Pepe’s Price Dips Amid Struggles in the Meme Coin Market

In the ever-volatile world of cryptocurrency, Pepe (PEPE) finds itself in choppy waters, experiencing a notable decline of 3.3% over the past week. This downturn is emblematic of a broader slump affecting meme coins, suggesting that the whimsical appeal of these tokens is currently waning. As the market shifts, it’s crucial for investors to understand the underlying trends and implications of this drop, particularly as influential players in the market—often referred to as whales—seem to be reevaluating their positions.

📉 On-Chain Metrics Signal Caution

Recent analytics present a bearish forecast for Pepe. An alarming trend has emerged: the count of wallets holding PEPE that are currently “in the money” (profitable) has decreased by 7%. This indicator signals a concerning reality for many investors, as it highlights that a substantial number are sitting on losses. Furthermore, large transactions involving PEPE have seen a decline of 5%, indicating that trading activities among whales are decreasing, leading to fears of capitulation.

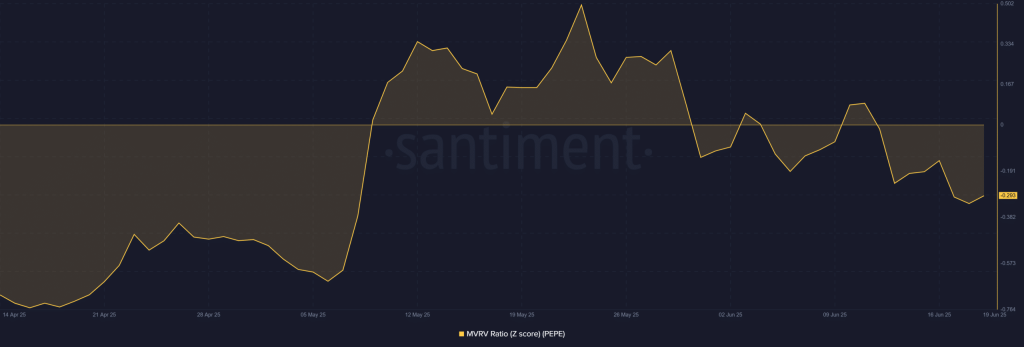

Adding to the bearish sentiment is the MVRV Z-score, a crucial metric that evaluates the profitability of PEPE holders. Currently, this score is in negative territory and has been dropping consistently since late May. With many investors potentially rethinking their outlook on Pepe, the implications of continuing negative figures could lead to further sell-offs as expectations shift.

🔥 Political Turmoil and its Impact on the Crypto Market

To complicate matters further, geopolitical tensions—particularly the ongoing conflict between Iran and Israel—are likely having a ripple effect on market dynamics. Such instability often drives risk-averse investors away from volatile assets, including meme coins, exacerbating an already bleak outlook for Pepe.

📊 Key Support and Resistance Levels for PEPE

Turning our gaze to technical analysis, Pepe’s recent price movements reveal critical support at the $0.00001000 mark. This level stands as a crucial threshold that traders will closely monitor as they wait for market catalysts. If PEPE can maintain this support, there’s a possibility of bouncing back to the $0.00001300 range. However, a drop below $0.00001000 could trigger a more significant decline, potentially pushing prices down towards $0.00000800.

Despite the bearish indicators, the Relative Strength Index (RSI) on the shorter timeframes has shown signs of potential recovery, inching above its 14-day average. This shift could signify developing positive momentum, but without a beneficial crossover known as a “golden cross” between the 9-day and 21-day exponential moving averages (EMAs), the bullish outlook remains hesitant. Traders are naturally left to ponder: will we see a resurgence, or is further decline inevitable?

🚀 Solana’s Meme Coins Defy Market Trends

While Pepe faces headwinds, it’s interesting to note that meme coins within the Solana ecosystem have bucked the trend by increasing their market value despite overall negative sentiment in the broader crypto landscape. This resilience could suggest strong community support and demand for these tokens, which may encourage traders to shift their focus.

In a related development, a new layer-2 scaling solution named Solaxy (SOLX) is in the works to address congestion issues on the Solana blockchain. After raising a hefty $55 million through its presale, Solaxy aims to enhance transaction efficiency by processing transactions in batches offline before sending them on-chain. This innovation is set to launch its mainnet soon, sparking excitement about the utility token $SOLX, which also offers appealing staking rewards of up to 76%.

📍 Conclusion: What’s Next for Pepe and the Market?

The current landscape for Pepe is fraught with challenges and uncertainties. With on-chain metrics suggesting bearish momentum and external factors influencing trader sentiment, it’s imperative for investors to remain vigilant. However, in the world of cryptocurrency, markets can shift rapidly. Will Pepe find the strength to rally, or will it succumb to the pressures of the market? Engage with us in the comments below—what are your predictions for Pepe’s next move?