In a thrilling turn of events for the Solana ecosystem, Helius Medical Technologies, now rebranded as HSDT Solana Company, has dramatically expanded its treasury to boast over 2.2 million SOL tokens, valued at more than $525 million. This remarkable achievement was revealed on October 6, merely three weeks after the company successfully closed a private placement that raised $500 million on September 18. This increased valuation eclipses the gross proceeds initially garnered, signaling a robust financial strategy in action. Cosmo Jiang, General Partner at Pantera Capital, who serves as a Board Observer, emphasized the company’s commitment to maximizing shareholder value through savvy accumulation of Solana assets.

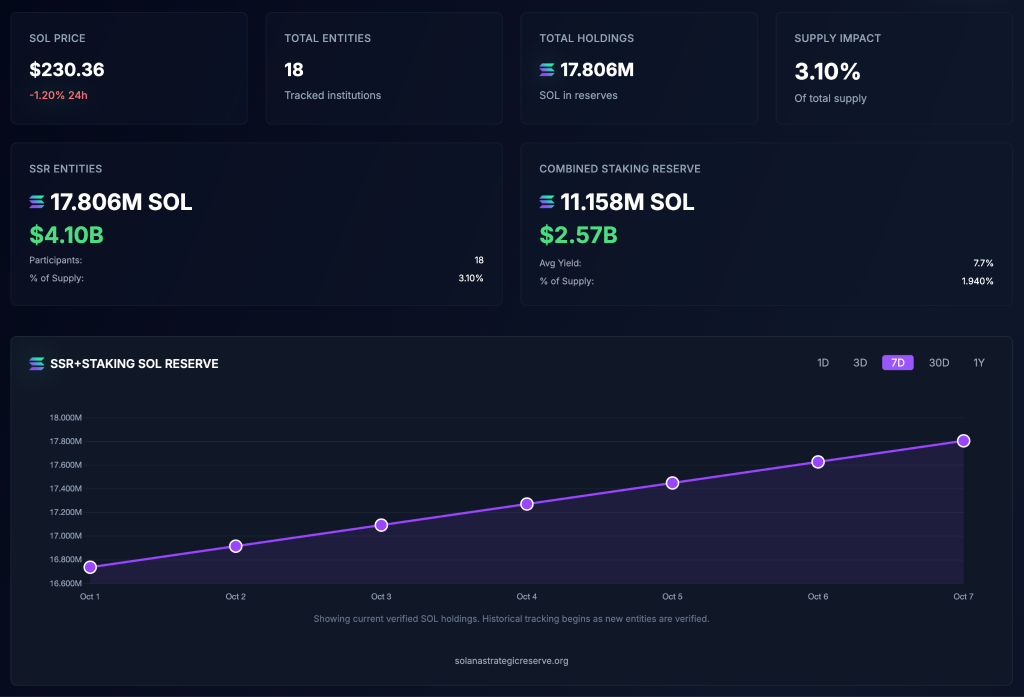

Data from Strategic Solana Reserve shows that institutional holdings of Solana have surged significantly, exceeding $4 billion across 18 participants, representing about 3.1% of the circulating supply. This aligns with the growing trend of corporate adoption in the cryptocurrency sector, as institutions eye Solana’s potential for future growth.

Leading the pack is Forward Industries, with an impressive 6.8 million SOL valued at $1.69 billion. Following closely is Sharps Technology with 2.1 million SOL and DeFi Development Corp, holding over 2 million SOL. Such massive treasury commitments are shifting the landscape, encouraging more corporations to dive into Solana’s ecosystem.

Forward Industries recently concluded a staggering $1.65 billion private placement on September 11, aided by investment giants Galaxy Digital, Jump Crypto, and Multicoin Capital. Notably, Kyle Samani of Multicoin Capital has taken the helm as Chairman of the Board. This collaboration has set the stage for an ambitious $4 billion equity program, alongside a partnership with Superstate to tokenize its stock on the Solana blockchain, plunging further into the crypto sphere.

Meanwhile, Helius Medical’s initial $500 million placement went above and beyond with an additional $750 million in stapled warrants, potentially raising its total treasury capital to an extraordinary $1.25 billion. Prominent investors in this venture include Summer Capital, Arrington Capital, Animoca Brands, and HashKey Capital, causing HSDT stock to skyrocket by over 159%, climbing from $7.91 to $45.51 before settling back to $19.63. Such fluctuations showcase the volatile yet exhilarating nature of cryptocurrency investments.

🔻 VisionSys AI stock has fallen 57% after unveiling a $2B Solana treasury plan with @MarinadeFinance. Shares later partly recovered. #VisionSysAI #Solana #SOLhttps://t.co/gaUYAVnjOf— Cryptonews.com (@cryptonews) October 1, 2025

In addition to these developments, VisionSys AI announced an ambitious $2 billion treasury plan in collaboration with Marinade Finance, kicking off with a $500 million SOL acquisition set to unfold over the next six months. Similarly, Australian company Fitell Corporation has secured a $100 million credit line to support its treasury initiatives as it transitions to rebranding as Solana Australia Corporation. To this end, it has acquired 216.8 million Pump.fun tokens, worth about $1.5 million, and enlisted new advisers to strengthen its strategy.

Stock buybacks are also gaining traction as companies adapt to the shifting market. Sharps Technology unveiled a $100 million stock repurchase program on October 2, following a $400 million private placement in August. Despite a broader rally in Solana prices, with SOL jumping 55% recently, STSS shares have seen a steep decline, closing at $6.67—down 43% in just a month.

Upexi Inc., with 2 million SOL holdings valued at $377 million, has introduced an “adjusted SOL per share” metric that shows a significant increase of 56% since the initiative began. They recently appointed former BitMEX CEO Arthur Hayes to their advisory committee, signaling a serious commitment to navigating the competitive landscape.

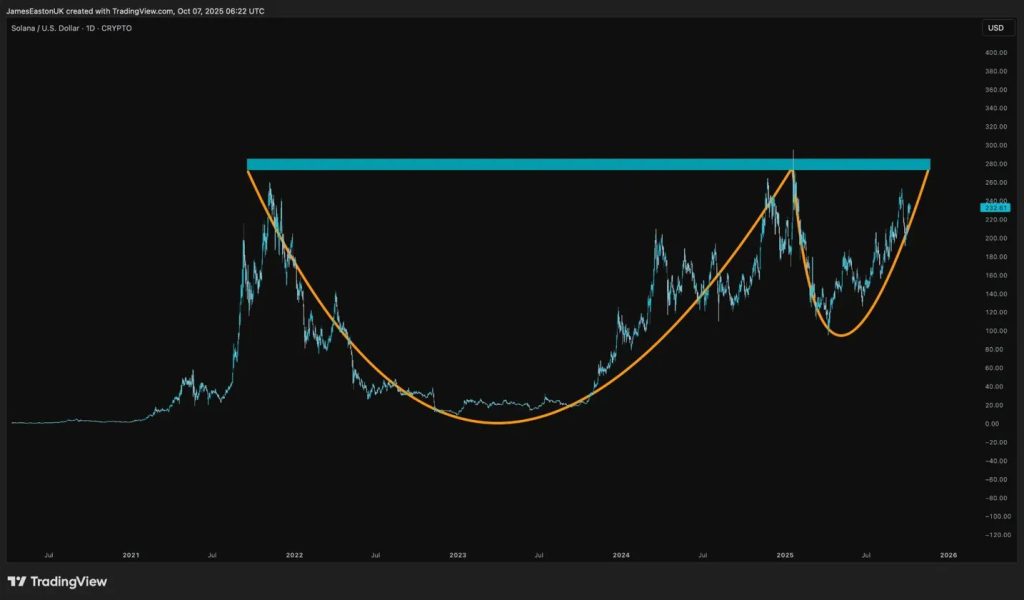

If we turn our gaze toward the technical analysis of SOL, we see a compelling cup and handle formation at multi-year resistance levels near $260-$280. Currently hovering around $231.34, traders are anxiously watching this crucial decision point. Should SOL manage to break through, analysts suggest it could target a range between $400 and $500, which would translate into a potentially lucrative 70-115% increase from current levels. Weekly Fibonacci extensions even hint at more ambitious targets, suggesting potential highs of $406.90, $672.37, and beyond.

As Solana makes waves, it has notably outperformed Ethereum in the past month, with a 26% surge compared to Ethereum’s 8%. Many experts are optimistic about the upcoming upgrades like Firedancer and Alpenglow, anticipating they will fuel even further growth and adoption. Looking forward, investment firm VanEck maintains a bullish outlook, estimating SOL could soar to $520 by year-end.

This pivotal moment for Solana comes as the deadline for the spot SOL ETF approval looms just days away, with analysts cautiously optimistic about approval chances. The stakes are high—will Solana break new grounds with this ETF, or will it face a correction toward support levels of $150-$180? The decisions made in the coming weeks could ideally dictate trends for this promising cryptocurrency. Only time will tell how this intriguing saga will unfold, but one thing is clear: the world is watching Solana intently.

Big week for Solana. The final deadline for spot $SOL ETF approval is just 4 days away.High chances we get the approval this week. pic.twitter.com/nAVUr2g7PC— Lark Davis (@TheCryptoLark) October 6, 2025

Stay tuned as we explore the latest developments in the crypto universe. The rise of Solana and the strategic maneuvers by corporations are setting a dynamic stage for the future of cryptocurrency investment.