Metaplanet’s Bold Commitment: Aiming for 10,000 BTC

In an inspiring show of determination, Metaplanet’s CEO Simon Gerovich has reaffirmed the company’s ambitious goal of accumulating 10,000 Bitcoin (BTC) by the end of the year. This commitment underscores Metaplanet’s focus on creating long-term value rather than being swayed by the tumult of short-term stock market fluctuations. In a recent communication, Gerovich addressed shareholders, acknowledging their concerns about the declining stock price while reinforcing the company’s steadfast vision for corporate growth in the cryptocurrency space.

一部の株主の皆さまから、株価に対するご不安の声をいただいております。そうしたご意見は真摯に受け止めており、足元のような不安定な市場環境においても当社のビジョンを信じて支えてくださっている皆さまに、心より感謝申し上げます。…— Simon Gerovich (@gerovich) April 22, 2025

Weathering the Market Storm: Share Price Insights

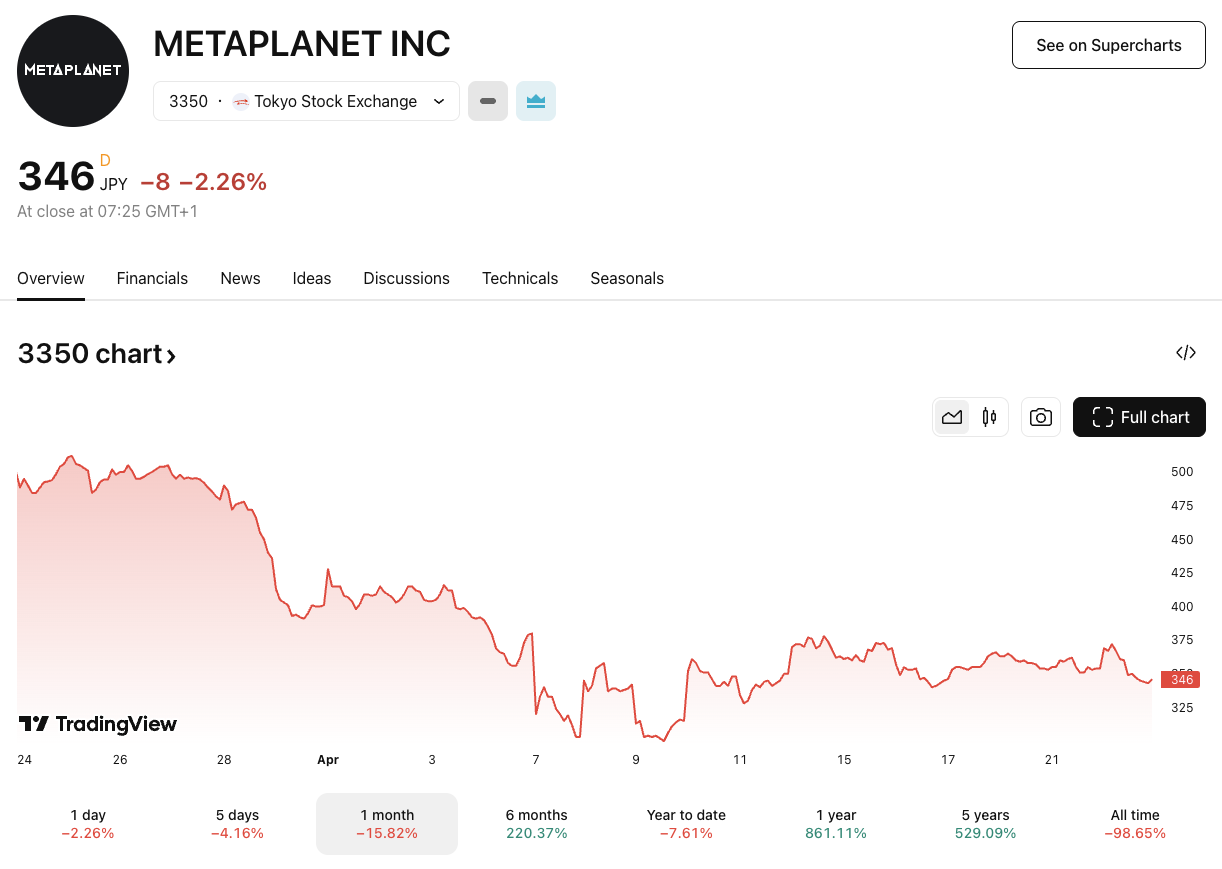

Amidst a challenging market backdrop, Metaplanet has witnessed a significant downturn in its stock, which recently plunged by 15.8% over the last month and 7.6% year-to-date. This dip is part of a broader trend affecting Bitcoin proxy stocks, reflecting a cooling in investor interest even as Bitcoin itself has maintained stable gains in 2025. Despite these fluctuations, Metaplanet’s stock has skyrocketed by over 860% since the launch of its Bitcoin treasury strategy in April 2024, emphasizing the company’s powerful growth trajectory.

*Metaplanet’s performance through the lens of Bitcoin treasury management*

*Metaplanet’s performance through the lens of Bitcoin treasury management*

Strategies that Stand Out

Gerovich elucidated that the current stock price volatility does not diminish the company’s strategic execution. “We are steadily executing on a clear strategy centered on Bitcoin treasury management, with the aim of building a company that ranks among the most valuable globally,” he explained confidently. The recent acquisition of 330 BTC valued at approximately $28 million has propelled Metaplanet’s total holdings to an impressive 4,855 BTC. This milestone positions the firm as Asia’s top corporate Bitcoin holder, and globally among the top ten.

Why This Matters: The Significance of Bitcoin in Corporate Finance

Metaplanet’s robust approach to Bitcoin accumulation is not just about numbers; it reflects a significant shift in how corporations perceive digital currencies as treasury assets. The firm’s total Bitcoin holdings are now valued at around $430 million, showcasing not only financial strength but also a long-term investment philosophy. This strategic focus could embolden other corporations to reassess their financial strategies in favor of crypto assets.

Fueling Growth: BTC Yield and Beyond

Notably, Metaplanet is achieving extraordinary yields on its Bitcoin holdings. The firm’s BTC Yield for the year stands at an impressive 119.3%, far surpassing its quarterly target of 35%. This yield is calculated based on the total Bitcoin held relative to the company’s fully diluted shares, a metric that emphasizes sustained growth and shareholder value.

🏦 Japan’s @Metaplanet_JP plans to scale its Bitcoin holdings to 10,000 BTC this year, using advanced capital market strategies to accelerate its crypto growth.#Metaplanet #BitcoinTreasury https://t.co/8CzfEGItV1— Cryptonews.com (@cryptonews) January 6, 2025

Furthermore, Metaplanet has developed an innovative metric called BTC Gain, highlighting the value generated through sophisticated financial strategies beyond outright Bitcoin purchases. For instance, through the use of cash-secured put options, the firm has managed to acquire Bitcoin worth $67.9 million, leveraging only $62.7 million in capital. The result? A staggering addition of 2,174 BTC to its treasure chest. “These accomplishments are not mere projections,” Gerovich emphasized, “but concrete results already realized.”

Expert Opinions: What Analysts Are Saying

Industry analysts are taking keen interest in Metaplanet’s approach, viewing it as a litmus test for corporate adaptation to cryptocurrency. Some experts predict that if Metaplanet successfully reaches its 10,000 BTC goal, it could set precedence, encouraging traditional companies to explore their own crypto ventures. Others believe that sustained confidence from leadership could reinforce investor sentiment, potentially stabilizing stock price fluctuations in the long run.

What Does the Future Hold? Predictions and Projections

Looking ahead, Metaplanet’s journey seems promising. With a robust strategy in place and growing investor interest, the firm is positioned to thrive amid market unpredictability. If Metaplanet continues on its current path, we might see a ripple effect throughout the corporate world, prompting similar firms to adopt Bitcoin and other digital currencies as substantive financial assets. Will Metaplanet lead a wave of corporate crypto adoption? The potential impact on the market could be significant.

Conclusion: A Journey Just Beginning

In conclusion, Metaplanet’s steadfast dedication to Bitcoin accumulation and corporate value creation is more than just a reaction to a volatile market; it represents a bold vision for the future of finance. With clear growth metrics and a commitment to transparency, the firm is setting a noteworthy precedent in the cryptocurrency landscape. As Gerovich concluded, “We’re just getting started.” This statement invites us all to ponder: what could the future hold for corporate engagements with cryptocurrencies? Engage in the discussion below!