Block Earner Triumphs: A Groundbreaking Federal Court Ruling

In a significant turn of events, the Federal Court of Australia has ruled in favor of crypto lending platform Block Earner, bringing an end to a lengthy and contentious legal battle with the Australian Securities and Investments Commission (ASIC). This ruling allows Block Earner to operate its crypto-linked ‘Earner’ product without the necessity of an Australian financial services license (AFSL), marking a pivotal moment in the intersection of technology and regulation in the cryptocurrency space.

Understanding the Ruling: What’s at Stake?

The Court’s decision, issued on Tuesday, determines that the discontinued ‘Earner’ product is classified as a loan rather than a managed investment scheme. This distinction is critical as it exempts Block Earner from the stringent licensing requirements that typically govern financial products in Australia. The ‘Earner’ product was available from March to November 2022, enabling users to ‘loan’ specific cryptocurrencies in exchange for fixed interest payments. The ruling essentially validates a business model that many in the crypto industry advocate for—flexible, innovative, and consumer-friendly lending options devoid of unnecessary regulatory hurdles.

Why This Matters: A Win for Crypto Innovation

In the current regulatory landscape, where many jurisdictions struggle to keep up with rapid technological advancements, this judgment stands out as a beacon of hope for crypto enthusiasts and entrepreneurs alike. It underscores the importance of adapting regulations to nurture innovation rather than stifle it. With such legal precedents, Australia can remain competitive in the global fintech arena, rather than risk losing emerging technologies and talent to more welcoming markets abroad.

Expert Opinions: Voices from the Industry

Industry analysts have hailed this decision as a watershed moment for fintech in Australia. “This ruling sends a clear message that Australia recognizes the evolving nature of financial products and the necessity for a regulatory framework that can keep pace with innovation,” stated blockchain expert, Dr. Samuel Richards. Moreover, crypto advocate and economist Professor Linda Tran emphasized, “Encouraging responsible innovation is essential for Australia to lead in the future of digital finance. Regulatory bodies must now focus on crafting frameworks that promote growth rather than hinder it.”

The ASIC vs. Block Earner Saga: A Timeline of Events

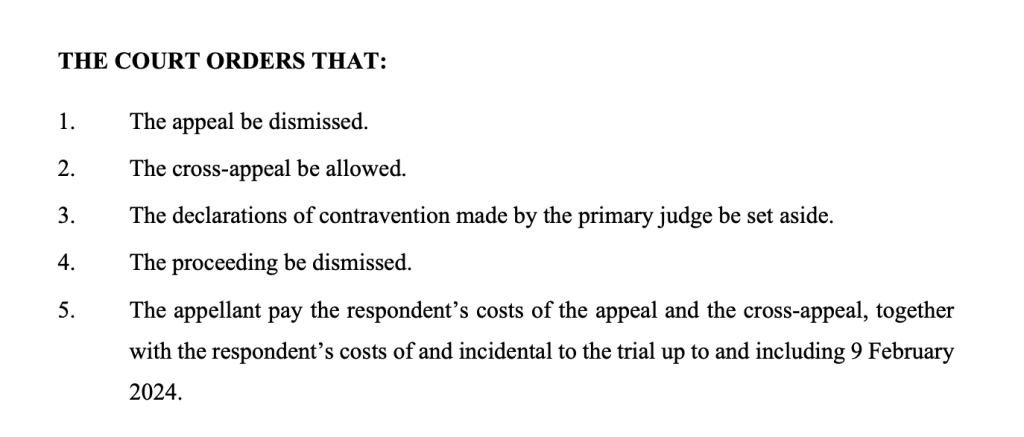

The legal clash began when ASIC alleged that Block Earner had breached corporation laws regarding its ‘Access’ and ‘Earner’ products. Seeking declarations, injunctions, and financial penalties, ASIC initially gained a ruling in February 2024 that required Block Earner to hold an AFSL for its products. However, a judicial review in June 2024 provided relief by exonerating Block Earner from potential penalties, citing the company’s integrity in launching the Earner product.

Ultimately, the trio of justices—David O’Callaghan, Wendy Abraham, and Catherine Button—dismissed ASIC’s appeal and mandated the regulator to bear the legal costs of both the initial proceedings and the subsequent appeal, further validating Block Earner’s position.

A Look Ahead: Future Plans and Industry Implications

Despite this legal victory, Block Earner has no intention to reintroduce the ‘Earner’ products for Australian clients. Co-founder James Coombes mentioned that the product was voluntarily phased out in November 2022, and there are currently no plans for its revival. He voiced a hopeful optimism, stating, “This ruling highlights the urgency of reforming our regulatory framework to foster an environment where fintech innovation can thrive, or we risk being left behind.”

Co-founder Charlie Karaboga echoed these sentiments, expressing gratitude for the resolution of a protracted legal struggle. With this favorable ruling, attention shifts to how this case will influence future regulatory approaches to cryptocurrency and digital finance in Australia and beyond.

Conclusion: A Call to Action for the Crypto Community

This landmark ruling not only benefits Block Earner but also signals a crucial shift for the broader cryptocurrency landscape in Australia. As the regulatory environment evolves, it prompts a vital conversation about how to balance innovation with consumer protection. Industry stakeholders and enthusiasts are encouraged to engage in discussions on regulatory reform, ensuring that Australia remains at the forefront of fintech innovation. What are your thoughts on the balance between regulation and innovation? Join the conversation below!