Unveiling a Major Crypto Scam: New York Law Enforcement Takes Action

In a remarkable stride against cryptocurrency fraud, New York law enforcement officials have seized over $440,000 in stolen digital assets. This action is part of a comprehensive investigation into a sophisticated scam that primarily targeted Russian-speaking communities through misleading Facebook advertisements. With losses exceeding $1 million reported in areas like Brooklyn, the urgency to tackle such fraudulent activities has never been clearer.

The Mechanism: How Scammers Lured Victims

The heart of this elaborate scheme revolved around deceptive advertising tactics that ensnared hundreds of individuals into investing in fictitious cryptocurrency trading platforms. On June 18, a joint announcement from Brooklyn District Attorney Eric Gonzalez, New York State Attorney General Letitia James, and Department of Financial Services (DFS) Superintendent Adrienne Harris shed light on the coordinated crackdown on this multi-layered scam operation.

My office, @BrooklynDA, and @NYDFS stopped a group of cryptocurrency scammers that targeted Russian-speaking New Yorkers using deceptive ads on Facebook. Hundreds of New Yorkers fell victim to these fraudulent ads and lost hundreds of thousands of dollars.— NY AG James (@NewYorkStateAG) June 18, 2025

This criminal network exploited Facebook’s advertising platform, utilizing Russian-language ads to promote fraudulent investment opportunities geared toward residents of Brooklyn and other regions with significant Russian-speaking populations. In a nod to the underbelly of online advertising, scammers used Vietnam-based “Black Hat” services to evade Facebook’s ad restrictions and mask their identity. This effort led to the eventual shutdown of over 700 fraudulent accounts by Meta.

The Investigation: A Multifaceted Approach

The investigation, which kicked off in October 2024, revealed that the scammers had created the fictitious platform WhalesTrade.com and were displaying a phony BitLicense—a regulatory certification signifying compliance among cryptocurrency businesses in New York. As law enforcement delved deeper, they uncovered a network of interlinked domains and accounts designed to impersonate legitimate crypto services.

To add a layer of deception, these scammers mimicked the social media presence of real influencers, attempting to build trust and credibility through fabricated testimonials and endorsements.

Facebook is running paid crypto scam ads using Elon Musk’s name. Tesla and Elon Musk are not affiliated with any cryptocurrency token and will never launch one. pic.twitter.com/VqZsJP6wVR— DogeDesigner (@cb_doge) June 5, 2024

Once victims were contacted, they were guided to encrypted messaging platforms like WhatsApp and Telegram. Here, they faced relentless pressure to deposit funds, with scammers showcasing fraudulent dashboards that falsely indicated rising profits. Unfortunately, when victims sought to withdraw funds, they were confronted with fictitious taxes or fees designed to keep them from reclaiming their investments, ultimately resulting in sacrificed deposits.

Why This Matters: A Growing Concern in Crypto Fraud

The fallout from these fraudulent activities is alarming, impacting not just individual investors but also raising significant concerns about the integrity of the cryptocurrency ecosystem. More than 300 identified victims were contacted prior to sending further funds, showcasing a proactive approach by investigators amid a volatile financial landscape.

Notably, this crackdown reflects a broader, global distress over cryptocurrency scams. An Australian Competition and Consumer Commission (ACCC) report stated that upwards of 50% of cryptocurrency ads on Facebook could be scams, further spotlighting the need for stringent regulations. This concern was echoed in a recent lawsuit filed against Meta, targeting its facilitation of misleading celebrity-endorsed crypto advertisements.

Expert Opinions: Insight from Industry Analysts

The rising tide of crypto scams has not gone unnoticed in the financial community. Analysts underline the need for increased regulatory scrutiny and better consumer education to protect users from such schemes. One hypothetical expert comment might emphasize, “As the cryptocurrency market continues to expand, so too does the avenue for fake platforms to trick unsuspecting investors. It is crucial for both law enforcement and the crypto community to work together in combating this threat.”

The Bigger Picture: A Rising Tide of Crypto Crime

Just prior to New York’s crackdown, the U.S. Department of Justice executed a massive seizure of $225.3 million linked to a “pig butchering” scam that scammed more than 400 victims—marking the largest seizure of its kind to date. According to the FBI’s 2024 Internet Crime Complaint Center (IC3) report, cryptocurrency-related scams led to staggering losses of $9.3 billion in 2024, which marked a disturbing 66% increase from previous years. This percentage continues to grow, alarming both investigators and investors alike.

Future Outlook: Adapting to New Realities

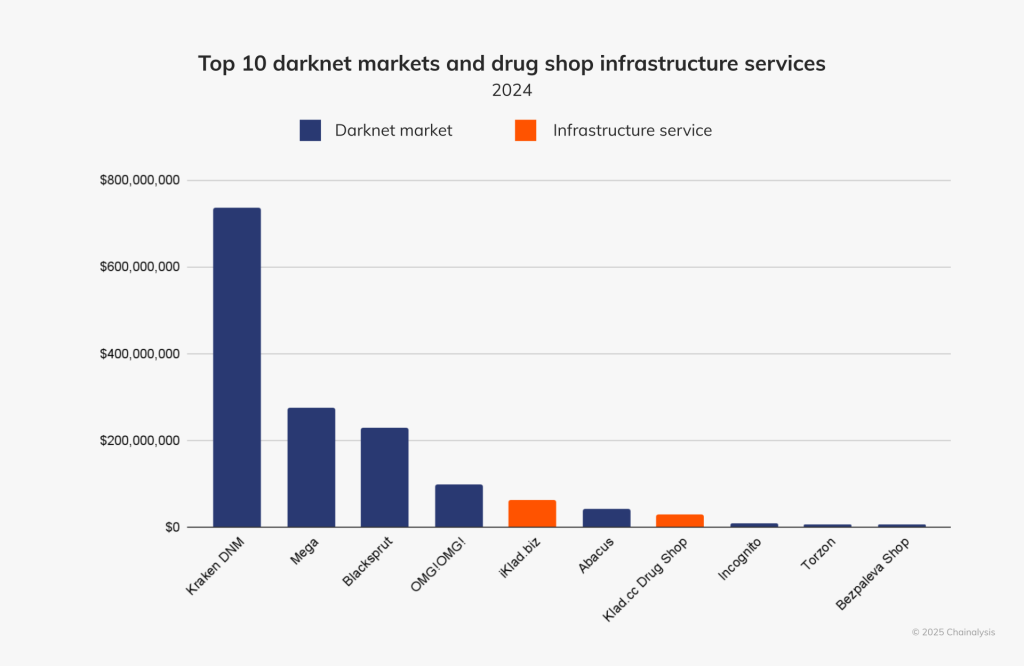

As the cryptocurrency landscape evolves, with significant activity identified in darknet markets, including the infamous “Kraken” marketplace, the focus on controlling and mitigating these fraudulent activities becomes paramount. With Russia identified as a significant hub for such operations, international cooperation will be essential.

New research from blockchain analytics firms like Chainalysis indicates a compelling need for comprehensive reform in how cryptocurrencies are regulated and marketed. As scams continue to proliferate, the question remains: how can both the authorities and the crypto community better protect and educate potential investors?

Conclusion: A Call for Vigilance

The recent seizure of stolen cryptocurrency marks a critical victory in the ongoing battle against crypto scams. Yet, as this issue becomes more pronounced, it’s imperative for potential investors to remain alert, seek credible sources of information, and educate themselves about the risks associated with the digital currency landscape. Let’s bring forth a discussion: What changes do you believe should be implemented to protect investors from the rising wave of cryptocurrency fraud?