🚀 MARA Holdings Eyes $2 Billion Stock Offering: A Game Changer for Bitcoin Mining?

In a bold move that could reshape the cryptocurrency landscape, major publicly traded Bitcoin miner MARA Holdings is contemplating an impressive stock offering of up to $2 billion. This ambitious plan, disclosed on March 28, includes a detailed report and prospectus submitted to the U.S. Securities and Exchange Commission (SEC). As the second-largest holder of Bitcoin, MARA’s steps may have significant implications for the cryptocurrency market and beyond.

📊 The Details Behind the Offering

MARA Holdings has entered into what’s known as an “at-the-market” (ATM) offering agreement. This mechanism allows the company to sell shares of its stock incrementally to raise capital over an extended period. The offering price is set at a nominal $0.0001 per share, making it accessible for various investors. By collaborating with recognized financial institutions like Barclays Capital, BMO Capital Markets, and others, MARA positions itself strategically to tap into the robust flow of capital.

It’s worth noting that the commissions for the sales agents involved may reach as high as 3% of the gross proceeds from each sale. This incentivizes agents to actively market and sell the shares, furthering MARA’s goal of amassing funds for its Bitcoin ventures.

🔍 The Significance of MARA’s Bitcoin Holdings

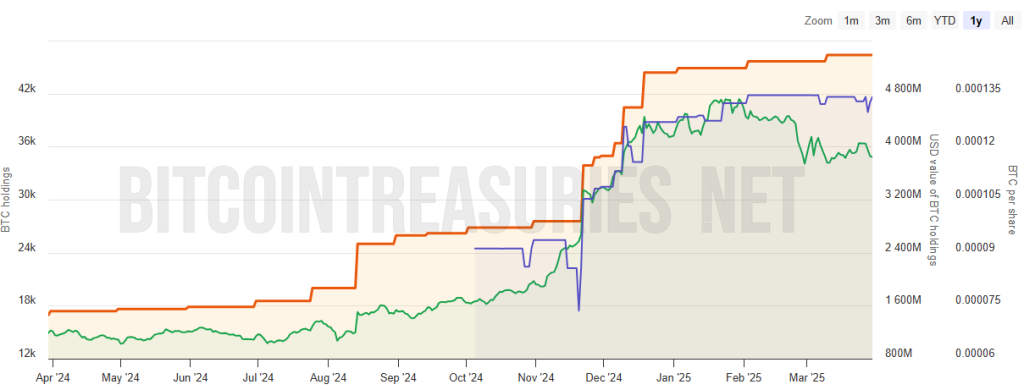

Currently, MARA Holdings boasts an impressive portfolio, managing 46,374 BTC valued at approximately $3.8 billion. This makes it the second-largest holder of Bitcoin, trailing only behind the giant Microstrategy. The strategic acquisition of more Bitcoin could solidify MARA’s position and influence in an increasingly competitive market.

📌 Why This Matters

This stock offering is more than just a financial maneuver; it mirrors the broader trend of institutional interest in Bitcoin and blockchain technologies. As a key player, MARA’s actions could set the pace for other mining companies and investors. With an eye toward future growth, MARA aims to utilize the proceeds not only for acquiring additional Bitcoin but also for bolstering its mining infrastructure and operational capabilities. This could enhance efficiency and ultimately drive profitability.

🔥 Expert Opinions: What Analysts Are Saying

Industry analysts are keenly observing MARA’s strategies. Some experts suggest that the capital raised could be crucial in navigating through the challenges posed by fluctuating Bitcoin prices and mining costs. “If MARA successfully capitalizes on this stock offering,” one analyst points out, “it could not only strengthen its balance sheet but also fund innovative projects that may yield higher returns in the volatile crypto market.” This sentiment signals that strategic investments in technology and infrastructure could pay off handsomely.

🔮 Future Outlook: The Road Ahead

The future appears bright yet challenging for MARA and the cryptocurrency mining industry at large. The funds raised could fuel expansion efforts and technological advancements, enabling the company to maintain a competitive edge. However, it will also require keen management of resources and an adaptable strategy in response to market dynamics.

As competition intensifies and operational costs fluctuate, MARA will need to tread carefully. Miners are increasingly challenged by dwindling transaction fees and the rising difficulty of mining Bitcoin, which could jeopardize the profitability of smaller operations. The emphasis on technological efficiency and economies of scale could prompt further consolidation in the industry, as larger entities like MARA absorb market share at the expense of smaller competitors.

💬 Conclusion: Join the Conversation

MARA Holdings’ pursuit of a significant stock offering is a noteworthy development that could have lasting repercussions within the cryptocurrency ecosystem. What do you think about MARA’s strategy in expanding its Bitcoin holdings and overall operations? Is this a move that signals a brighter future for Bitcoin mining, or is it a gamble in an unstable market? We invite you to share your thoughts and engage in the discussion!