conflicts continue to unfold, fears are deepening. Reports of Israel gearing up for military action against Iran are unsettling investors, with the ongoing Russia-Ukraine conflict adding to the prevailing risk-off sentiment. In times of uncertainty, one might expect safe-haven assets to thrive; however, Bitcoin’s behavior has been counterintuitive, unable to capture the traditional flight to safety.

BREAKING: Israel is fully prepared to launch an operation against Iran, and the US anticipates Iran could respond by striking American assets in Iraq – CBS news pic.twitter.com/e318qBmDnM— Current Report (@Currentreport1) June 12, 2025

🚀 Institutional Interest Amid Market Stress

Even though the broader market sentiment appears bearish, not all is bleak. Remarkably, U.S. Bitcoin ETFs have recorded $164.57 million in net inflows recently. Moreover, GameStop has increased its Bitcoin holdings by 4,700 BTC since May, while Mercurity Fintech aims to gather $800 million for a potentially impactful BTC treasury reserve. Yet, the question remains: will these institutional interests be sufficient to counterbalance the prevailing market pressures?

💡 Technical Analysis: What Lies Ahead for Bitcoin?

The technical indicators are looking grim for Bitcoin as it has plunged below both the critical trendline and the 50-period exponential moving average (EMA) of $107,985. Indicators like MACD are showcasing a bearish crossover along with a widening gap, suggesting an increase in downward momentum. With rejection points clearly marked at $110,376 and a pattern of lower highs, the outlook for Bitcoin seems considerably bearish.

Current support is being tested at approximately $106,401. Should this level fail, potential further declines to $105,180 or even $104,026 loom on the horizon. Essentially, the market stands at a pivotal juncture: either it will break down towards Brandt’s target of $27,000 or experience a fleeting bounce due to institutional accumulation.

🔍 Trade Setups for Short Sellers

For traders looking to capitalize on the bearish sentiment, here’s a potential trade setup:

- Entry: Short on rejection near $108,000

- Stop-loss: Above $108,800 (above EMA)

- Target 1: $106,400

- Target 2: $105,180

- Risk Level: 6/10

🚀 Altcoin Focus: BTC Bull Token Gains Traction

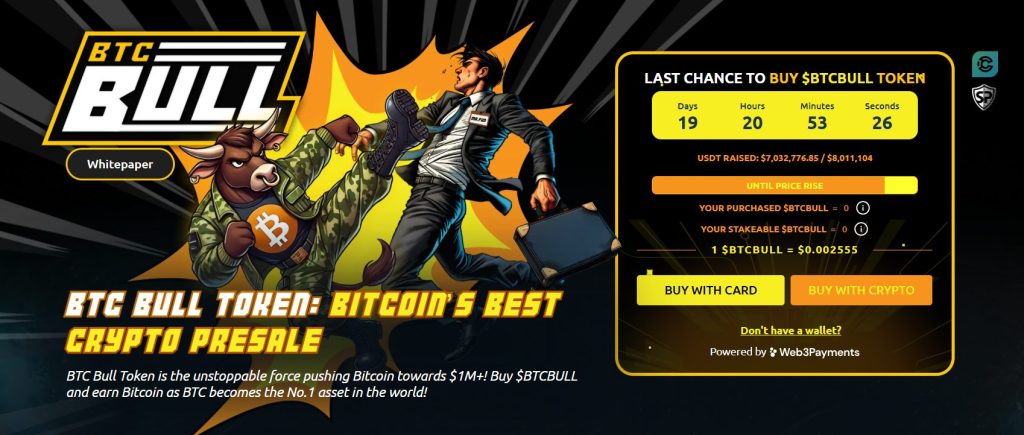

Amid the turbulence in the Bitcoin market, attention is gradually shifting toward altcoins, notably BTC Bull Token ($BTCBULL). With Bitcoin hovering around $107K, the project has successfully raised $7.1 million out of its $8.15 million cap. As the countdown continues, anticipation grows around an imminent price increase once the cap is achieved. The current price stands at $0.00256, creating an enticing opportunity for early investors.

BTC Bull Token intricately ties its value to Bitcoin through two main mechanisms:

- BTC Airdrops: Holders receive rewards, prioritizing presale participants.

- Supply Burns: These are triggered automatically every time Bitcoin increases by $50,000, thus reducing the circulating supply of $BTCBULL.

This token also boasts a remarkable 58% APY staking pool, currently holding over 1.81 billion tokens, appealing to both DeFi veterans and novices seeking stable passive income.

Conclusion: Preparing for the Road Ahead

As Bitcoin grapples with significant technical pressures and macroeconomic headwinds, the potential for heightened volatility remains. Investors should keep a close watch on critical support levels and market developments. While institutional interest may provide a glimmer of hope, the broader environment suggests that caution is warranted. With the market in a precarious position, the coming days could be decisive. What are your thoughts on these developments? Are you preparing for possible volatility or are you betting on a bounce? Join the discussion!