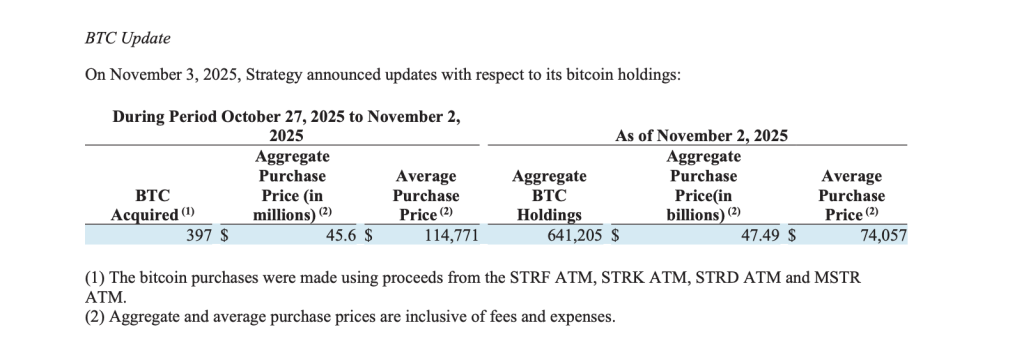

In a bold move that further cements its position as a titan in the world of cryptocurrency, Strategy, the brainchild of billionaire executive Michael Saylor, has significantly expanded its Bitcoin portfolio. This latest acquisition, detailed in a filing on November 3, reveals that the company purchased 397 BTC between October 27 and November 2, investing a total of $45.6 million. This translates to an average price of approximately $114,771 per Bitcoin. Such a headline is bound to catch the attention of investors and crypto enthusiasts alike.

Strategy has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/yJfoyeNzCm— Strategy (@Strategy) November 3, 2025

This latest purchase brings Strategy’s total Bitcoin reserves to a staggering 641,205 BTC, marking a significant milestone in its investment journey. The company’s overall Bitcoin holdings now represent an investment of approximately $47.49 billion, acquired at an average price of $74,057 per Bitcoin. The sheer scale and commitment behind this accumulation is nothing short of remarkable.

How does Strategy finance these monumental purchases? The company has turned to its active at-the-market (ATM) equity programs, a strategic choice that has underpinned its Bitcoin acquisition efforts throughout 2025. Recent filings indicate that during a one-week period, Strategy raised around $69.5 million through various stock issuances, which included both preferred and common shares. Notably, proceeds from the sale of Series A perpetual preferred stock and class A common shares were specifically earmarked for Bitcoin purchases. This strategic maneuver not only reflects Saylor’s ambitious vision but also showcases the firm’s commitment to modern financial tactics.

The breakdown reveals that $8.4 million was generated from the sale of STRF shares, $4.4 million from STRK shares, $2.3 million from STRD shares, and a whopping $54.4 million from MSTR common stock. Each dollar raised is intended to be channeled directly into Bitcoin, reinforcing Saylor’s belief in the cryptocurrency as the “digital gold” of our time.

Since establishing Bitcoin as its primary reserve asset back in 2020, Strategy has become a dominant player in the corporate cryptocurrency arena. Saylor argues that Bitcoin is an invaluable asset class, offering better long-term value retention than traditional cash or bonds. Despite facing criticism during market downturns, the company’s investments often yield substantial unrealized gains when the market rallies.

Currently, Strategy’s Bitcoin holdings surpass those of any other publicly traded company and even many sovereign treasuries. With market evaluations placing its Bitcoin stash at around $45 billion, the firm proudly stands as the largest corporate holder of the digital currency.

Interestingly, there’s no sign of Strategy slowing down. The company’s regular weekly acquisitions highlight Saylor’s resilience and steadfast faith in Bitcoin as a cornerstone investment. In fact, he has publicly committed to converting every dollar raised into Bitcoin, suggesting a relentless pursuit of this digital asset. With a robust ATM financing capacity and Bitcoin trading near historic thresholds, the momentum appears poised to continue.

As it stands, if Strategy maintains its current acquisition pace, Bitcoin holdings could soon exceed 650,000 BTC, a feat that would further entrench its status as a pivotal player in the cryptocurrency ecosystem. What does this mean for the future of Bitcoin investment? Are we witnessing a paradigm shift in how corporations view and leverage crypto assets? Only time will tell, but one thing is certain: Strategy and Michael Saylor are emphatically betting big on Bitcoin.

For continual updates on Bitcoin news and analyses, you might want to explore more information from [CoinDesk](https://www.coindesk.com) and [CoinTelegraph](https://cointelegraph.com).