In a move that has caught the attention of the cryptocurrency community, Tokyo’s Metaplanet is stepping boldly into the Bitcoin lending game. On October 31, the company secured a staggering $100 million loan backed by its impressive Bitcoin reserves, powered by a newly established $500 million credit facility. This strategic financial maneuver aims not only to expand Metaplanet’s crypto portfolio but also to bolster its options trading business and explore share repurchases. Remarkably, the loan represents just a sliver—about 3%—of Metaplanet’s substantial Bitcoin reserve, which sits at an impressive $3.5 billion, offering a robust safety net even in the face of potential market downturns.

What makes this deal even more intriguing is that the loan carries no fixed maturity date, allowing for flexible repayment options and further emphasizing Metaplanet’s commitment to long-term growth. The company has set an ambitious target of accumulating 210,000 Bitcoins by 2027, positioning itself for potential dominance in the market.

JUST IN: Metaplanet borrows $100 million loan by using its Bitcoin as collateral to buy more #Bitcoin pic.twitter.com/UayQKj1FKi— Bitcoin Magazine (@BitcoinMagazine) November 5, 2025

The borrowing strategy emerges from a turbulent backdrop for many companies holding Bitcoin. In September, approximately one in four businesses in the Bitcoin treasury space were trading below their actual crypto assets, a concerning sign of market distress. Against this backdrop, Metaplanet has proactively initiated a ¥75 billion (approximately $675 million) share repurchase program, designed to target periods when its enterprise value relative to Bitcoin holdings falls below parity. This tactical initiative aims to reduce the overall number of shares, thereby enhancing the ownership stake of existing shareholders.

🔴 Metaplanet’s mNAV hits 0.99, trading below $3.4B Bitcoin reserves as one in four treasury firms are trading at discount, with corporate buying down 95% since July.#Metaplanet #Bitcoinhttps://t.co/1KgbHxWGf5— Cryptonews.com (@cryptonews) October 14, 2025

Simon Gerovich, the Representative Director of Metaplanet, emphasized that the purpose of the repurchase plan is to “enhance capital efficiency and maximize BTC Yield” in a landscape where market multiples are contracting. With corporate Bitcoin adoption declining by nearly 95% since summer, Metaplanet finds itself navigating a challenging environment—only one firm initiated treasury strategies in September compared to 21 in July. The average market-to-net-asset-value ratio has dwindled from 3.76x in April to just 2.8x currently, and daily Bitcoin accumulations among treasury firms have slowed to only 1,428 tokens.

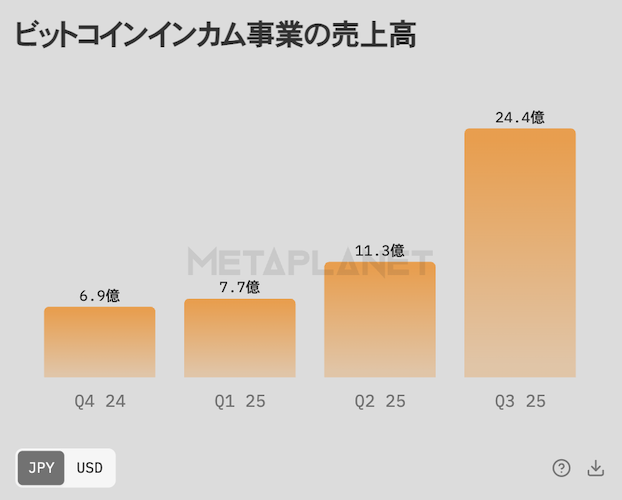

In a bid to generate stable returns amid this uncertainty, part of the borrowed funds will fuel Metaplanet’s Income Business. This sector focuses on creating and selling cash-secured Bitcoin options, which allow the company to rake in premium income while maintaining exposure to the cryptocurrency market. Projectedly, this division is set to see sales reach 2.44 billion yen ($22 million) in Q3 2025—an impressive 3.5-fold leap from last year’s sales of 690 million yen. This options strategy not only provides a buffer during turbulent market conditions but also helps in generating revenue through collected premiums.

Furthermore, Metaplanet continues to practice prudent financial management, ensuring that its borrowing remains within limits where collateral capacity is sufficient—even during significant price fluctuations in Bitcoin. Although the company anticipates minimal impacts on its financial results for fiscal year 2025 from this current borrowing, management has committed to transparency and will notify stakeholders of any significant changes or risks as they arise.

As we step into a high-stakes arena for corporate Bitcoin strategies, experts observe a competitive transformation. According to a recent report by Coinbase Research, the cryptocurrency treasury landscape is now characterized by a “player-versus-player” dynamic. This shift from guaranteed premiums to a more competitive strategy necessitates that companies distinguish themselves through innovative positioning. Omid Malekan, a professor at Columbia Business School, refers to this transition as a “mass extraction and exit event,” indicating a broader market crash that has gripped many digital asset providers.

🔻 Bitcoin falls below $100,000 as excessive leverage triggers over $1 trillion in crypto market losses despite ongoing institutional accumulation.#Bitcoin #Liquidation #Cryptohttps://t.co/gy5LkirDRM— Cryptonews.com (@cryptonews) November 4, 2025

Recently, Bitcoin slipped below the $100,000 mark for the first time since June, entering bear market territory with a 20% drop since its October peak. This decline has led to over $1 trillion being wiped off the total crypto market capitalization. This downturn coincided with a staggering $19 billion in liquidations that occurred on October 10, following escalated tariffs announced by President Trump, which further intensified market volatility.

Yet, amidst the chaos, certain players are still making significant moves. For instance, one strategic firm acquired 397 Bitcoin within a week for approximately $45.6 million, raising their total holdings to a formidable 641,205 Bitcoin. As noted by Shawn Young, Chief Analyst at MEXC Research, a combination of major market players’ coin accumulation, the prospects of trade agreements, and moderate stock market gains could signal a potential recovery on the horizon for November.

In this ever-evolving landscape of cryptocurrency, Metaplanet’s bold strategies illustrate the firm’s commitment not only to weather the storm but to emerge stronger. As institutional interest in Bitcoin fluctuates, the financial maneuvers of companies like Metaplanet offer insight into the future of corporate crypto treasuries—highlighting the delicate balance between risk and opportunity in a maturing market.

As this story unfolds, how will other companies respond to similar market challenges? Will we see more firms adopting innovative strategies like Metaplanet’s? The cryptocurrency world remains watchful and poised for what comes next. For real-time updates on the evolving crypto landscape, stay tuned to [CoinDesk](https://www.coindesk.com) for the latest news and insights.