MANTRA’s $OM: Breaking New Ground in the Marketplace

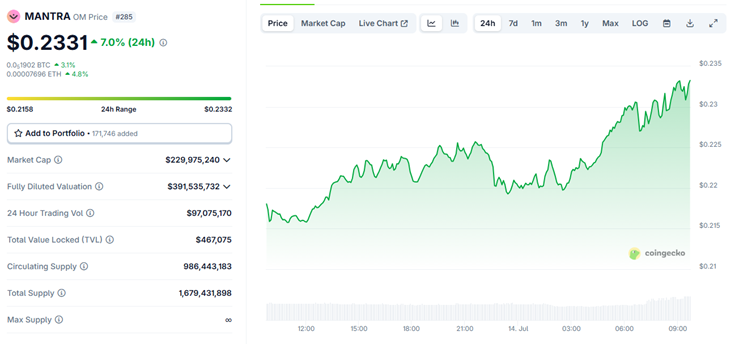

In an exciting development for the cryptocurrency community, MANTRA’s $OM token has just surged past the pivotal double-bottom pattern at $0.233. According to the latest derivatives data, this breakout signals mounting investor confidence and ongoing accumulation. With the endorsement of Google Cloud, strategic token burn initiatives, and burgeoning partnerships in real-world asset (RWA) sectors, MANTRA’s innovative dual-architecture blockchain is primed for explosive growth. This is particularly relevant as interest from institutions in RWAs ramps up.

📌 Why This Matters: A New Era for MANTRA

The significance of this development cannot be overstated. A double-bottom breakout is a classic technical indicator, often suggesting a robust reversal in price trends. This pattern has emerged after a turbulent period during which $OM experienced a dramatic 90% decline earlier in the year. As the token now surges, it indicates a potential turnaround in market sentiment and investor interest.

Additionally, the recent validation by Google Cloud, which is now MANTRA’s largest validator, adds an impressive layer of credibility to the project. This endorsement not only enhances network security but also aligns MANTRA with cutting-edge technological advancements, reinforcing its positioning in the competitive blockchain landscape.

🔥 Expert Opinions: Insights from the Market

Market analysts are buzzing with excitement about $OM’s potential trajectory. One expert commented, “The upward movement of $OM is not merely a spike; it’s indicative of a larger trend where institutional buyers are starting to take notice. With listings on over 100 centralized exchanges—such as the largest in Korea, Upbit and Bithumb—$OM is strategically positioned for growth.”

As trading volumes spike and bullish sentiment prevails, the anticipated $1 target for $OM is becoming a hot topic. The emphasis is on monitoring whale accumulation patterns, as these larger investors typically signal sustained interest and future price movements.

Today the @MANTRA_Chain community sentiment is 97.7% positive. The $OM price is also relatively green. As a community, we are on the right path. Aiming for $1 pic.twitter.com/rCOZlcoOUZ— MOON JEFF 🪐 (@CRYPTOAD00) July 13, 2025

🚀 Future Outlook: What Lies Ahead for $OM

Looking ahead, the landscape seems promising for $OM, bolstered by strategic moves from the MANTRA team. A recent token burn of 150 million $OM tokens was executed to address supply concerns. This decisive action, in conjunction with observed accumulation patterns, creates an environment conducive to price appreciation. Clearly, $OM is on the radar of both retail investors and large-scale institutions.

Market analysts believe a 5-fold increase to $1 is plausible, spurred by growing interest in RWA solutions and the adoption of MultiVM technology. Moreover, the increase in Total Value Locked (TVL) on the platform indicates strong ecosystem engagement, making it a beacon of growth in the tokenization space.

Technical Analysis: Observing the $OM Breakout

From a technical perspective, the recent breakout above the neckline of the double-bottom pattern suggests a period of renewed bullish momentum for $OM. After forming two significant lows at $0.186 and a subsequent retest of that level, the breakout around $0.233 was marked by increased trading volume, indicating heightened investor interest.

As the price aims for the $0.260-$0.265 target zone, it’s crucial for investors to monitor key price levels, particularly the $0.240 area. A successful retest here could confirm that the breakout is sustainable and set the stage for further price increases.

📈 Market Activity Highlights

Data from Coinglass illustrates a remarkable uptick in $OM trading activity, with a 69.37% rise in 24-hour trading volume and a 10.62% increase in open interest, reflecting renewed conviction from traders. This bullish sentiment is echoed by the favorable long/short ratios observed on major exchanges like Binance and OKX, suggesting a strong preference for bullish trades following the breakout.

The volume profile further emphasizes buy-side momentum, demonstrating a significant imbalance between buy and sell orders. This sustained demand points to a robust interest in accumulation, particularly around critical retest zones like $0.233.

Conclusion: The Road Ahead for Investors

As we navigate this transformative period for MANTRA and its $OM token, all eyes will be on whether it can maintain its momentum above the critical $0.233 level. The combination of institutional support, strategic token burns, and technical indicators suggests that the path to sustained growth is within reach. As always, traders should keep an eye on market conditions and how volume reacts near key price levels.

What are your thoughts on $OM’s potential? Is it time to get onboard, or is caution warranted? Join the conversation below!