🚀 Moscow Exchange to Launch Ethereum Fund: A Bold Move Towards Crypto Integration

The cryptocurrency scene in Russia is poised for a major transformation as the Moscow Exchange announces the upcoming launch of a fund that closely tracks one of the heavyweight contenders in the Ethereum ETF arena. This milestone comes hot on the heels of the exchange’s successful introduction of Bitcoin index futures, marking its increasing commitment to incorporating digital assets into traditional finance.

*Maria Patrikeyeva, Managing Director of the Moscow Exchange Derivatives Market. (Source: RBC Investing/Screenshot)*

📅 Ethereum Fund Set to Debut This August

Maria Patrikeyeva, the Managing Director for the Derivatives Market at the Moscow Exchange, has unveiled plans for their Ethereum fund to officially launch in August. This fund is designed to facilitate trading in futures contracts tied to the performance of the BlackRock-managed iShares Ethereum Trust ETF. The futures contract will have a size slightly less than that of the existing Bitcoin contract, with its value pegged to the share cost of the ETF itself.

Patrikeyeva’s forward-looking statements indicate confidence in the fund’s reception, considering the iShares Ethereum Trust ETF launched only last month on NASDAQ, representing a significant shift toward institutional adoption of Ethereum.

*Trends in iShares Ethereum Trust ETF prices over the last six months. (Source: Financial Times)*

📈 Moscow Exchange’s Crypto Ambitions Grow

With a clear trend towards embracing digital currencies, the Moscow Exchange is ramping up its cryptocurrency offerings this year. The initial Bitcoin futures contract launched in June has already set the stage for further derivatives aimed at transforming the Russian trading landscape. Currently, these offerings are limited to qualified investors, providing a controlled environment for uptake.

Moreover, officials have hinted at the imminent launch of new Bitcoin derivatives and other innovative financial products. Notably, they are in the process of securing regulatory approval for mutual funds and structured bonds focused specifically on crypto asset indices, setting a precedent in a traditionally cautious environment.

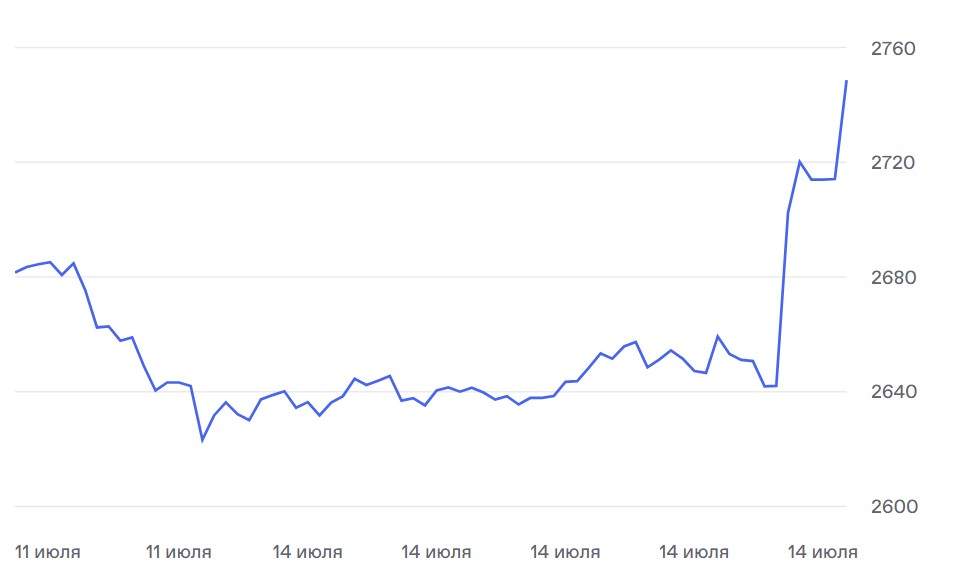

*Graph of IMEOX prices, reflecting investor sentiment on the Moscow Exchange from July 11 to July 14. (Source: Moscow Exchange)*

💼 Future Horizons: What Comes Next for the Moscow Exchange?

The innovative trajectory at the Moscow Exchange does not stop with Ethereum. In the coming months, the exchange plans to introduce futures contracts tailored to various American investment funds, specifically those focusing on U.S. government bonds, highlighted by the forthcoming iShares 20+ Year Treasury Bond ETF. This move not only diversifies their offering but also integrates international market dynamics into their portfolio.

Additionally, the long-awaited futures contracts for shares of renowned Chinese technology companies, such as Tencent and Xiaomi, are set to be unveiled this week. Trading on these giants, currently listed on the Hong Kong Stock Exchange, could offer local investors an exciting avenue to engage with world-leading firms.

📣 Why This Matters: The Bigger Picture in Crypto Investment

The launch of an Ethereum fund by the Moscow Exchange is not merely a localized financial event; it represents a significant step in the global narrative of cryptocurrency adoption. By aligning with established global financial institutions like BlackRock, the Exchange signals that Russia is keen to integrate with the international finance ecosystem. This could potentially open doors for a broader acceptance of cryptocurrencies and blockchain technology in regions traditionally cautious about embracing digital assets.

🔥 Expert Opinions: Insights from Industry Analysts

Market analysts are keeping a close eye on these developments. Comments from industry experts suggest that the introduction of crypto-related products on traditional exchanges offers a safe and regulated pathway for mainstream investors to dip their toes into the world of digital assets without stepping into unregulated waters. This strategic move could invigorate the investment landscape in Russia and present new opportunities as the barrier to entry lowers.

🔮 Conclusion: A Turning Point in Digital Finance

The Moscow Exchange is charting an ambitious course toward a more crypto-friendly future, enticing investors with a tantalizing prospect of new futures products amid increasing market demand. As traditional financial landscapes evolve to accommodate cryptocurrencies, the ripple effects could reshape how investors view the viability and stability of digital assets. Following these developments closely may be crucial for anyone interested in the future of finance.

What are your thoughts on the Moscow Exchange’s latest initiatives? Could this be a game-changer in the Russian investment landscape? Share your opinions in the comments below!