🌟 Nano Labs Makes Waves with Major BNB Acquisition

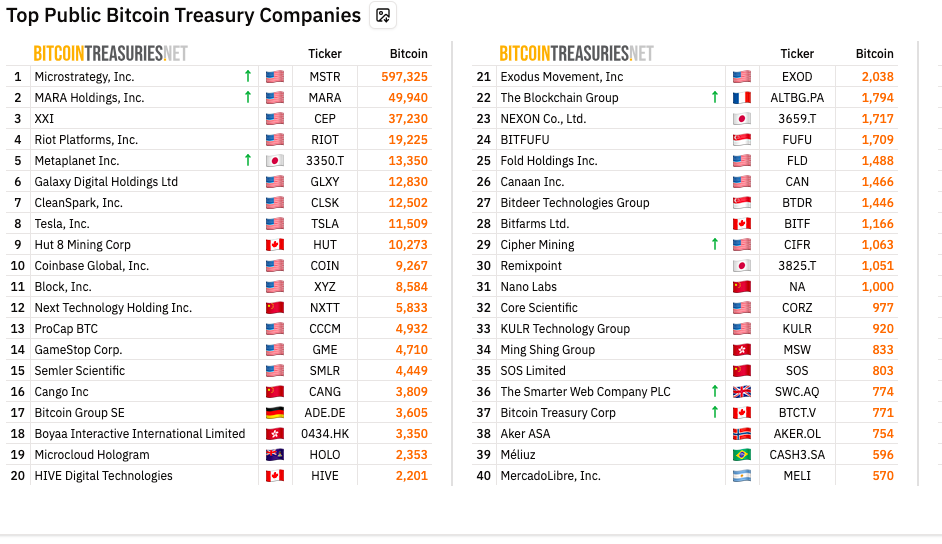

In an exciting development for the cryptocurrency industry, Nano Labs Ltd, a prominent player in the Web3 infrastructure landscape based in China, has officially announced its acquisition of an impressive 74,315 Binance Coin (BNB) tokens through over-the-counter (OTC) transactions. This investment, totaling around $50 million at an average price of approximately $672.45 per token, underscores Nano Labs’ aggressive strategy in building a significant digital asset reserve. With this latest purchase, the company’s total digital asset holdings—including Bitcoin—now amount to approximately $160 million, marking a pivotal moment in their journey.

📌 Why This Matters

The acquisition of BNB by Nano Labs is more than just another corporate investment; it’s a strategic move that signals the growing institutional interest in cryptocurrency as a key asset class. By amassing a substantial position in BNB, Nano Labs positions itself as a forward-thinking company that recognizes the potential of utility tokens beyond traditional assets like Bitcoin. This trend may encourage more businesses to explore cryptocurrencies as viable parts of their treasury strategies.

🔥 Expert Opinions: Insights into the BNB Accumulation Strategy

Industry analysts have noted that Nano Labs’ commitment to acquiring up to $1 billion worth of BNB through convertible notes and private placements indicates a long-term vision. According to a July 3 press release, the company is not only looking at short-term gains but is also conducting comprehensive evaluations of BNB’s utility and network security. This proactive approach may lead other companies to follow suit, potentially reshaping the landscape of corporate crypto holdings.

🎯 Nano Labs’ BNB Holdings: A First for Public Companies

Nano Labs aims to control between 5% and 10% of BNB’s total circulating supply, a feat that could position it as the first public company to stockpile the token on such a scale. Just last month, the company secured a landmark $500 million convertible note agreement, a move clearly intended to bolster its BNB accumulation strategy. Their recent promotional efforts showcase BNB as a strategic reserve asset, igniting conversations around its long-term value.

🚨 BREAKING 🚨Nano Labs just acquired approximately $50M worth of $BNB via OTC — bringing our mainstream digital asset reserve to around $160M.🔗https://t.co/MrgpeSN0NB pic.twitter.com/XvrlnsqtMC— Nano Labs (@NanoLabsLtd) July 3, 2025

📹 Building the Future Together

On the same day of the announcement, Nano Labs released a captivating promotional video highlighting Binance’s nearly eight-year operational journey. In an inspiring message, the company stated, “Nano Labs is cheering you on as the big day approaches. Let’s keep building the future together.” Such endorsements hint at a deep-rooted belief in BNB’s potential and signify Nano Labs’ intent to establish itself as a pivotal player in the growing crypto ecosystem.

🚀 Future Outlook: The Path Ahead for BNB

As of now, BNB is trading at $658.64, showing slight fluctuations amidst a market that seems to be gaining momentum. With a market cap exceeding $92 billion, the token remains a top contender, ranking as the fifth-largest digital asset by market capitalization. As more public companies recognize the various use cases for BNB, could we see a breakthrough above the $662 resistance level? Observers are closely watching as it aims to challenge its all-time high of $793 set in December 2024.

🔗 The Ripple Effect: Bhutan’s Strategic Move

Interestingly, the momentum around BNB isn’t limited to corporate investments. Recently, Bhutan’s Gelephu Mindfulness City (GMC) announced its plans to include BNB in its strategic reserves alongside Bitcoin and Ethereum, reflecting a broader trend towards embracing cryptocurrencies at a national level. This could signal a burgeoning opportunity for Bhutan to integrate into the Binance ecosystem, tapping into its DeFi tools and staking options.

🏞️ Bhutan becomes the first to offer a national crypto payment system for tourism through Binance Pay.#Bhutan #Binance https://t.co/PR8sbIBtFn— Cryptonews.com (@cryptonews) May 7, 2025

💡 Conclusion: A New Era for Crypto Adoption

With Nano Labs leading the charge in BNB accumulation, we stand on the brink of a new chapter in the narrative of corporate cryptocurrency adoption. As utility tokens gain traction in treasury strategies, the financial landscape may see substantial shifts akin to those experienced in traditional markets. Is your portfolio ready for this shift? The growing trend of recognizing digital assets as strategic reserve assets could pave the way for an even broader acceptance of cryptocurrencies. Share your thoughts—what do you think of Nano Labs’ bold move?